Investment Philosophy

Gauging the risks and rewards of the markets

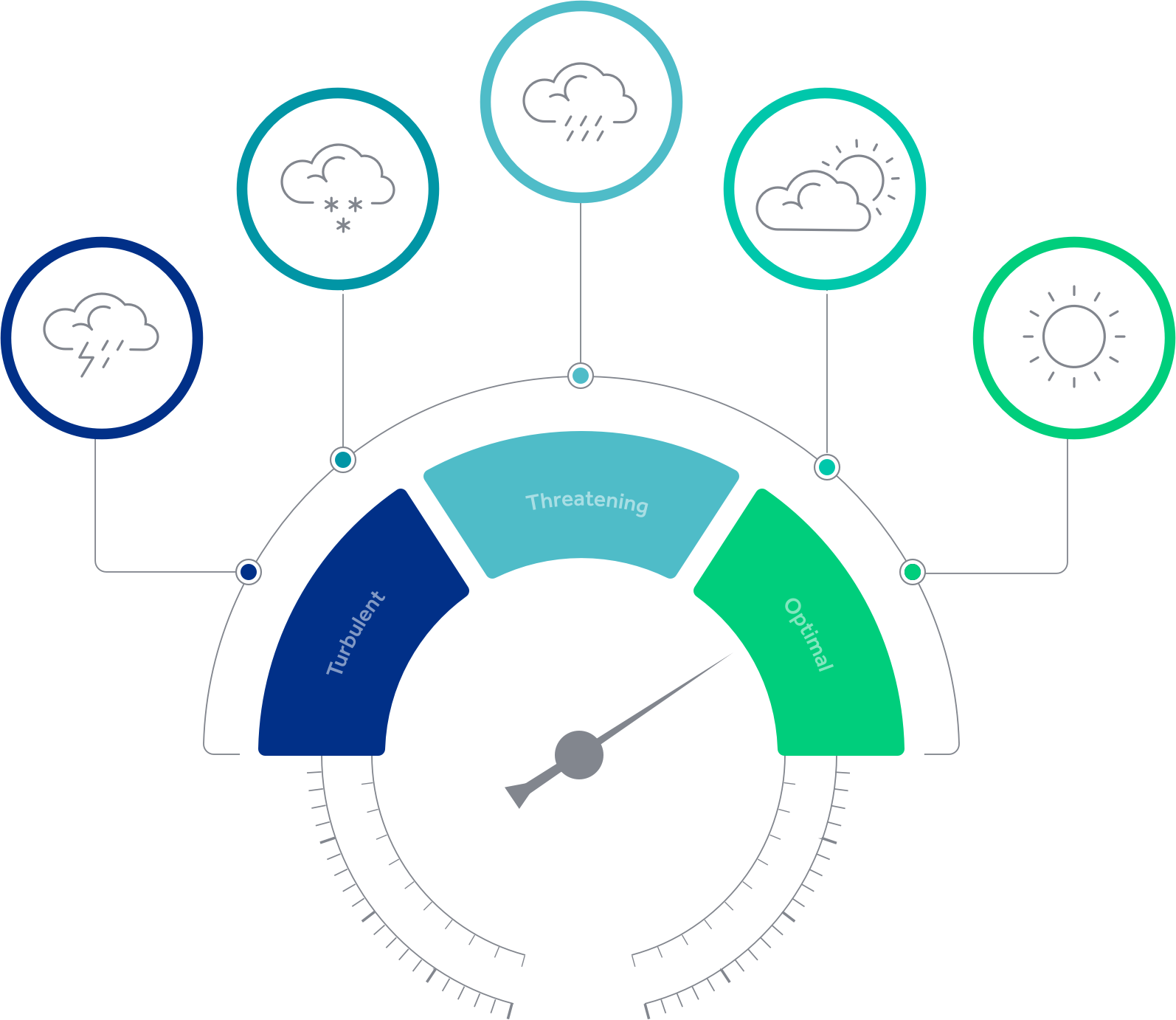

What are the conditions where you are?

If you’re an investor and you’re paying attention, it doesn’t take long to realize that market fluctuations are like weather systems.

Each system is unique, of course, but there are also some common indicators that provide hints at what’s coming next—that is, if you’ve got the skills and experience to spot them.

The Pring Turner Advanced Investment Barometers™

Anyone can use investment performance data to locate the “sunny” spots on the financial map. But not long after your financial advisor guides you to one of those “incredible opportunities,” it’s very possible that the winds will change, the clouds will form, and they’ll say you need to pack your bags and chase some more sunshine.

Our “Marketologists” carefully assess financial weather patterns to gauge the risk and opportunities of the financial markets. Understanding the historical inter-relationship between bonds, stocks, and inflation-sensitive assets allows for timely portfolio adjustments. Your portfolio changes with the primary goal to both protect and grow your wealth.

1. Bonds

2. Stocks

3. Inflation

This approach enables clients to anticipate market changes, find their optimal position, and let the weather come to them. They enjoy much more sunshine than rain this way. And when the skies get dark and others maybe taking losses, they endeavor to take fewer than most.

Time-tested Market Indicators

We gain foresight from our time-tested Advanced Investment Barometers™ by using proprietary algorithms to assess a wide range of market indicators, this enables us to make important portfolio adjustments based on our assessment of long-range shifts in market trends that aim to improve risk-adjusted returns, curtail losses, or both.

For example, when entering an economic downturn, it might make sense for your asset allocation to include a significantly lower exposure to stocks, a healthy mix of high-quality bonds, and extra cash to stabilize your investment portfolio. We arrive at that conclusion based on the combination of an in-depth understanding of your needs, our proprietary analytics tools, and decades of success helping people like you enjoy financial security.

Objective #1: More Reward. Less Risk.

The prevailing “wisdom” in financial management is that you have to take greater risks to reap greater rewards. We’ve thrown that tired adage out the window. Our systematic approach to investing may not have the allure of hunting for “the next big thing,” but it seeks to help our high-net-worth clients achieve greater rewards with less risk. And they can utilize those rewards to enjoy a comfortable retirement even as other investors are busy chasing sunshine.