After a volatile first half of the year, market gains accelerated in the third quarter. Encouragingly, the recent advance unfolded with a welcome steadiness and a more stable environment for investors. Several sectors, most notably technology, industrials, and precious metals performed well, while others such as energy and real estate investment trusts (REITs) experienced more modest results. Your portfolio remains positioned to participate in the current market strength. Looking ahead, we continue to see reasons to stay optimistic—and we will explain why next.

Three Positive Signs

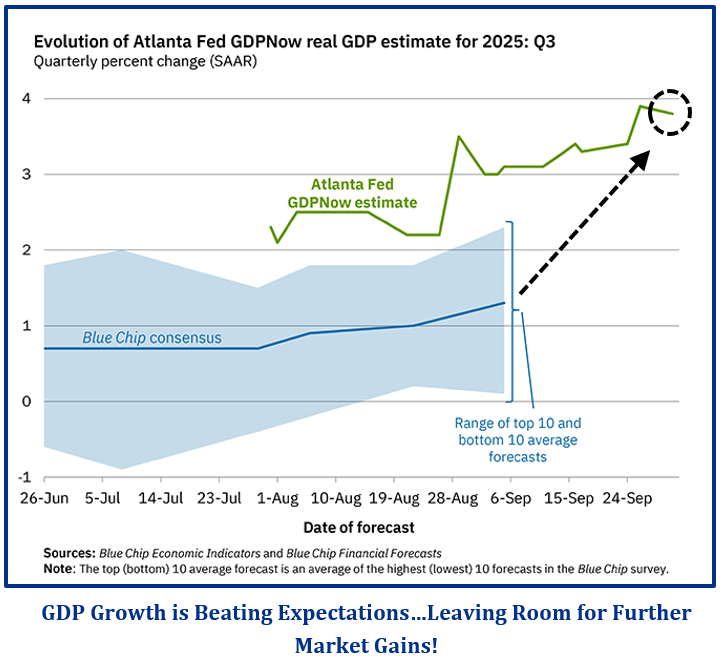

First, the economy appears to be holding up well. Case in point: The Atlanta Fed’s GDPNow model accelerated during the quarter and as of October 1st forecasts a 3.8% annualized growth rate for the third quarter. This model updates in real time as new data arrives, giving investors an early read on how the economy, consumer spending, and corporate profits are tracking. It now appears that the private “Blue Chip” consensus of economists may need to raise their modest growth forecasts. Positive surprises are usually welcome news for investors.

Stronger economic growth should support higher corporate earnings and, in turn, stock prices. Analysts are already lifting earnings estimates for the quarter, with a double-digit annual growth rate for S&P 500 profits shaping up as a welcome surprise for investors. The improving earnings backdrop aligns well with the way your portfolio is positioned, reinforcing a focus on high-quality companies that can thrive as growth and profits accelerate.

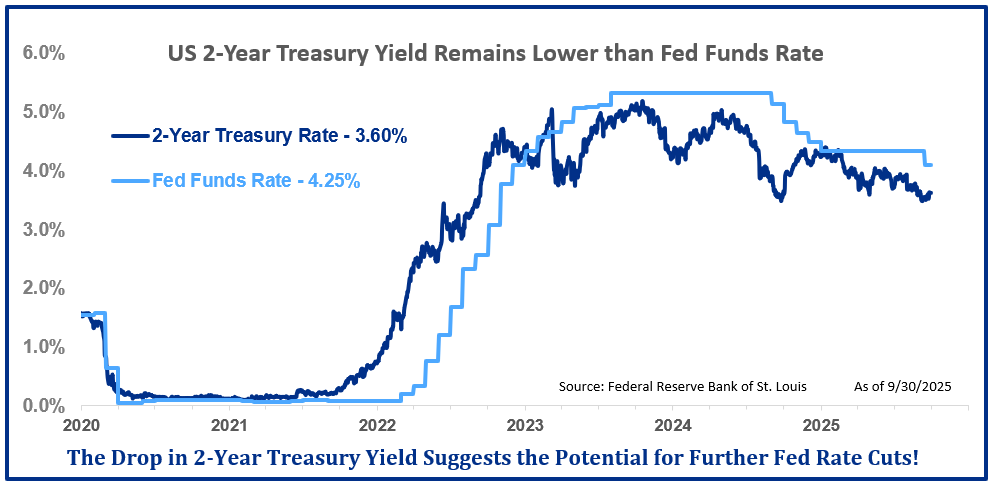

The second positive development was the Federal Reserve’s September interest rate cut. In typical fashion, the Fed has been slow to respond—raising rates later than markets anticipated in 2021–22 and then taking its time to lower them over the past year. One way to see this lag is by comparing the U.S. 2-year Treasury yield to the Fed funds rate. The spread shows the Fed is once again behind the curve. Many financial observers, ourselves included, believe monetary policy should more closely follow market rates for smoother adjustments and less market uncertainty. Based on this simple relationship, there is room for another Fed rate cut or possibly two before the end of this year.

