Spring Stock Market Update – Driving a Slow Speed

Summary of Webinar from March 16th, 2016

This client webinar, offered an update on our current thinking and explanation of recent portfolio actions. Specifically, we reviewed reasons for our current conservative portfolio profile, and discussed what would turn us more positive in our stock market outlook.

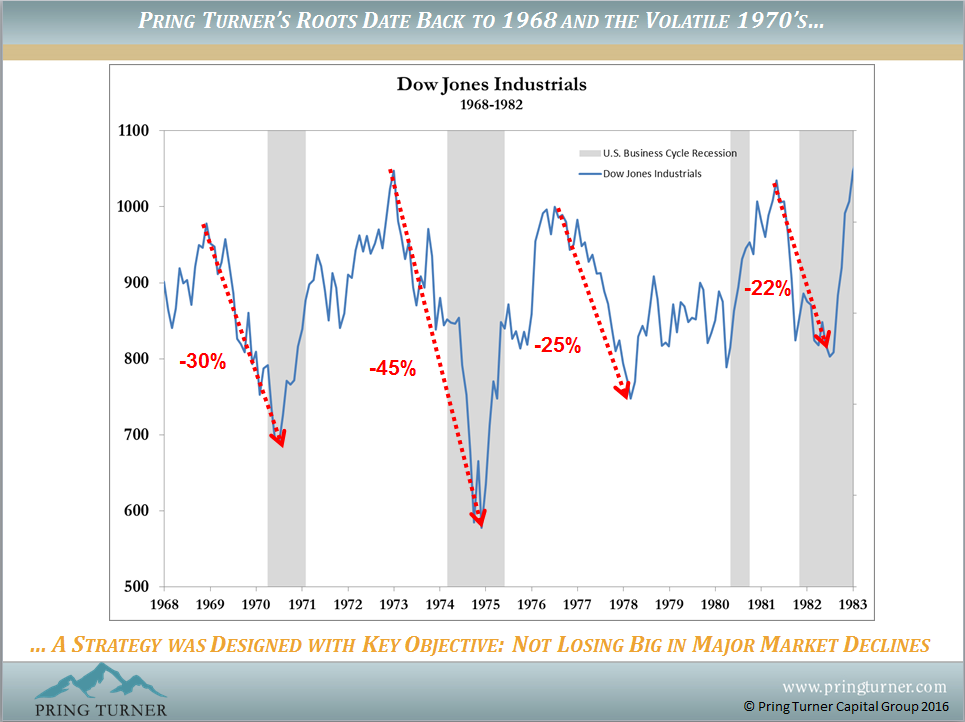

Tom began by highlighting the similarities of the past 16 years’ trading range to the late 1960s to early 1980s trading range, where the markets travelled far and wide but made no real progress. Then he reviewed a chart that demonstrated how Pring Turner’s active investing approach has provided steady growth compared to passive or index investing, especially when applied to retirees who are taking a monthly withdrawal to live on.

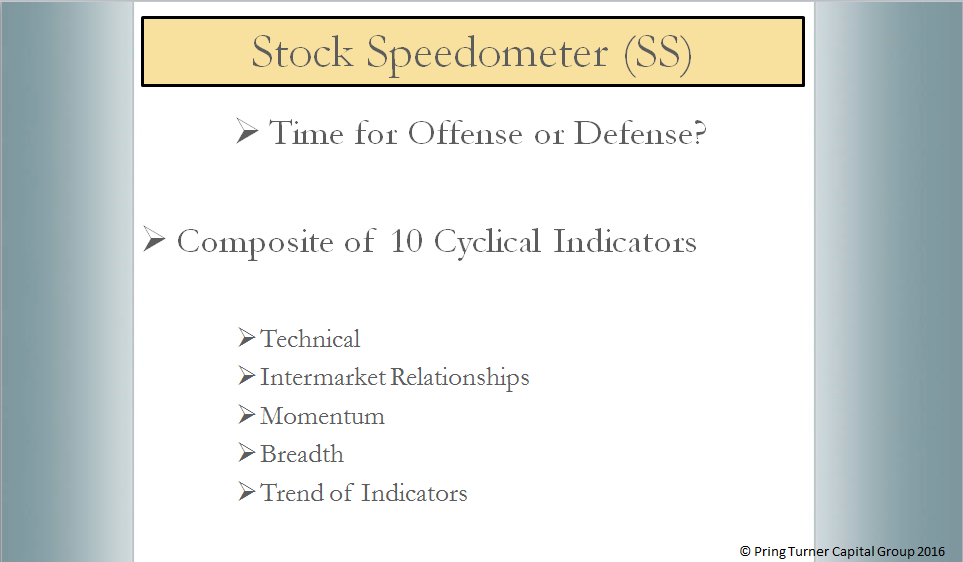

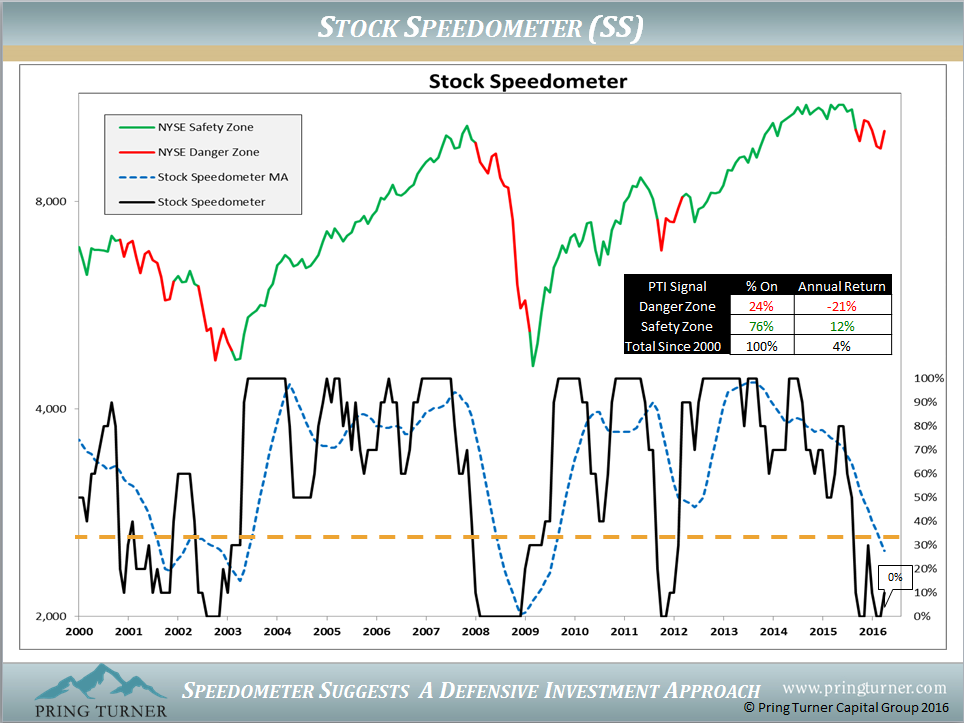

Jim followed by discussing a core thesis of Pring Turner, which is that we are always on the path for continuing improvement. One recent improvement was to enhance our barometer results with a more comprehensive model based on our multi-decade experience with financial modeling. So, Jim introduced our Stock Speedometer, a primary trend indicator, and explained its powerful results.

