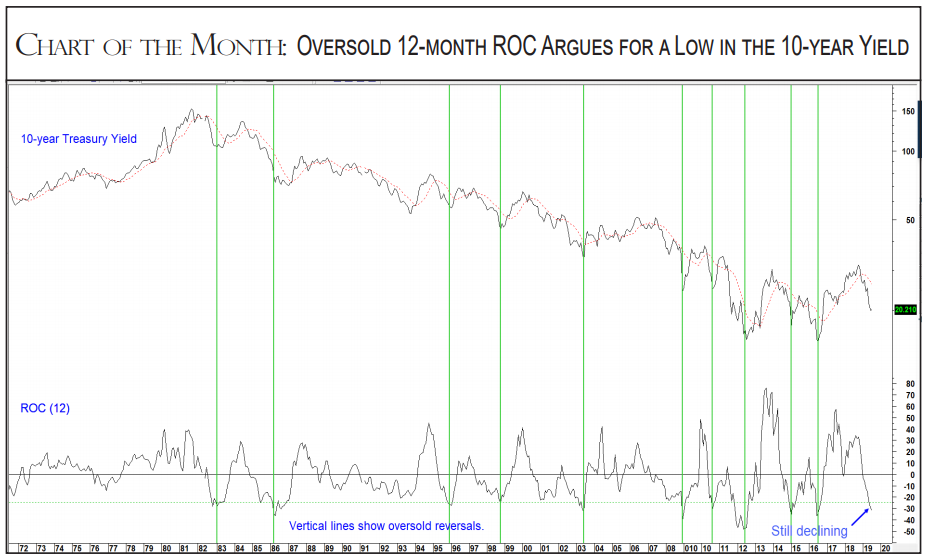

The chart of the month (below) compares the 10-year U.S. Treasury yield to its 12-month ROC. This oscillator is like a pendulum of a clock as it is continually swinging between an overstretched overbought +25% reading to a -25% oversold one. The arrows demonstrate that once it reaches -25% and then reverses, odds suggest that the yield is headed higher. A rise for yields would lead to a drop in bond prices as the two series move inversely. We don’t know where the low in the ROC will develop because its trajectory is still downward. However, what we do know, is that when it does turn, there will be very high probability that the next primary bull market for yields (bear market in bond prices) will already be underway. That’s an important piece of information to have!

Bond Pendulum Set to Swing Yields Higher

Source: Martin Pring’s InterMarket Review

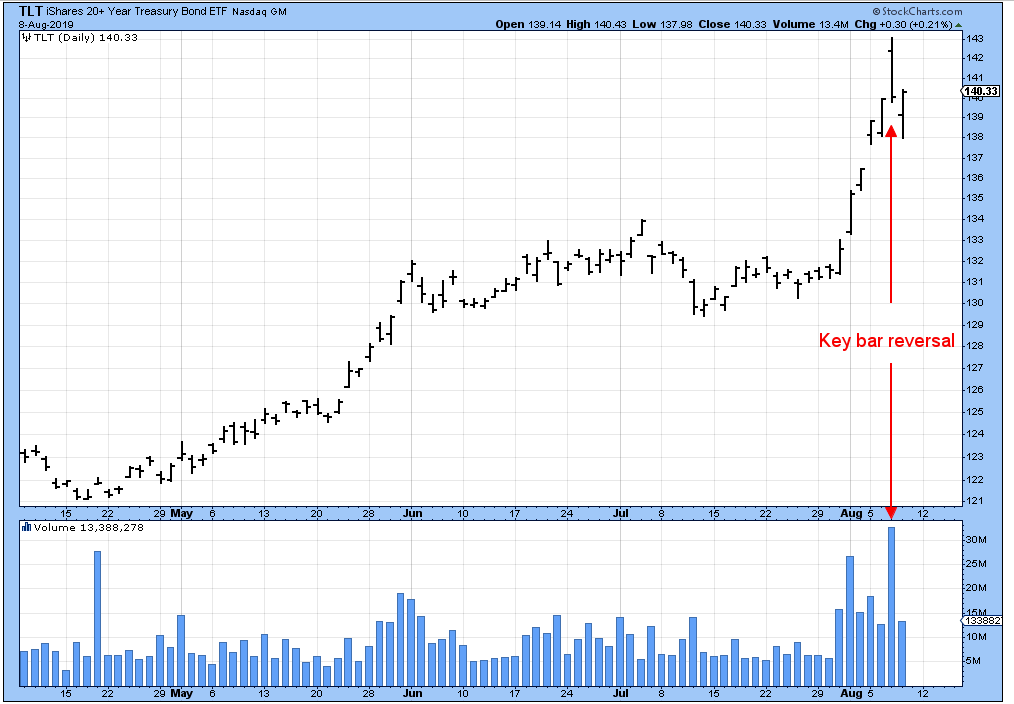

Could we be at a key reversal point? In the chart below, the iShares 20-Year Trust (U.S. Bond ETF) experienced a key reversal on August 7, 2019. A key reversal develops after a sharp rally as buyers become exhausted. Consequently, buyers are very in much control coming into that session, as they cause the price to gap up at the opening. By the end of the session, though, sellers hold sway, as the price closes close to where it closed the previous day. High volume accentuates such action, as many traders go home trapped at higher prices. These key reversals are a rare phenomenon, but, when they develop, they often occur at major turning points. If bonds and stocks continue to move in opposite directions, that should be bullish for stocks. Stay tuned!

Source: Stockcharts.com

Photo by Jeremy Bishop on Unsplash

Disclaimer: The views expressed herein represent the opinions of the Investment Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. Neither the Investment Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein.