…Looking Forward to the Second Half!

Pring Turner clients enjoyed strong returns in the 2nd quarter and once again reached all-time highs in wealth (adjusting for deposits and withdrawals). That makes new highs for portfolios in 13 of the last 15 very challenging years. Grateful for the market strength we are also mindful of typical market behavior in the later stages of the business cycle. Late in the cycle, inflation begins to accelerate and our portfolio tactics gradually adjust to these changes. We are prepared to both navigate the challenges and take advantage of the opportunities in the second half of 2014.

Middle-East Turmoil – A New Challenge (Again)

Middle-East tensions historically have a direct impact on energy prices and consequently inflation expectations and investment portfolios. Recent rapid deterioration of security and stability in Iraq in addition to unrest in Libya, Syria and Egypt is certainly an element in the recent upward push in oil prices. One responsibility as conservative investment managers is to determine the implications of Middle-East turmoil and proactively position portfolios for the consequences.

For the US, the best defense is to grow our own energy production and become less dependent on Middle-East oil—and we have! In our October 2013 Newsletter, we highlighted the game-changing implications of the US oil renaissance. We suggested the ongoing energy boom would significantly reduce dependency on foreign energy, add hundreds of thousands of jobs to our economy, initiate a US manufacturing re-birth and improve the balance of trade payments. Most importantly, any disruptions in foreign energy supply will now have fewer consequences for our economy and financial markets as the US moves closer toward energy independence.

Our portfolios are benefiting from this tremendous global shift in energy production and we continue to search for quality beneficiaries of surging domestic oil and gas production. These beneficiaries include investments in energy infrastructure that supports the development, movement, storage and processing of North American energy sources.

Inflation is Starting to Heat Up

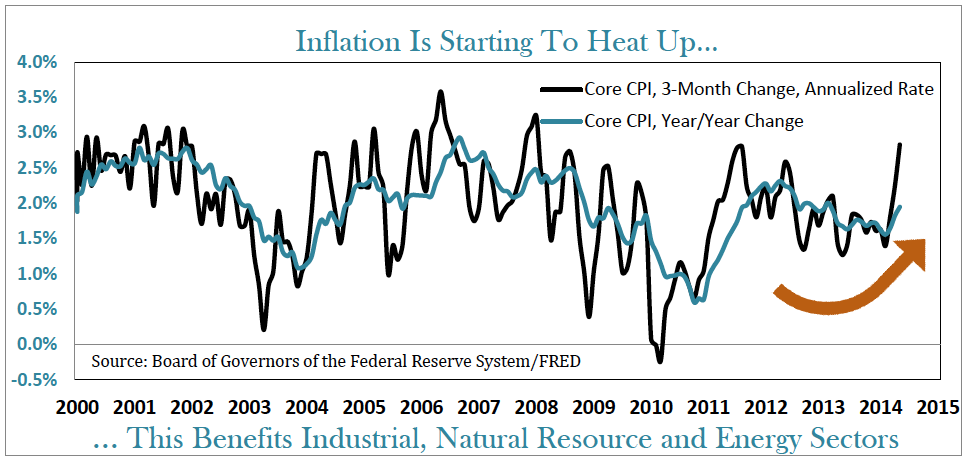

Last quarter’s newsletter pointed out financial markets were trying to identify a clear winner in the battle between the forces of inflation and deflation. We reported with the backdrop of global growth tailwinds the evidence was tipping towards higher inflation. The latest Consumer Price Index (CPI) data released in mid-June shows prices climbed .4% in May alone (equates to nearly 5% on an annual basis) with recent gains accelerating. Indeed, energy, food, shelter, healthcare and other consumer prices continue to firm, adding credence to budding inflationary concerns.

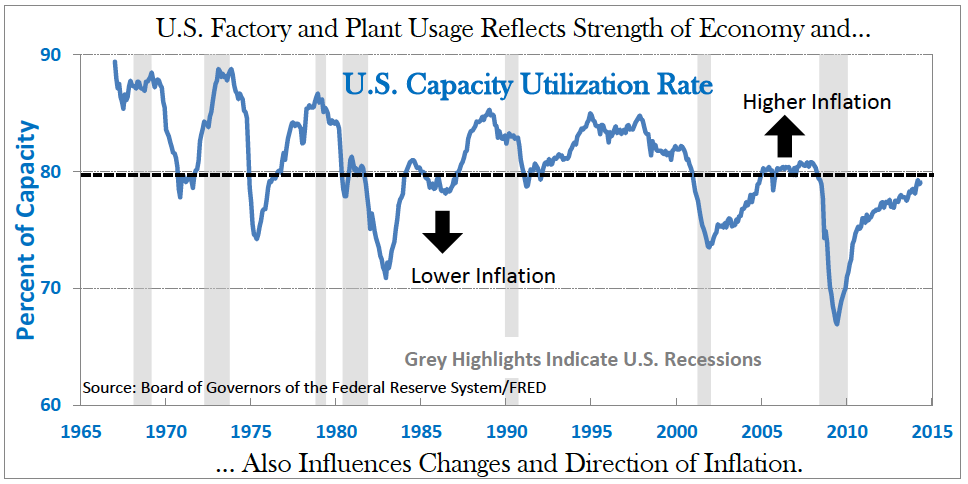

Adding to recent CPI data is an important economic indicator, the US Capacity Utilization Rate. Capacity utilization is simply the percentage of factory usage. This measure typically alerts to changes in direction of inflation. The most recent reading at the end of May 2014 is 79.1—meaning plants are running at close to 80% of capacity. That’s a far cry from the dismal readings coming out of the last recession when only 65% of our nation’s plant capacity was operating! Historically, readings approaching 80 in this indicator argue that inflationary pressures will begin to build as we use up idle capacity and the economy continues growing.

After five slow-growth years for the economy we are finally starting to feel the effects of higher prices and that has implications for investments. Inflation is a lagging indicator for the economy that typically kicks in later in the business cycle. Recent firming price behavior is rational considering how far along we are in this cycle. We believe the continuing leadership trend in inflation-sensitive securities will be durable. After three years of cyclical declines, commodity and resource based equities put in a second consecutive quarter of robust outperformance. Evidence continues to build that a new bull market for commodity prices has begun. This year’s overall portfolio outperformance is due to both persistent stock market strength and the healthy exposure to inflation beneficiaries such as energy and precious metals sectors in your portfolio.

Grateful, Yet Vigilant

As we pass the halfway mark of 2014, we are pleased with your portfolio performance given the numerous challenges facing the markets. Our disciplined business cycle investment strategy is designed to help you navigate the risks and rewards of the markets. While grateful for past years of adding value to your wealth without taking undue risk we also remain vigilant and on alert for any signs of a major turning point in the markets that would change our tactics toward more caution.

We look forward to the challenges in the second half of 2014 and believe our disciplined methodology and prudent portfolio tactics will generate continued growth for your portfolio over the long run. Thank you for your continued confidence in us. As always, please feel free to contact us should you have any questions regarding your portfolio or changes in your personal circumstances.

DISCLOSURES: Pring Turner Capital Group (“Advisor”) is an investment adviser registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2014 Pring Turner Capital Group. All rights reserved.