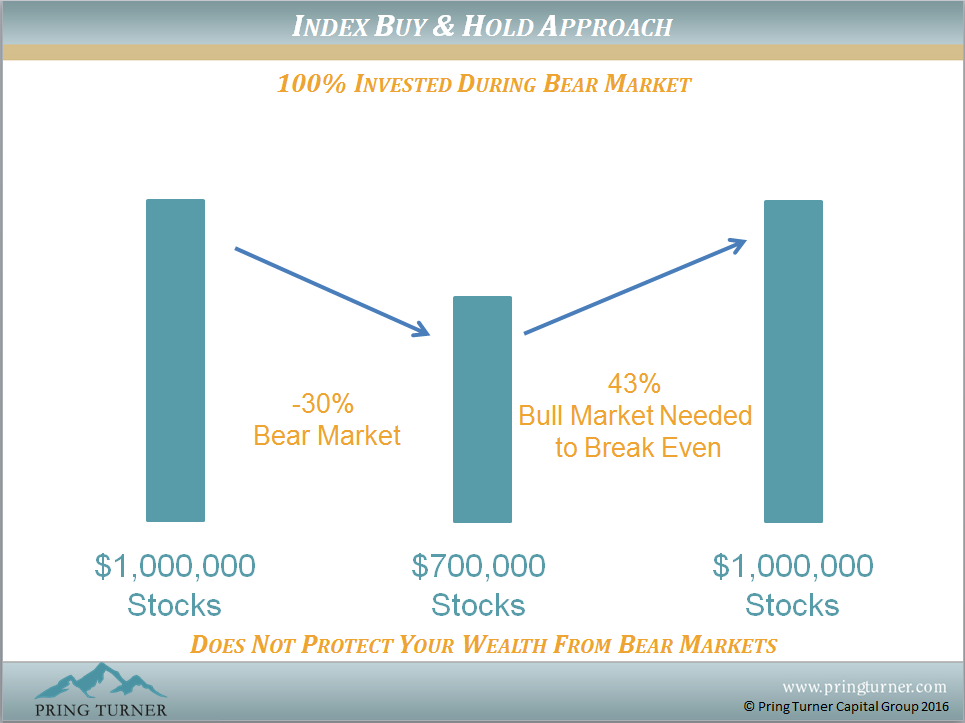

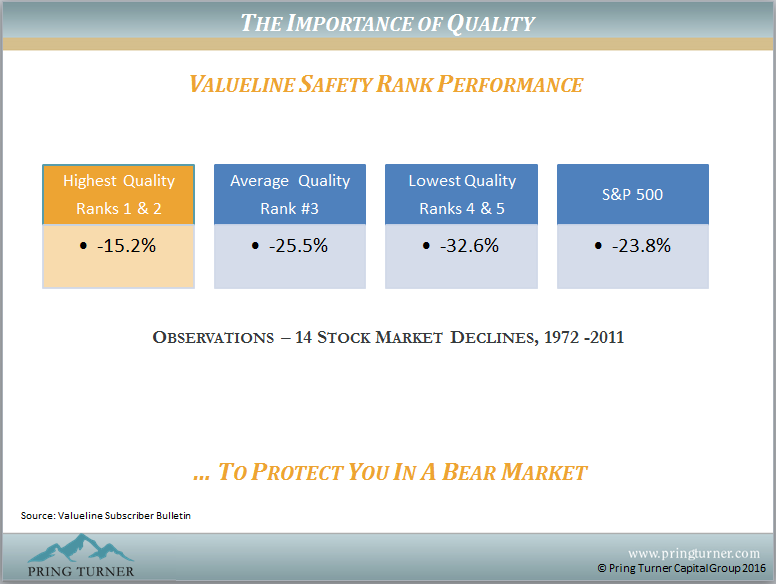

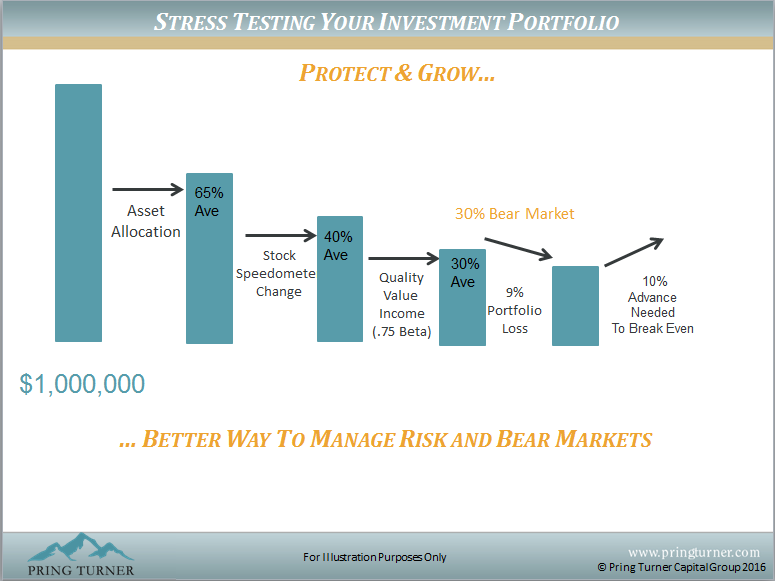

Next, Joe introduced the concept of stress testing your portfolio for a bear market. Stress testing means you understand how well your portfolio will survive a typical bear market decline. He demonstrated the importance of having a prudent discipline, such as how the Stock Speedometer helps an investor sidestep much of a bear market decline and how an emphasis on high quality stocks will further protect investors. The end result is a much more favorable and tolerable path to compounding wealth.

