« This article a part of our Frequently Asked Investment Advisor Questions Section – Return to FAQ

Active vs. Passive Investment Strategies: Which is Right for You?

Academics and investors have debated over the superiority of a passive investment strategy versus an active investment approach for years. First, let’s clear up the confusion surrounding active investing. As fee-only investment advisors we believe “active” is best defined as meaning active risk-management. With nearly 50 years of observing investors, active risk management is the superior approach for two core reasons. The first is due to the “law of large losses” which demonstrates the importance of not losing big. An example of this timeless investment “law” is shared later in this article. The second reason is due to the inability of investors to suffer through the psychological stress or emotional aspects associated with steep price declines. There is no denying that the passive investment strategy has an attraction. This “set it and forget it” strategy is simple to understand and quite alluring. After initial setup there is little time or effort needed to monitor the investment portfolio making the process a relatively mindless endeavor and is supposedly worry-free.

But is any investment strategy really worry-free? If the stock market only went up, passive investing would be easy to stick with…but past painful bear markets teach most assuredly it is not. Unfortunately a passive strategy designed to capture all of the gains as the market moves higher will also capture all the losses during market declines. Inevitably, as bear markets grind lower and inflict pain, “buy and hold” investors recognize much too late that the approach entails a lot more risk than they first assumed. Many ultimately do capitulate when losses decimate their portfolio and only sell when the pain and emotional intensity can no longer be stomached.

Generally the passive approach adheres to a fixed asset allocation regardless of changing economic or financial market conditions and that can lead to uneven results. In fact, the standard passive tactic of re-balancing makes investment decisions automatic but there is a big downside. Re-balancing is the process of, for instance, selling part of a strong performing asset class to add to a weaker one. During major market declines the strategy actually compounds the loss potential by keeping an investor fully exposed during the most volatile negative periods. During bear markets substantial portfolio losses can accumulate in a very short period of time and take a heavy emotional toll on retirees. For instance, the terrifying 60% bear market decline of 2008-2009 lasted a little over one year and wiped out all of the stock market gains of the prior 5 years! Adding further insult to injury for passive index investors it took nearly six years (until 2013) to regain the losses from the 2007 peak: the law of large losses in effect.

Passive investing advocates usually downplay the severity of bear market periods and the effect on investor portfolios and their emotional well-being. In our lengthy careers as fee-only financial advisors we have never met a passive investor that did not feel disillusioned after losing a significant amount of wealth during a bear market.

In fact it can be absolutely devastating. This is critically true if you are a retiree who is in the “distribution phase” of life and tapping into their nest egg for added retirement income. Rather than systematically adding to an investment account during bear market periods and taking advantage of lower prices, you are forced to sell at low price levels in order to withdraw funds to meet income needs. This added hurdle for you should be a real consideration when selecting an investment strategy because it is virtually impossible for retirees to maintain their standard of living if their nest egg suffers significant market losses.

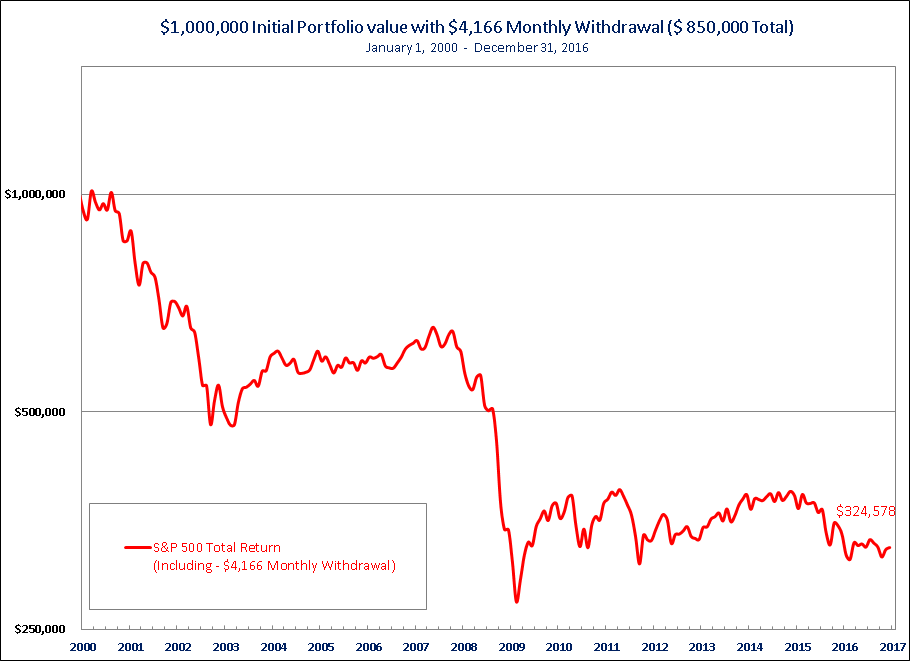

So how important is actively managing risk in order to preserve your capital? The next illustration points out the major fallacy of passive index investing for retirees. Let’s demonstrate the effect by comparing results for a hypothetical retired couple, Mr. and Mrs. Smith. The case study of an initial $1,000,000 investment portfolio with a seemingly safe 5% annual withdrawal by the Smiths illustrates the impact of $50,000 yearly withdrawals ($4,166 each month) during the challenging stock market environment since 2000. If the Smiths retired with $1,000,000 at the beginning of this century, passively invested those funds in an S&P 500 index fund, and took regular withdrawals, they are clearly destined to outlive their hard earned retirement nest egg.

Will the Smiths Outlive Their Retirement Nest Egg?

The combination of periodic bear markets for stocks and steady withdrawals for retirement income leaves the Smiths’ destined to outlive their nest egg.

In conclusion, it is essential for all investors to focus on long term performance of any approach through a full bull and bear cycle or more to judge its success. Even more crucial is to insure the suitability of any particular strategy matches the investor’s particular needs. Any careful review, gauged over long periods of time suggests a sensible, disciplined, active investment management discipline can achieve better returns with less risk. As an added bonus—the Smiths do sleep much easier at night!