Is a passive, buy and hold investment strategy or an active investment approach right for me?

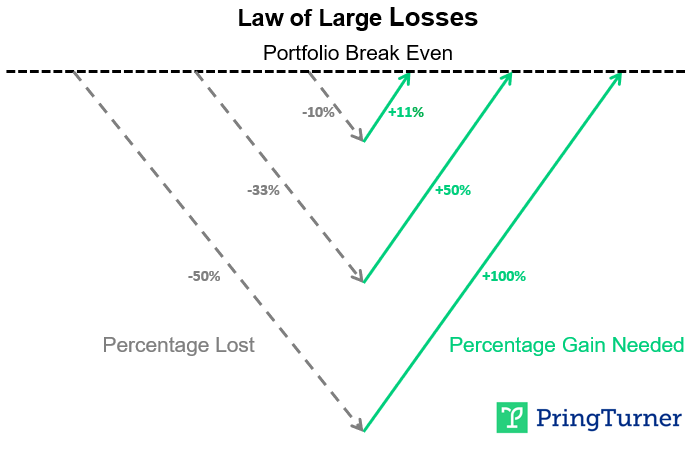

First, let’s clarify the concept of ‘active’ investing. As a fee-only Investment Advisor, we emphasize the importance of active risk management. Over our many years of experience, we have found that active risk management has significant advantages. One key reason is the potential mitigation of significant losses, as demonstrated by the ‘law of large losses.’ This principle underscores the need to avoid substantial losses in investment strategies. For example, losing 33% in a typical bear market for stocks requires a gain of 50% to just get back even!

The second reason relates to the challenges many investors face when dealing with market volatility and price declines. It’s important to acknowledge that passive investment strategies have their own appeal. The ‘set it and forget it’ approach, which simplifies investment decisions after an initial setup, is straightforward and convenient for many.

However, it’s crucial to understand that no investment strategy is devoid of risks, and each approach has its advantages and disadvantages. If the stock market only moved upwards, passive investing might appear easy to maintain. However, past bear markets have demonstrated that it’s not without its challenges for many investors. It’s essential to recognize that a passive investment strategy designed to capture market gains will also entail capturing losses during market declines. As bear markets persist and introduce volatility, ‘buy and hold’ investors may realize that this approach involves more volatility than initially expected. Some may decide to adjust their investment strategy when losses decimate their portfolio and sell when the pain and emotional intensity can no longer be stomached.

The passive approach typically involves maintaining a fixed asset allocation regardless of changing economic or financial market conditions. This approach may lead to different investment outcomes. For example, the standard passive tactic of periodic rebalancing involves making automatic investment decisions, but it’s important to recognize that there are potential drawbacks. Rebalancing entails selling a portion of a strong-performing asset class to allocate more to a weaker one. During significant market declines, this strategy may keep investors fully exposed during highly volatile negative periods, which can impact investment results. During bear markets, substantial portfolio losses can accumulate in a very short period and take a heavy emotional toll on investors. For instance, the terrifying 60% bear market decline for the S&P 500 Index of 2008-2009 lasted a little over one year and wiped out all of the stock market gains of the prior 5 years! Adding further insult to injury for passive index investors it took nearly six years (until 2013) to regain the losses from the 2007 peak: the law of large losses in effect.

Passive investing advocates may sometimes downplay the challenges of bear market periods and their impact on investor portfolios and emotional well-being. Over our lengthy careers, we have encountered passive investors who have felt dissatisfied after experiencing significant wealth declines during bear markets. Passive investing comes with both benefits and limitations and may not suit every investor.

Bear markets can be absolutely devastating. This is critically true if you are a retiree who is in the “distribution phase” of life and tapping into your nest egg for added retirement income. Rather than systematically adding to an investment account during bear market periods and taking advantage of lower prices, you are forced to sell at low price levels in order to withdraw funds to meet your spending needs. This added hurdle for you should be a real consideration when selecting an investment strategy, as it can be extremely difficult for retirees to maintain their standard of living if their nest egg suffers significant market losses.

It is important for all investors to focus on the long-term performance of any investment approach, encompassing full market cycles, to assess its effectiveness. Equally important is ensuring that the chosen strategy aligns with the investor’s specific needs, risk tolerance, and emotional comfort.