With interest rates at generational low levels, investment advisors face two distinct dilemmas. How to: 1) safely generate additional investment income, and 2) do this while retaining the flexibility to adapt to rising interest rates in the future? A tool we think makes sense to use in today’s low interest rate world is to build a “bond ladder”. A bond ladder is a conservative strategy to manage bond investments. Specifically, it can reduce some of the risk you face from rising interest rates, while providing additional income to your investment portfolio.

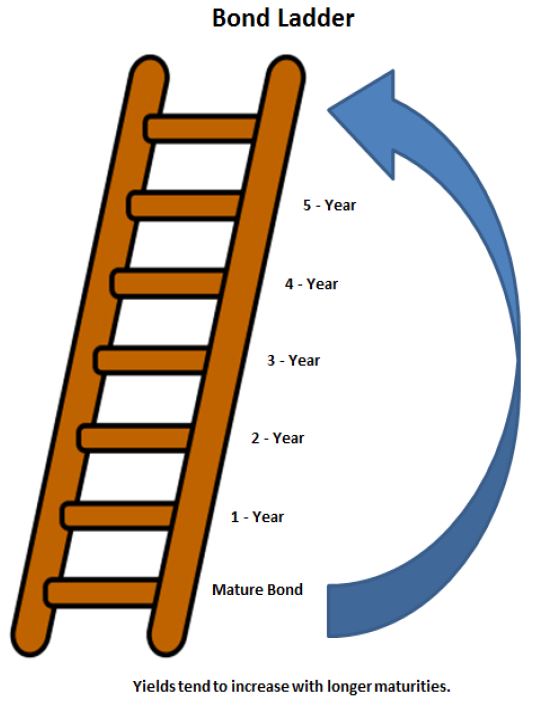

Here’s how the strategy works. All bonds have set maturity dates. These dates represent the time when the initial investment (principal) is repaid to the investor. A bond ladder investment strategy spreads roughly equal amounts of money in bond investments that mature on different dates. For example, a relatively short bond investment ladder would have a portion come due each of the next five years. Each maturity date represents a rung on the bond ladder. Investment income from the bond ladder is relatively stable because only a portion of the portfolio will mature at any given time. After the first year, when the shortest term-bond matures, the proceeds can be reinvested in a bond maturing in year six. This continuous process keeps the rolling five year maturity portfolio intact. Even if interest rates stay low, you will see an increase in investment income after the first year since a bond paying less income (1 year maturity) will be rolled into a new higher paying bond (5 year maturity). However, if over the next decade interest rates steadily rise, this flexible strategy will allow an investor to take advantage of those higher interest rates. As bond investments mature and are reinvested into the next maturity date on the ladder, the investment portfolio will see a steady rise in overall income.

The length of time, spacing between maturity dates, and types of fixed income securities can vary when building an investment ladder. We take all of these into consideration when putting the component bond investments together. Nobody knows for sure how long interest rates will stay low, but we believe a bond ladder investment strategy is a timely tool and low risk way to generate predictable income flow.

DISCLOSURES:

Pring Turner Capital Group (“Investment Advisor”) is an investment advisor based in Walnut Creek, CA. The Investment Advisor invests on behalf of individuals, organizations, and other financial advisors that appreciate a conservative and active investment style that aims to deliver consistent results without taking undue risk. The key objective of the Advisor’s investment philosophy is to not lose big during major market declines, making it easier to compound wealth over the long run.

The Investment Advisor is registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Investment Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments.

In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Investment Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2016 Pring Turner Capital Group Walnut Creek, CA. All rights reserved.