Last year presented us with the largest consensus of economists forecasting an imminent recession that we ever recall. Contrary opinion theory says that when people start to think alike it is time to look in a different direction. After all, if businesspeople and investment advisors think a recession is on the way, is it not logical that they will already have taken steps to protect themselves from such a downturn?

At Pring Turner we are very data driven and agree that at first glance, it looks as if the economy is headed for a recession. Several of the leading economic indicators we follow are literally right at recession triggering levels, on the edge of a cliff if you will. Given the expectation of rising short-term interest rates and the reality of an inverted yield curve, it is not difficult to project a weaker economy.

Indicators On the Threshold of a Recession

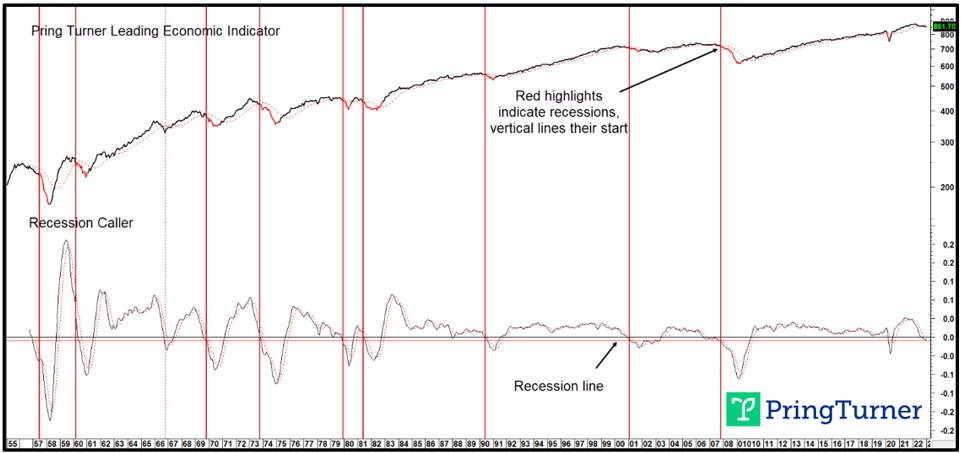

For example, our Pring Turner Leading Economic Indicator calls recessions when it approaches the “Recession Line” in Chart 1. Some recessions, as we can see from the vertical lines and red highlights, start prior to reaching the line. Others lag the crossover, so it’s not an exact science. However, this indicator is certainly in the ballpark for a signal, should things deteriorate further. In that respect, the recent slowing of its downward trajectory is an encouraging sign that further damage can be avoided.

Chart 1 Pring Turner Leading Economic Indicator and the Recession Caller

Negative crossovers of the recession line warn of an impending recession.

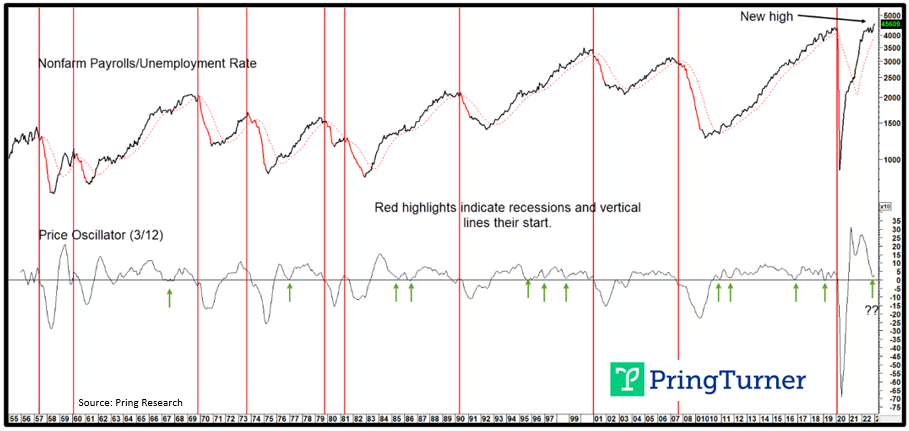

Chart 2 features another indicator on the brink. It compares a coincident economic indicator with a lagging one, nonfarm payroll data to the unemployment rate. Once again, the red highlights represent recessions, as they do for all the charts in this article, and the vertical lines their beginning. The price oscillator in the lower window compares a 3- month to a 12- month moving average (MA) of the ratio. In this instance negative zero crossovers generally warn of an impending recession. Prior to January’s employment report the oscillator was falling sharply but had not crossed the zero threshold.

