Stocks enjoyed a solid quarterly performance, which added to the very strong recovery from March’s major market low. While 2020 started off on a smooth growth trajectory, nobody could have predicted what happened next. The arrival of the COVID-19 virus, followed by mandated shutdowns, led to a “flash recession” that turned into the worst economic decline with the highest unemployment rate since the Great Depression! However, as is often the case, amid all the extreme fear and uncertainty, stock prices abruptly reversed course by the end of March and steadily climbed a wall of worry. Indeed, we successfully navigated last year’s volatility and, as the New Year begins, remain optimistic!

Business conditions are gradually returning to normal and, when vaccines become more widely distributed, the pace should accelerate as more people return safely to the workforce. Leading economic indicators continue to point higher, signaling that we are still early in a developing global expansion, and we expect further portfolio rewards lie ahead. We believe this economic recovery is sustainable, and the business cycle sequence continues to play out as illustrated below.

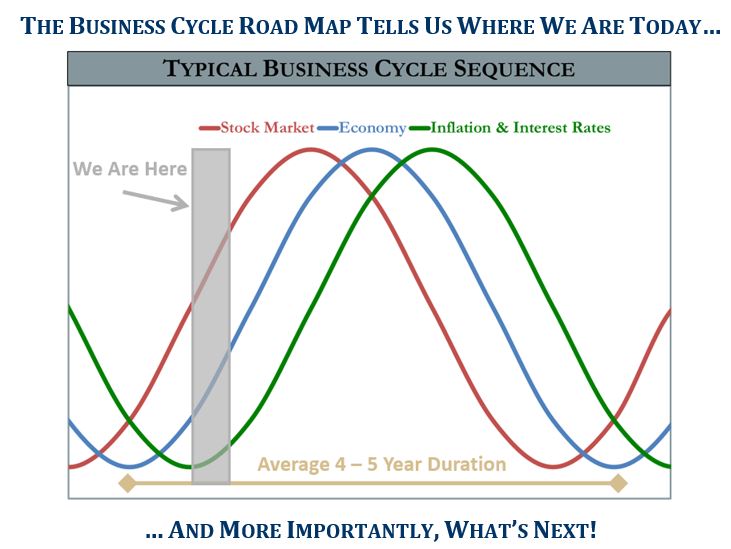

You may be familiar with our three bell curves model of the typical business cycle, featured above. This simple yet elegant chart illustrates the relationship between stocks, bonds, inflation-sensitive assets and the economy. The blue line represents the trajectory of the economy (GDP), from boom-to-bust and back again. Stock prices (red line) lead the economy, peaking and bottoming ahead of business activity. Lastly, inflation and interest rates (green line) lag the economy.

Where are we today? The shaded grey area is our best estimation of where we are in the cycle. Stock prices have embarked on a new cyclical bull market after experiencing the nearly 40% “Covid-Crash” in March. Just a few months later, the short but vicious recession ended, and economic momentum snapped back into growth mode. So, what’s next? The schematic suggests we can expect to see higher levels of inflation and interest rates as this new business cycle expansion progresses.

The real advantage of following the inter-relationship between the business cycle and financial asset prices is to always be on alert for the next turning point. For us, each month begins with a thorough review of market and business cycle research. In fact, you may recognize the “three bell curves” disguised as a mountain range in the Pring Turner logo. Our business cycle roadmap serves as a gentle reminder not to extrapolate the past forever into the future, because the economy and financial markets move in ever-changing cycles.

A Welcomed New Trend for Value Investors

As the tragic impact of the pandemic and its effect on the economy came into focus, “work-from-home” and other online technology stocks shined, while much of the rest of the market lagged behind. For instance, while the major stock market indexes recovered, led by the mega-cap technology stocks, many others – namely in the financial, energy, utility, REIT and health care sectors – remained mostly range-bound. However, later in the summer, the stock markets’ advance began to broaden out with more sectors joining the bull market party. We believe the markets’ more recent improvement could signal a long-awaited rotation into value stocks. The developing market trend toward value is certainly welcomed by us conservative investors who strive to generate consistent returns with dependable income. In fact, we are downright excited for your portfolio in 2021 and beyond!

Tactics for 2021

Stocks: Continued economic growth and improving corporate earnings should act as a tailwind for stock prices. Your core stock holdings are well diversified amongst the various economic sectors and exhibit common characteristics of high quality, solid value and growing dividend income. It is also important to keep in mind you do not own ‘the market’; rather, you own a carefully selected group of top-notch companies.

The stock market is now being driven by improving profits and earnings rather than lower and lower interest rates. Historically, as you move from an interest rate-driven market to an earnings-driven market, late-stage stocks tend to outperform. Later cycle beneficiaries include energy, financial, industrial, technology and basic materials, which are well represented sectors in your investment portfolio.

Bonds: In direct opposition to stocks, stronger economic growth and rising inflationary pressure provide a headwind for bond investors. This environment calls for the continued use of a shorter-term “bond ladder” in your portfolio. Any significant upturn in interest rates during the year, as suggested by the business cycle schematic, would provide an opportunity to lock in higher bond yields and extend the bond ladder in your portfolio. For the time being, if you have a mortgage and have not done so already, you can still take advantage of low interest rates by refinancing your loan on better terms.

Summary

Congratulations! You survived one of the most tumultuous and volatile years in history. The sound business cycle tools we utilize to manage your portfolio are time-honored and allow us to anticipate and answer the question: “What’s next?”. As we start a new year, we expect stock prices will continue to lead the way, notwithstanding temporary pullbacks, and we are optimistic that better days lie ahead for the economy and financial markets! Our ultimate goal for you is to stay a step ahead to better protect and grow your valuable assets. We look forward to the challenges and opportunities in 2021 and are focused on making sure you participate measurably in market gains while reducing your downside risk, no matter what challenges lie ahead.

We wish you a happy, healthy and prosperous New Year! Thank you for your continued confidence in us! As always, please feel free to contact us should you have any questions regarding your investments or changes to your financial circumstances.

Did you like this article?

Footnotes:

Photo by Immo Wegmann on Unsplash