The second quarter of 2025 brought a wave of global upheaval and domestic political tension, which unnerved investors. Despite market volatility, major indexes finished the first half of the year near all-time highs — a reminder of the importance of staying invested with a disciplined, long-term strategy. As we stated in our January client newsletter: “Most likely, 2025 will bring a return to a more normal and challenging financial environment for investors.” Indeed, the first half was challenging, but nicely profitable. That said, numerous economic and political crosscurrents suggest choppy financial conditions will persist. Considering the many uncertainties, we remain vigilant and prepared to carefully navigate the second half of the year for you.

Geopolitical Turmoil

This recent quarter opened with a jolt as President Trump announced surprisingly aggressive tariff rates on all major U.S. trading partners. This “shock-and-awe” tactic stoked fears of a 1930s-style global trade war. The unexpected severity of tariff rates raised serious concerns among investors about the potential for a sharp and sudden recession. Fortunately, markets began to recover once the three-month pause in tariffs was announced to allow more time for negotiations.

But the calm was short-lived. In June, a “12-day war” between Israel and Iran, along with a bombing raid by the U.S., ignited fresh geopolitical fears. Meanwhile, at home, markets contended with growing fiscal uncertainty surrounding the negotiation of President Trump’s “Big Beautiful Bill” — a major tax and spending package still working its way through Congress. Adding to the uncertainty, Fed Chairman Powell—fearful of the inflationary effects tariffs may have—remains reluctant to lower interest rates.

Despite this barrage of uncertainty, the financial markets showed impressive resilience. After an early-quarter panic-driven selloff, stocks staged a strong V-shaped recovery.

Whew — that was a wild quarter. So, what is next?

A Closer Look at Market Momentum: The 12-Month Moving Average

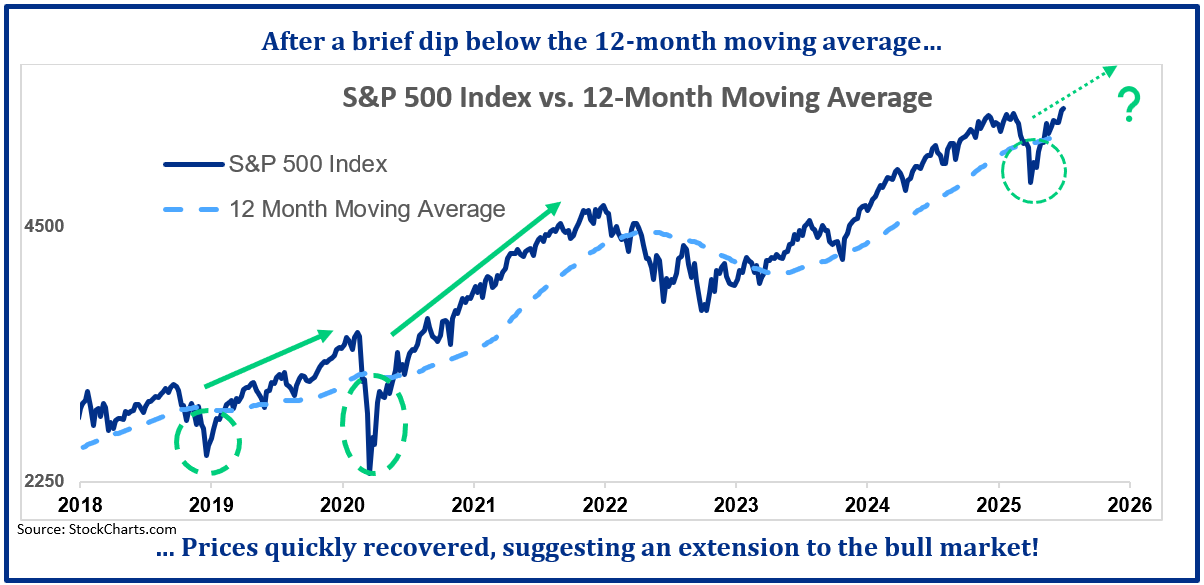

One important tool we use to assess the stock market’s longer-term trend is paying close attention to its 12-month moving average. Martin highlighted this indicator in our annual client webinar in June, which you can watch on our website. This technical analysis tool smooths out the price fluctuations of an index (or any asset) by averaging its monthly closing prices over the past year. The 12-month moving average helps investors identify the long-term trend of a market. If the current price is above the moving average, it may signal an uptrend. If it is below, it could indicate a downtrend.

Early in the quarter, the market dipped below this key indicator. However, it quickly reversed course, closing above the moving average by mid-quarter. This move is meaningful to us: it happens to be one of the indicators in our proprietary *Advanced Investment Barometer™. While no indicator can predict market direction with certainty, this signal has historically been associated with market recoveries rather than the onset of extended downturns.

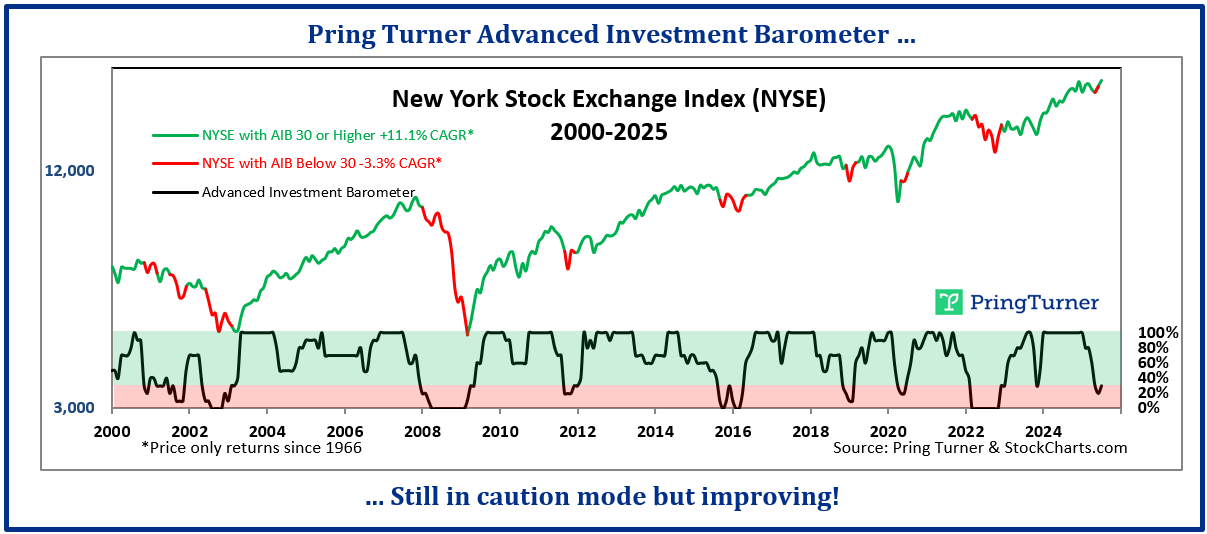

The most recent update of our Advanced Investment Barometer™ shows it remains in the “caution zone”. However, we are encouraged to see it moving in the right direction — gradually improving as the market recovered from the onslaught of troubling headlines. If the AIB™ continues to improve, it may suggest improving market conditions and the potential for the ongoing bull market, which began in late 2022, to continue. On the other hand, we are prepared to shift to a more defensive stance in your portfolio if the indicator deteriorates again. We are cautiously optimistic but remain on high alert!

Portfolio Positioning: Quality, Value, and Income

Throughout this volatile quarter, we continued to emphasize Quality, Value, and Income — key principles designed to manage risk and support long-term goals. These investment characteristics help reduce risk during turbulent times, providing a smoother path through uncertainty without sacrificing long-term return potential.

