Happy New Year! While 2025 delivered positive total returns for major U.S. stock markets, the path to those gains was marked by significant market volatility. A new presidential administration, shifting policy priorities, renewed tariff negotiations, a lengthy government shutdown, and rapid advances in artificial intelligence contributed to an unsettled environment with frequent market swings. Investor sentiment moved repeatedly between optimism, speculation, and deep fear, often resulting in sharp but temporary market declines during the year.

Despite this volatility, markets ultimately delivered solid results. The S&P 500 and Nasdaq Composite indices finished the year up by double-digit percentages, marking the third consecutive year of gains. Beneath the surface, however, returns were uneven. Technology, financials, utilities, and precious metals performed especially well, while homebuilders, real estate investment trusts (REITs), energy, and consumer staples lagged behind. Many observers have described this as a “K-shaped” market, with clear winners and laggards. Navigating this kind of uneven market is where steady discipline is important.

This backdrop also set the stage for many of the questions investors are asking today, particularly around technological change and how innovation reshapes the economy.

New Technology, Old Concerns

Periods of rapid change naturally make people uneasy, and today’s environment is no exception. When new technologies emerge, uncertainty often shows up first in headlines and market volatility, well before long-term benefits become clear. We saw this dynamic over the past year as investors worked to understand the potential impact of artificial intelligence (AI).

History shows this reaction is nothing new. Electricity, automobiles, computers, and the internet all sparked concerns about disruption and job losses when first introduced. At the time, these shifts felt unpredictable; in hindsight, they became powerful drivers of productivity, growth, and rising living standards.

The excitement surrounding AI in 2025 also led to periods of speculation, as investors rushed to identify potential winners before fundamentals were firmly established. Similar episodes followed earlier breakthroughs, including the internet era of the late 1990s, when expectations often ran ahead of business results. While innovation ultimately proved transformative, over-enthusiasm created volatility and losses for those who became excessively concentrated in speculative trends—reinforcing the importance of discipline and risk management.

Technological change has always produced a mix of winners and losers. Some businesses fade, others adapt, and new opportunities emerge. Economists refer to this as “creative destruction”—a normal process in which economic activity shifts as markets evolve. AI appears to fit squarely into this pattern and in our view is a productivity tool whose benefits will unfold gradually across all industries. Our sense is that 2026 may see investment interest broaden beyond last year’s mega-cap growth technology leaders toward areas that have been overlooked.

2026 Outlook: Maturing Cycle, Focused on Discipline

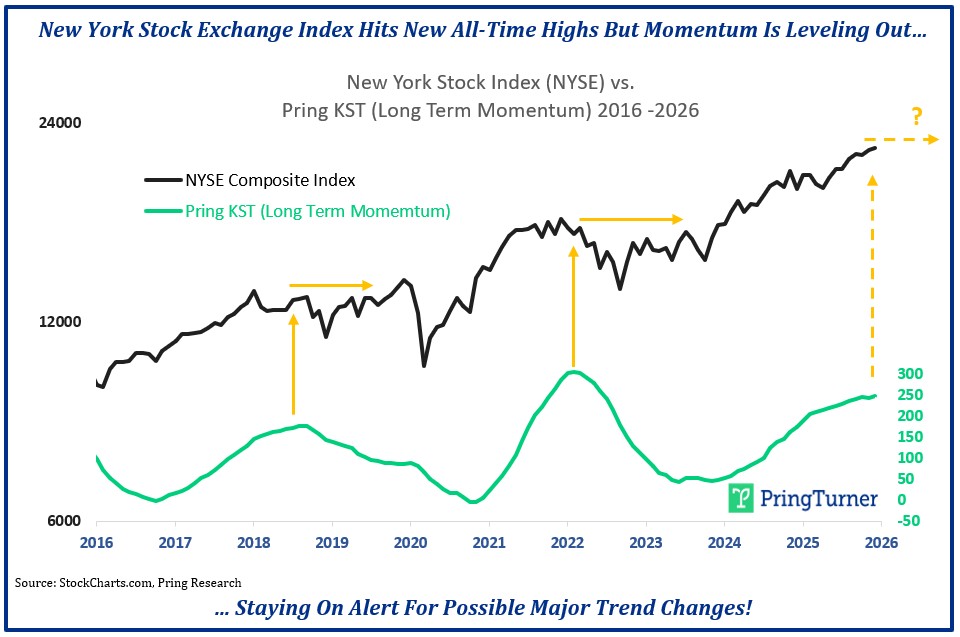

After three consecutive positive years for major stock indices, we view the current environment as a maturing bull market—one that may be getting long in the tooth but still has room to move higher. Using a baseball analogy, we may be in the seventh or eighth inning of this cycle. Extra innings are possible, but later stages typically call for greater selectivity and steady discipline.

As shown in the accompanying chart, the New York Stock Index appears overextended or “stretched”, with longer-term momentum beginning to level out. Historically, this does not signal an immediate downturn, but it does suggest staying alert for possible major trend changes. Typically, maturing bull markets often bring more volatility and shifting leadership rather than a sudden end to the expansion.

That possible leadership shift is an important theme as we enter 2026. Some of last year’s strongest performers may struggle to repeat their success, while areas that lagged in 2025 could offer more attractive, lower-risk opportunities. These rotations are a normal part of market cycles and our approach seeks to be adaptable to these shifts.

This environment plays to our strengths, and we are encouraged by the opportunities ahead. Our disciplined business cycle approach—with a focus on quality, value, and income—allows us to adjust as conditions evolve. In 2026, our focus will be on trimming areas that appear fully valued and reinvesting toward more reasonably valued opportunities.

Closing Thoughts

As we reflect on the past year, we want to congratulate you on navigating another challenging market environment. Three consecutive years of strong stock market performance are never guaranteed, and 2025 once again highlighted the value of patience, discipline, and a long-term perspective. We are grateful for the trust you place in Pring Turner and take that responsibility seriously every day. Our mission remains the same. While volatility is a fact of life for investors, we strive to pursue attractive returns and manage risk to smooth your ride over time.

As we begin the new year, we wish you and your families a happy, healthy, and prosperous 2026! We look forward to working with you in the year ahead and guiding your investments with care, discipline, and confidence.