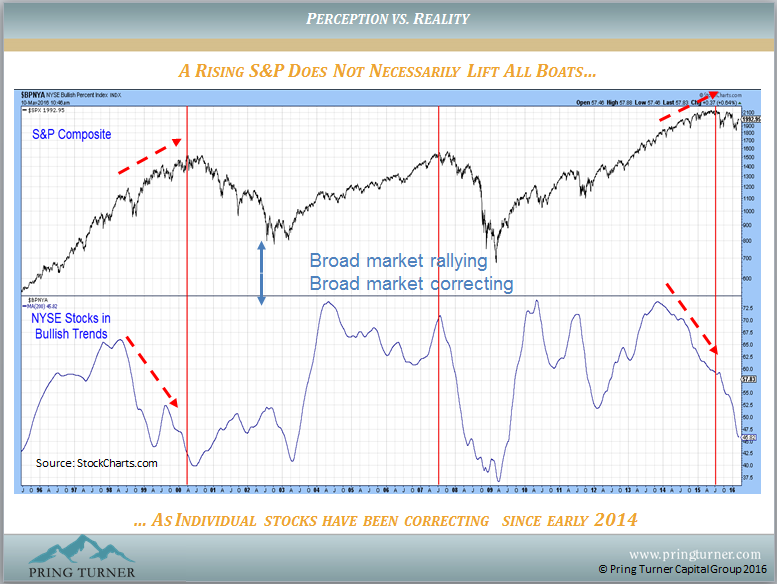

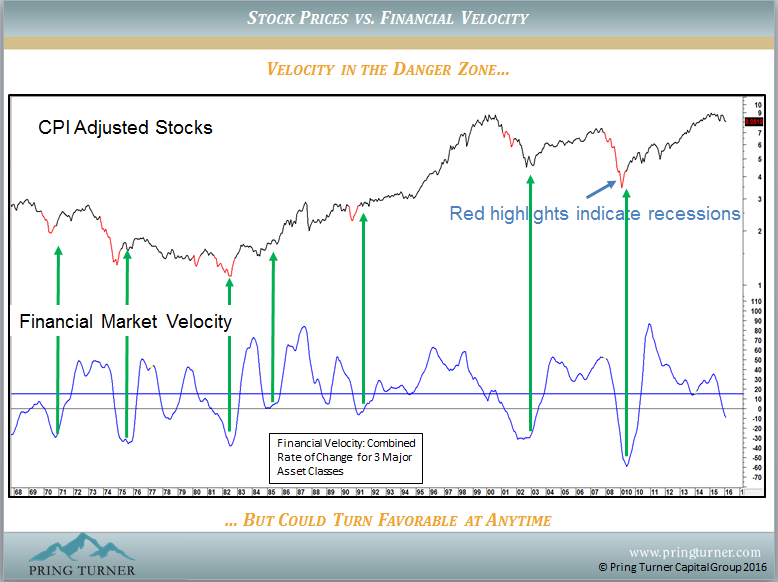

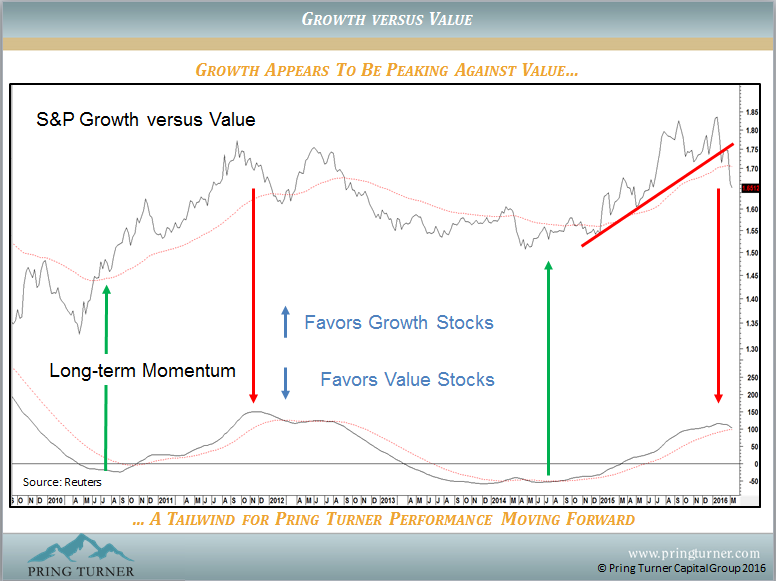

Martin continued the webinar by reviewing two charts that displayed some of the rationale for our current defensiveness, and showed why we may be near the end of the current bear market. One chart demonstrated how value stocks were taking leadership over growth stocks after several years of under-performance. This is good news for Pring Turner clients as we emphasize value stocks in your portfolio.

Tom wrapped up the webinar and concluded that our portfolios are currently in a ‘protect’ mode, but we are prepared to put the offense back on the field as the evidence turns positive.

Last summer and again to start the New Year, it felt like markets drove off a cliff with deep and sharp market declines. Have we bottomed out? Are we there yet? This update explains why we continue to drive portfolios at a safer speed.

Your portfolio is in “protect” mode for now, but we are preparing to put the offense back on the field as the evidence turns more positive.

Click Here to Download the Webinar Recap

DISCLOSURES: Pring Turner Capital Group (“Advisor”) is an investment adviser registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2016 Pring Turner Capital Group. All rights reserved.