Looking beyond the circus in Washington and other underlying concerns like government debt growth, rapid money printing by the Federal Reserve and potential higher inflation coming, we can also report significant underlying positive influences in the economy. These positive influences will help extend this aging bull market. Unlike our undisciplined big spenders at the government level, consumers have taken dramatic steps to improve their personal balance sheets. Debt is perceived as a truly four letter word. As debt has been reduced, refinanced and restructured, consumers now enjoy the lowest monthly debt payments relative to their income in decades. Add in the fact homes are appreciating in value for the first time in over five years, and it is easy to see why consumers are feeling better about their financial circumstances. Corporate America has also gotten the message learned during the last ‘Great Recession’ and taken strong steps to reduce costs, bolster balance sheets and lower capital spending. The result is record cash balances that give corporations financial durability to live through any unforeseen soft patches that may lie immediately ahead. State and local governments, forced to take tough measures on budgets because they cannot run deficits like the Federal government, have made meaningful strides in reversing budget deficit problems. Progress is being made on many levels as our economy slowly heals and builds momentum that will extend the bull market for stocks.

Impending Business Cycle Stage

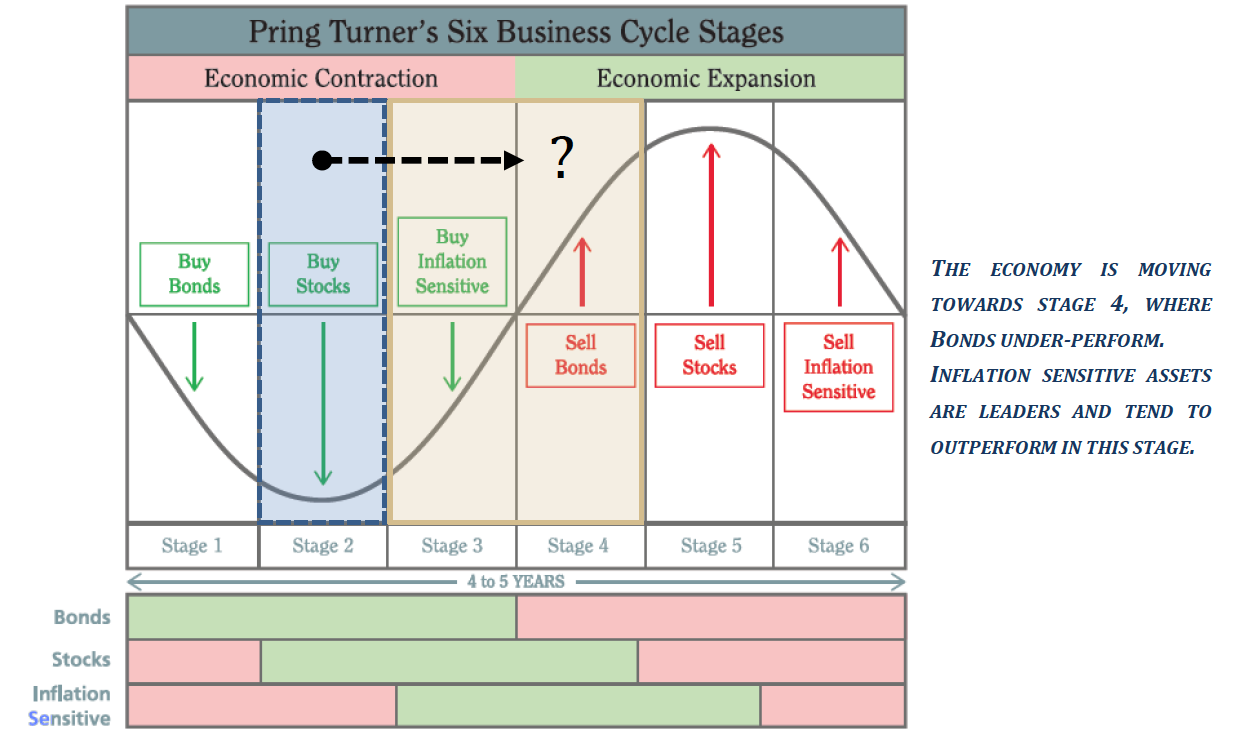

The business cycle is advancing in its sequential progress and that has implications for portfolios. Our barometers, developed to identify the business cycle stage, currently place us in Stage 2, which is generally a favorable environment for bonds and stocks but not a good one for inflation-sensitive assets (commodities and natural resource sectors). It has been a Stage 2 environment since March 2012. However a change appears close at hand. Indicators within the barometers are showing an underlying transition is underway that will advance the business cycle to Stage 3 or possibly even 4. A stage shift signals important portfolio allocation changes and stock sector decisions. In simple terms it means we are moving toward a more inflationary direction in the markets—that implies a tougher backdrop for high quality bonds and new leadership opportunities from natural resource sectors. Historically, late cycle (Stage 3, 4) leaders include many raw material and resource sectors including metal, mining, energy, chemicals, and industrials. As the business cycle progresses portfolios will be systematically re-shaped to adapt to the changing environment.

Another emerging profit opportunity lies in markets outside our borders where international stock markets are waking up from a long hibernation. Our relative strength analysis is showing a reversal and growing level of outperformance by international markets over the U.S. for the first time in nearly five years. Should this emerging trend persist we will progressively move to take further advantage of quality, growth and income producing investments from overseas. In several ways 2013 begins with important asset allocation and sector emphasis decisions taking place.

Thirty Five Years and Counting

As the year 2013 begins Pring Turner can look back on 35-years of investment advisory service to many wonderful clients. Indeed, the principals at our firm (Martin, Joe and Tom) now combine for more than 115-years of investment management experience. Our newest associate portfolio manager Jim (celebrating his 4th year) may bring our average experience down but he certainly brings our technological proficiencies and good looks up! Rounding out the team, Nancy, the cornerstone of our operational side passed the 25-year anniversary mark this year and we are thankful for her faithful dedication to client service.

The reason we bring up a little history is to remind folks we have seen plenty of good and bad markets during our lengthy careers. The most recent years, also known as the “lost decade,” have actually now stretched to a full baker’s dozen of cyclical up and down markets with stock prices showing little net progress. For reference the S&P 500 stock index finished the last century at the 1469 price level and interestingly enough it ended 2012 just below that level at 1426. Thirteen years of wide price swings for buy and hold investors and only dividends to show for it.

We look forward to the challenges 2013 and beyond will bring to investors. Confident our experience, research and investment disciplines that have brought our clients profitably and safely through this past 13-year stock market roller coaster ride will be up to those challenges. Thank you for assigning us this essential responsibility. We wish everyone a healthy and prosperous New Year!

2012 marked a number of significant milestones at Pring Turner. First, in March Dow Jones Indexes after exhaustive research of Pring Turner’s “Six-Stage” business cycle strategy launched the Dow Jones Pring US Business Cycle Index. The index validates and deepens Pring Turner’s already strong business cycle knowledge and portfolio decision-making process. We are gratified to have a prestigious organization such as Dow Jones Indexes confirm the value of our long standing conservative investment approach with their new index. Secondly, in June the Pring Turner team co-authored a new book Investing in the Second Lost Decade, published by McGraw Hill. We are hopeful our book helps other investors navigate through a confusing and difficult market environment. Lastly, in December after nearly two years in the pipeline, we were proud to launch our new actively managed Pring Turner Business Cycle ETF (Symbol DBIZ), now listed and trading on the New York Stock Exchange.