Chart 2 Nonfarm Payrolls/Unemployment Rate and a Price Oscillator

Negative zero crossovers indicate the likelihood of a recession.

Its January firmness is not enough to call an actual upturn. However, it could be an indication that things may be improving. After all, the actual ratio touched a new high in January and the small green arrows show that the oscillator has rebounded eleven times from around its equilibrium point since the late 1960’s. But wait, as they say in the infomercials, there’s more!

Tentative Evidence of an Economic Bounce

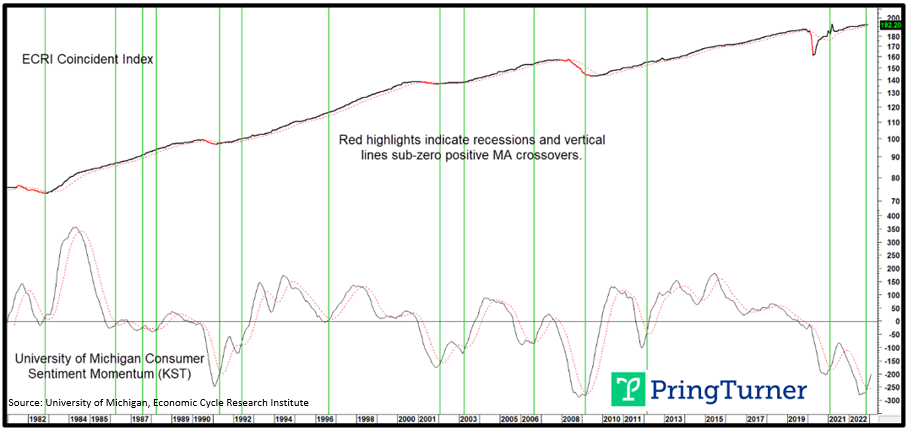

A key ingredient for economic growth is an improvement in the level of confidence. In that respect, the University of Michigan has been publishing consumer sentiment information since the late 1970’s. The raw data is extremely volatile and does not easily lend itself to trend analysis. However, if it is presented in the form of long-term smoothed momentum, a clearer path is exposed. Chart 3 compares sentiment momentum to a proxy for the economy i.e., the ECRI Coincident Index. The green vertical lines show when it crosses above its 9-month MA an end to the recession is consistently signaled. In the absence of a recession the remaining lines indicate a multi-month extension to the recovery.

Chart 3 ECRI Coincident Indicator vs Michigan Con Sentiment Momentum

Upturns in momentum signal an end to a recession or future growth.

What Does This All Mean for Stock Investors?

