You can watch the entire 70-minute event by clicking the play button below, read the transcript here, or keep reading for the executive summary.

This client event focuses on our mid-year financial market outlook. Our intention is to keep you informed and answer any questions that you may have.

As we cross into our 48th year of managing client portfolios, we hosted a special summer webinar to share the origins of our investment discipline, how we’re navigating today’s challenging markets, and what clients can expect in the months ahead.

The Power of Process

Joe Turner kicked things off by revisiting how our approach to risk-managed investing was shaped over decades of market cycles. From his early days in the late 1960s—when the Dow touched 1000 and wouldn’t return to that level for 14 years—to building a process anchored in following business cycle progress and focusing investments that feature quality, value, and income. Joe highlighted the importance of humility, mentorship, and research.

“If you manage risk well, the miracle of compounding can take care of the rest.” — Joe Turner

Our investment process operates like an inverted pyramid—starting with long-term secular trends and working down through business cycles, intermediate moves, and ultimately security selection.

The Business Cycle View

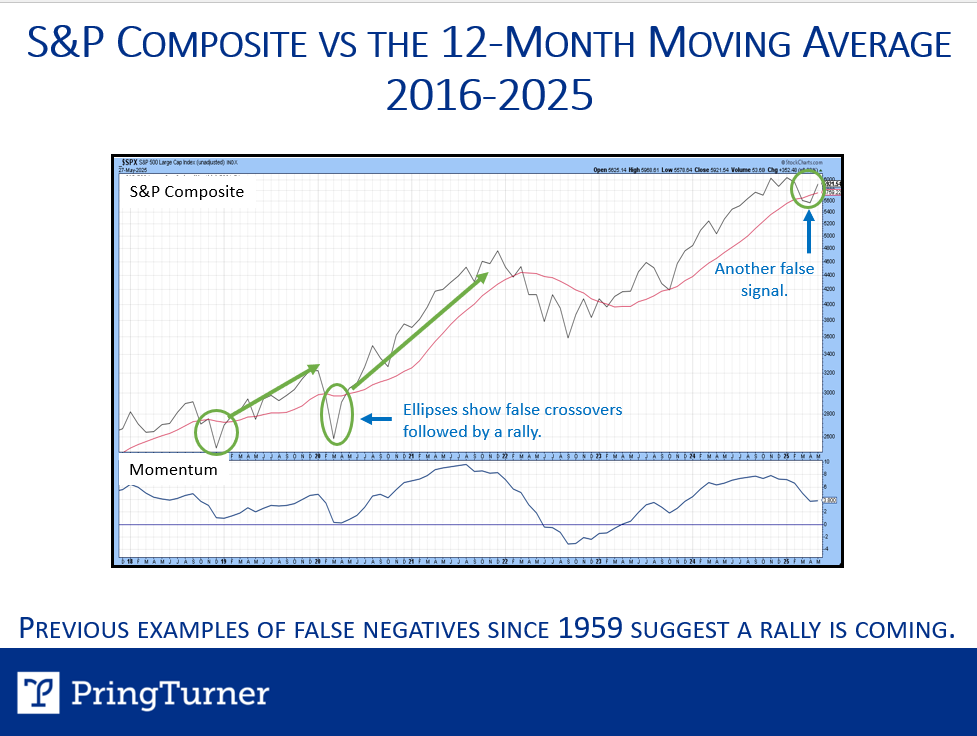

Martin Pring provided historical context around the 12-month moving average crossover — a trend-following signal that has historically been useful over the past 70 years, though like all technical indicators, it has experienced periods of failure or whipsaw. Recent market activity, he noted, looks more like a “whipsaw” pattern—a brief dip below the average followed by a recovery—than the start of a prolonged bear market. Looking at a Michigan consumer sentiment indicator reinforces the optimistic outlook.

