Business Cycle Outlook

This business cycle continues to make slow progress. This slow recovery is typical of economic expansions that develop after experiencing deep financial crises such as the painful 2008-2009 melt-down. Decision-makers everywhere are understandably cautious which supports both good and bad scenarios. Good in that no unhealthy excesses have developed, yet bad in that cautiousness restrains spending and new investments. The outcome is a labored economic recovery.

Longer term one big reason we have low expectations for this and future business cycle expansions relates to the link between employment and consumer spending. This link is important because consumer spending drives nearly 70% of the nation’s business activity. The American consumer still has concerns for their job security, and rightly so, resulting in cautious spending for goods and services. The secular bear market theme we outlined in our “Lost Decade” article, published in late 2009, can in part be explained by the continuing U.S. struggle to reverse the long-term structure of American job losses.

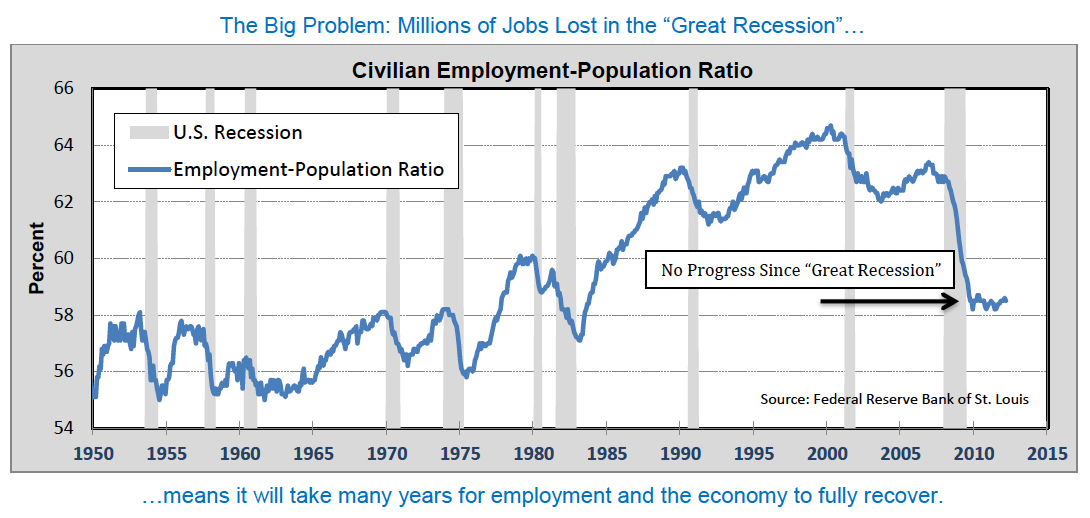

Recent monthly employment statistics reflect historically weak job growth for this nearly three year old economic expansion. Relatively weak job growth is only part of the bigger problem. Millions of jobs were lost during the 2007-2009 ‘Great Recession’ that have not been recovered and will take years to mend. The Civilian Employment to Population Ratio (number of working Americans/ total eligible workforce) demonstrates the extent of the bigger problem.

Since the end of the last recession it is clear no net new jobs have been created relative to our growing population. Jobs are simply not being created fast enough to meaningfully lower the unemployment rate and bring those idle workers back into the labor force. The result is a continued sub-par recovery that teeters between modest growth and slowdown. Eventually, a stronger employment environment will lead to higher consumer spending and a stronger economy—the virtuous cycle we would like to see take hold. But this more favorable environment is not yet evident.

Financial Market Outlook

U.S. financial markets are benefiting from 1) a slow and steady improvement in a still fragile economy, 2) a strong Federal Reserve easing of monetary conditions, and 3) the perception of being a safe haven from the European debt crisis. These conditions should continue to support U.S. markets for the duration of this business cycle and contrasts with less promising performance in overseas financial exchanges.

We believe the three year cyclical bull market for stocks is not finished, but perhaps getting tired. After a five month rally the stock market is entitled to take a short breather. Expect stocks to consolidate some of the recent gains and pull back in price over the next few weeks. However, our business cycle research shows evidence of continued modest, yet positive, economic momentum. This allows the stock market more upside potential as the year progresses. We will be searching and evaluating additional conservative growth and income ideas to purchase on weakness. Our goal is to see your portfolio achieve further new all-time high levels later this year.

As mentioned earlier, our longer term view remains that the U.S. stock market is still in a secular bear market and faces strong headwinds for a number of years to come. In fact, the Pring Turner team has completed a new investment book to be published by McGraw Hill next month entitled Investing in the Second Lost Decade. Our forthcoming book not only lays out the detailed case why investors should prepare for another lost decade but also how investors can protect and even grow their assets during this continued difficult time. The investment principles, disciplines and course of action we explain in the book are the same ones that brought you safely and profitably through the last 13 very difficult investment years. We are working hard to develop even better tools to navigate the second lost decade and look forward with confidence to both the challenges and opportunities in the years ahead.

Thank you for your trust and the opportunity to help you. As always, please feel free to contact us should you have any questions.