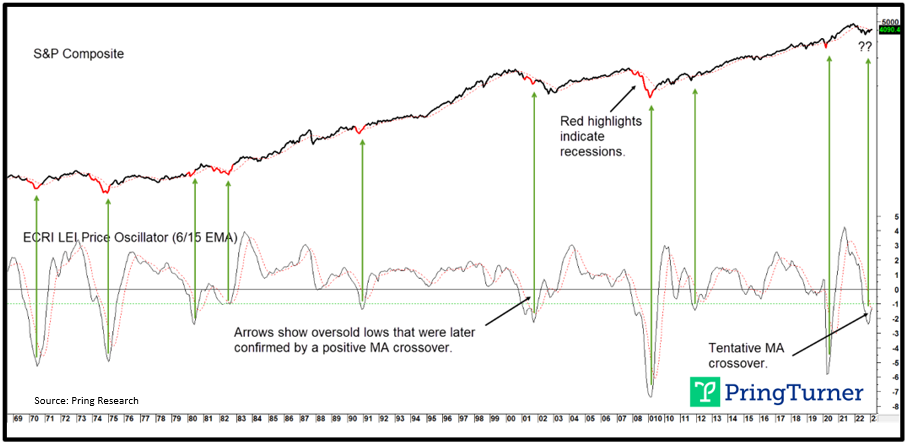

Chart 4 compares the S&P Composite to the ECRI Weekly Leading Economic Index, or rather its momentum. That momentum takes the form of a price oscillator, constructed by dividing a 6-month by a 15-month exponential MA. The arrows indicate when it dips below the -1% level and reverses to the upside. Such action consistently signals an end to the prevailing recession and/or a long-term buy signal for equities. It’s also important to make sure such upturns are not temporary, as occurred in 2001 and 2008. One way to filter out such outliers is to observe when the oscillator confirms the low by crossing above its 9-month MA. This series looks as though it may have bottomed in December. Preliminary February data puts it slightly above the average, so there is a pretty good chance that a ninth such positive signal has been triggered.

Chart 4 S&P Composite vs ECRI Leading Economic Indicator Momentum

Upside momentum reversals from an overstretched position signals an end to the recession and usually a great buying opportunity for equities.

But Wait, There’s Even More…

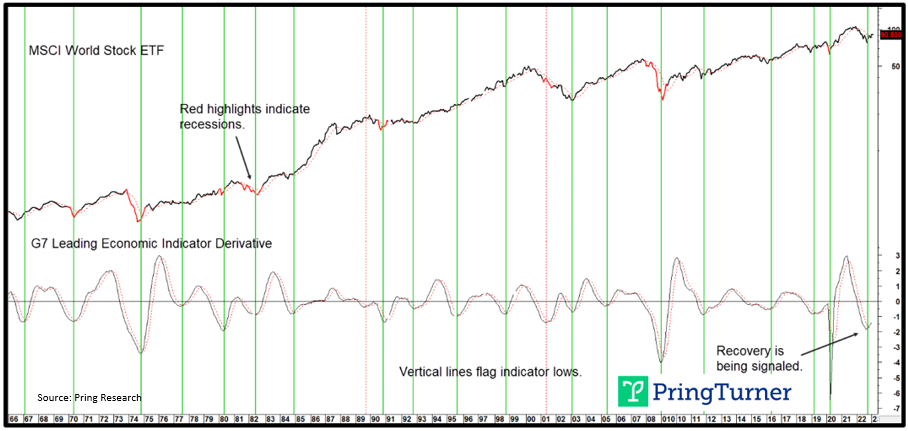

Looking around the world, one might think that the global economy has the potential to drag down the US. Ironically, a derivative of the G7 LEI, published by the OECD has not only started to turn up, but has crossed above its 6-month MA. The arrows show that, except for the 1989 and 2001 experiences, each reversal represented a great buying opportunity for global equites and by implication a global economy ready to expand. This indicator has also consistently led the termination of US recessions.

Chart 5 MSCI World ETF and a G7 LEI Derivative

Upturns in the derivative offer buying opportunities for global stocks and an advance warning US recessions have terminated.

Conclusion

The US economy has reached a crucial juncture point, as several leading economic indicators are on the edge of signaling a recession. By the same token some others have begun to turn up, suggesting that a recession will be avoided. So, how does one resolve the conflict between a worrisome macro environment, but an improving technical condition of the market? Perhaps, the funny thing that happened on the way to the recession is that it has been postponed.

History of course, tells us, that, unless the business cycle has been repealed, another recession inevitably lies down the road. It’s just a question of depth and timing. Many yield curve spreads inverted late last year, an event that has consistently called business contractions. The problem lies in the fact, that the leads have varied from a few months to almost two years. That leaves plenty of time for the latest inversion to eventually validate itself.

One possible scenario would be for the economy to get a decent bounce, frustrating the majority of forecasters, only to fulfill the negative yield curve omen at a much later date. In our opinion, that could be when the majority has begun to look up again rather than down!

Welcome to a new investment environment where higher interest rates and inflation lead to a likely trading range market. Passive investment strategies run the risk of wholly inadequate performance in this more challenging economic backdrop. Portfolio managers should pay close attention to risk management and have a tactical gameplan to take advantage of cyclical bull markets, even if they turn out to be just mini-bulls. And just as importantly, be prepared to incorporate a defensive strategy for protecting capital in the difficult periods.