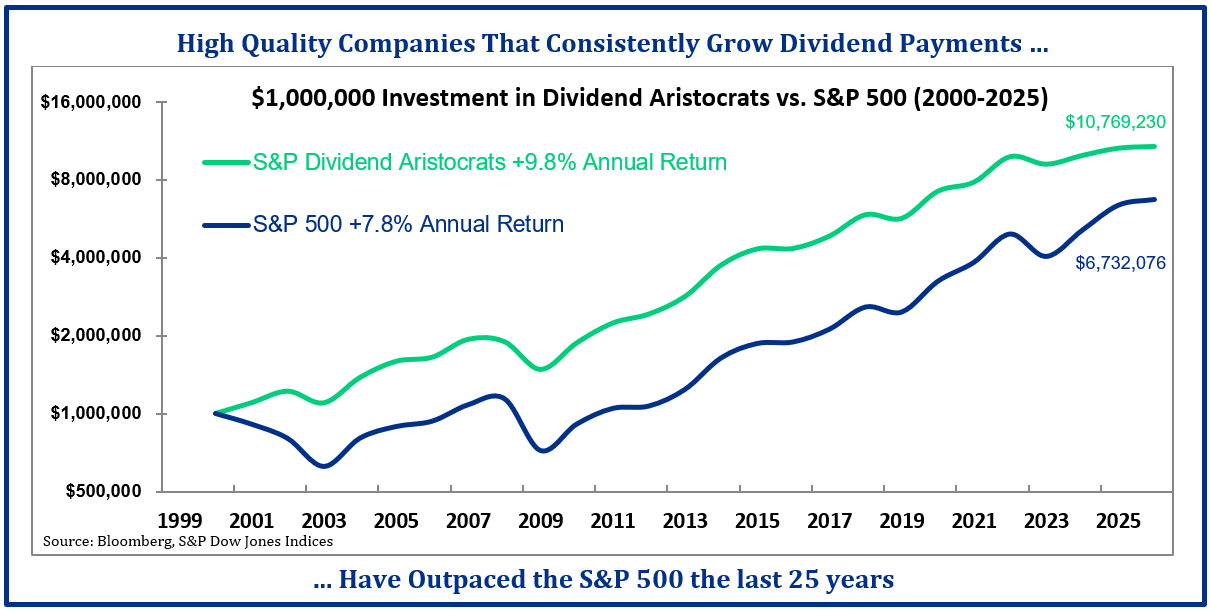

Quality, Value, and Income are three key factors we emphasize to protect and grow your portfolio. While all three are critical, income is often the underappreciated component. The chart illustrates the power of dividend growth over time. Since 2000, the S&P Dividend Aristocrat Index—made up of companies that have increased dividends for 25 consecutive years—has significantly outpaced the broader S&P 500. Much like this index, your portfolio is constructed with the goal of generating higher income than the overall market, focusing on dividend-paying companies that have historically demonstrated consistent growth and financial stability.

A highly selective and robust process is used to place growing dividend income into your portfolio. Higher dividends, a margin of safety, and a history of annual increases form a powerful recipe for generating strong total returns over the long run.

Another key advantage: dividend income acts as a natural downside shock absorber when markets stumble — as they did earlier this quarter. As shown in the chart, stocks that pay attractive, reliable dividends tend to hold up better during declines. This stability, combined with a consistent income stream, can provide meaningful support during periods of market uncertainty, while also positioning your portfolio for long-term growth potential.

As a result of our disciplined, risk-managed investment approach, portfolios focused on Quality, Value, and Income have historically demonstrated the potential to keep pace with the broader market — often with lower volatility.

Congratulations and Thank You

We want to congratulate you for staying the course through a quarter filled with noise and uncertainty. By trusting the process and remaining committed to your long-term investment plan, you have participated fully in the recovery and growth that followed. This quarter serves as a powerful reminder: a well-constructed portfolio is built to weather occasional storms. Your patience and discipline are the true foundation of this success.

As always, we remain focused on helping you grow your wealth prudently, preserving your purchasing power, and pursuing your financial goals with confidence. We appreciate you and are truly grateful for your continued trust.

Learn how our unique approach and personalized advice are designed to help you manage risk and support your long-term financial goals.

*The Advance-Decline Institutional Barometer™ (AIB™) is a proprietary indicator developed by Pring Turner. It is based on historical market data and is designed to provide insight into potential market trends. However, no indicator can guarantee future results, and the AIB™ has experienced periods where signals did not correspond with subsequent market performance.

Past performance is not indicative of future results. This commentary reflects the opinions of Pring Turner Capital Group, which are subject to change without notice. Any references to market indexes or indicators are for informational purposes only and do not imply that a client account has achieved similar results. No proprietary model, including the AIB™, can assure future investment success. Investing involves risk, including the possible loss of principal.