“Right now, it looks less like the start of a bear market and more like a classic whipsaw—a short-term scare in a longer-term bull trend.” — Martin Pring

He also reviewed economic leading indicators, and sector momentum—concluding that a recession hasn’t been confirmed, although there are early signs of economic softening that we are watching closely.

Portfolio Positioning: Playing Offense and Defense

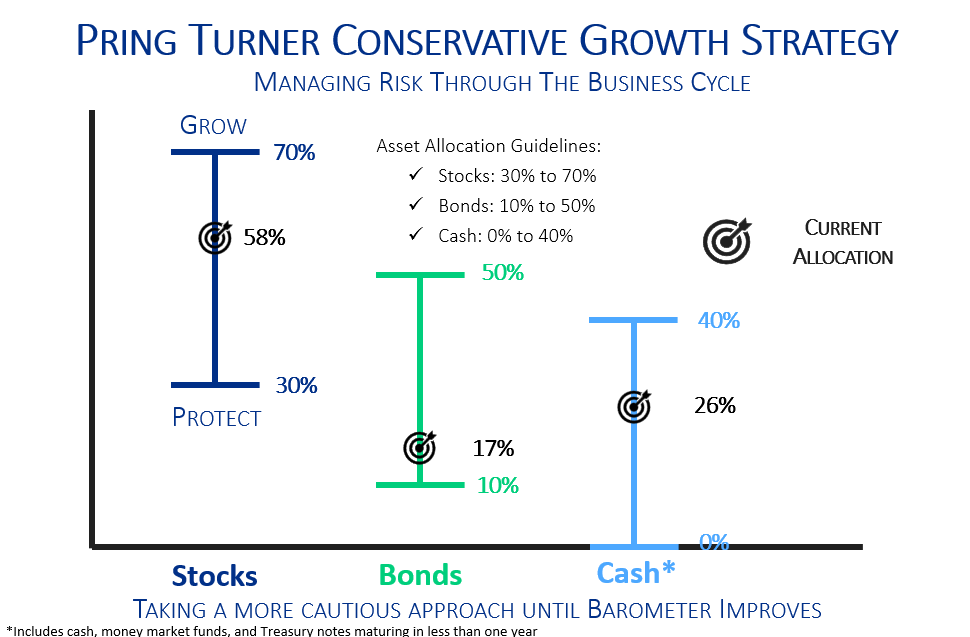

Tom and Jim Kopas walked through recent changes to portfolios. While it’s still a bull market, we’ve taken a more cautious stance in recent weeks—reducing equity exposure, increasing cash, and sticking to short-term U.S. Treasury bonds.

“We’re still riding the bull—but we’ve eased off the gas pedal just a bit.” — Tom Kopas

We liken this to driving in light rain: slowing down to a safer speed. As of now, our Conservative Growth portfolios are roughly 58% in stocks, 17% in bonds, and 26% in cash. That cash is invested in high-quality money market funds earning over 4%, giving us both stability and flexibility.

Sentiment & Psychology

One of the most powerful lessons we continue to emphasize is the role of investor psychology. Joe often reminds our team that studying psychology may be more useful than studying finance. Fear and greed cycles remain powerful forces in markets, and we use tools like the CNN Fear & Greed Index and our own Advanced Investment Barometer to stay grounded.

“We’re emotional creatures—and that’s why understanding investor psychology is just as important as understanding markets.” ” — Jim Kopas

Final Thoughts

We’re still riding the bull—but with our eyes wide open. Volatility has returned in 2025, and our strategy is designed to adapt to changing conditions, manage risk, and pursue quality opportunities.

Thank you to all who joined the webinar. For those who couldn’t attend live, the recording is available, and we welcome your questions anytime.

Portfolio allocations vary by client objectives, risk tolerance, and circumstances.

Past performance is not indicative of future results. This commentary reflects the opinions of Pring Turner Capital Group, which are subject to change without notice. Any references to market indexes or indicators are for informational purposes only and do not imply that a client account has achieved similar results. No proprietary model, can assure future investment success. Investing involves risk, including the possible loss of principal.