For households, this could mean modestly lower mortgage rates and a potential boost for the stalled housing market. For investors, it suggests the stock market may continue to move ahead of the Fed, generating further profits for well-positioned portfolios. Lower interest rates generally support stocks while also making borrowing cheaper for businesses and consumers—factors that can help sustain portfolio gains in the months ahead.

However, there is one potential “fly in the ointment” with easier Fed monetary policy: lower interest rates could add fuel to an already worrisome inflation backdrop. Chairman Powell described the latest cut as an “insurance policy” against a weakening jobs market. Yet, while the labor market has softened, the strong GDPNow forecast points to ongoing economic strength. The key question now is whether further rate cuts could keep inflation uncomfortably high? Your portfolio is designed to navigate either outcome – inflation-sensitive holdings can benefit if price pressures linger, while Treasury notes should gain value if interest rates move lower.

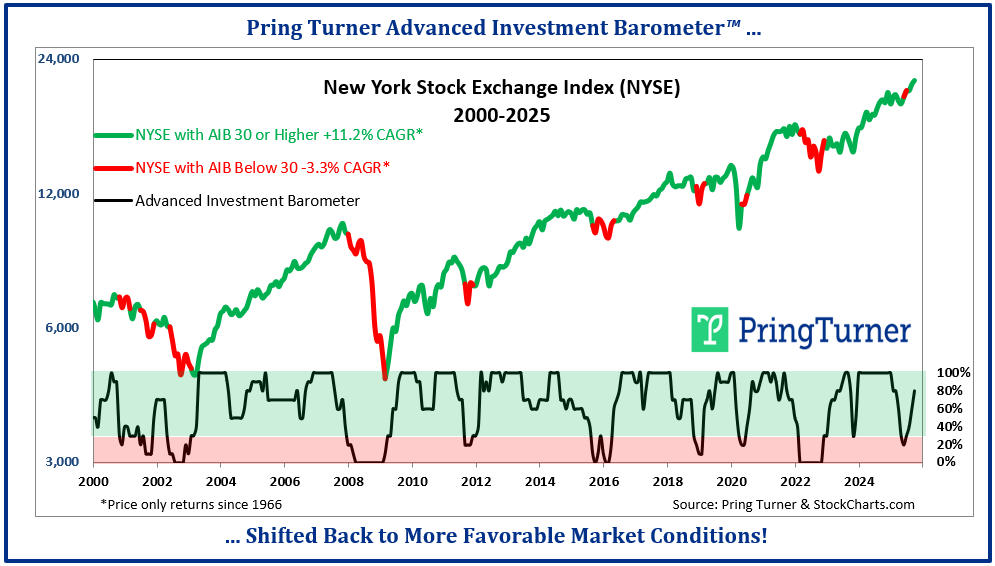

In addition to these broader trends, our proprietary Advanced Investment Barometer™ (AIB™) continues to show improvement. This model helps us assess the overall health of the stock market and fine-tune portfolio positioning. Historically, higher readings have led to better returns for the average stock; conversely, lower readings have led to poorer returns. After signaling caution after the market’s “Tariff Tantrum” in April, the AIB™ has recently shifted back into “growth mode”. This reflects stronger market conditions and continued opportunity to grow your portfolio. The return to growth mode gives us extra confidence as we carefully add high quality stocks that provide good value and above-average dividend income to your portfolio.

Looking Ahead

As we head into the final quarter, your portfolio is positioned to take advantage of both ongoing economic growth and favorable market conditions. Strong earnings, steady gains in key sectors, supportive Fed policy, and positive signals from our Advanced Investment Barometer™ all suggest that opportunities remain for further growth. At the same time, we continue to monitor inflation, interest rates, and other potential risks to ensure your portfolio stays well diversified and resilient. While markets cannot be predicted with certainty, the combination of these factors gives us reason to remain optimistic—and your portfolio is positioned to benefit.

Thank You

Your confidence means a lot to us, and we thank you for your trust. As always, please feel free to contact us should you have any questions or if your financial circumstances should change. Here’s to finishing the year on a strong note!

We are thrilled to announce that Katie Fisher has been named a Partner and Owner at Pring Turner! Katie, your exceptional leadership and dedication have elevated our operations to new heights. Your meticulous attention to detail and warm, engaging personality are deeply valued by our team and clients alike. Please join us in congratulating Katie on this well-deserved achievement!

Learn how our unique approach and personalized advice are designed to help you manage risk and support your long-term financial goals.

*The Advanced Investment Barometer™ (AIB™) is a proprietary indicator developed by Pring Turner. It is based on historical market data and is designed to provide insight into potential market trends. However, no indicator can guarantee future results, and the AIB™ has experienced periods where signals did not correspond with subsequent market performance.

Past performance is not indicative of future results. This commentary reflects the opinions of Pring Turner Capital Group, which are subject to change without notice. Any references to market indexes or indicators are for informational purposes only and do not imply that a client account has achieved similar results. No proprietary model, including the AIB™, can assure future investment success. Investing involves risk, including the possible loss of principal.