This year continues to be one of the worst years for stocks and bonds combined. After kicking off the quarter with a vigorous rally, stock prices reversed direction and finished near the market low for 2022. At this stage of the current business cycle, the same villains are busy attacking investment portfolios: steadily higher interest rates, inflation, and concerns of an imminent economic recession. However, prudent portfolio management is a continual process of risk control, and we used the summer stock market strength to trim back portfolio stock holdings. This step raised cash reserve levels and reflected an even more defensive investment stance for your portfolio. Indeed, this has been a year for defense and a reason why portfolios are weathering the current financial storm relatively well.

Interest Rates, Bond Prices, and Teeter-Totters

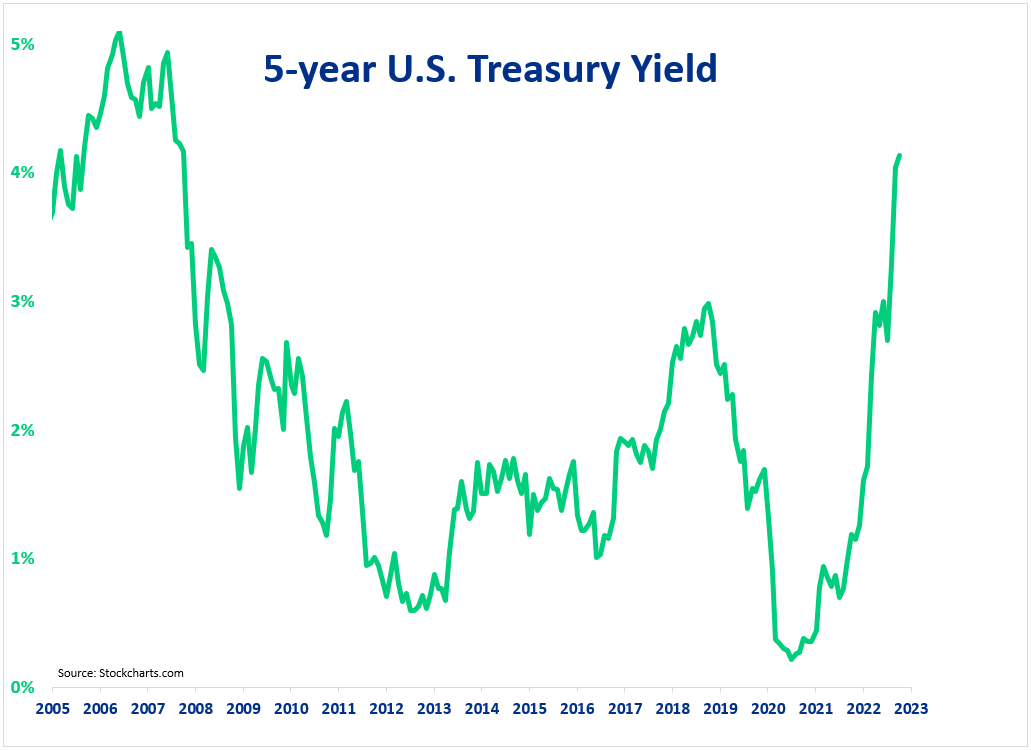

Why all the financial market volatility this year? The simple answer is interest rates. The Federal Reserve is executing one of the most aggressive rate tightening cycles in history. Higher interest rates have a damaging effect on the value of all asset classes including stocks, bonds, commodities, and real estate. In fact, this year’s aggressive monetary tightening moves are hurting long-term bond prices even more than the S&P 500 stock index!

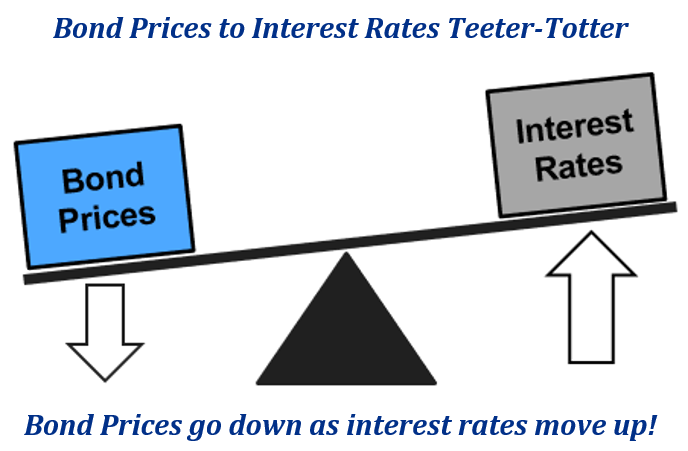

Bond price movements can be confusing, so we would like to briefly explain how bonds behave as interest rates change. The key to understanding bond pricing is to picture a teeter-totter with interest rates on one side and bond prices on the other. Bond prices move in the opposite direction of interest rates, and the longer the maturity, the larger the price swings.

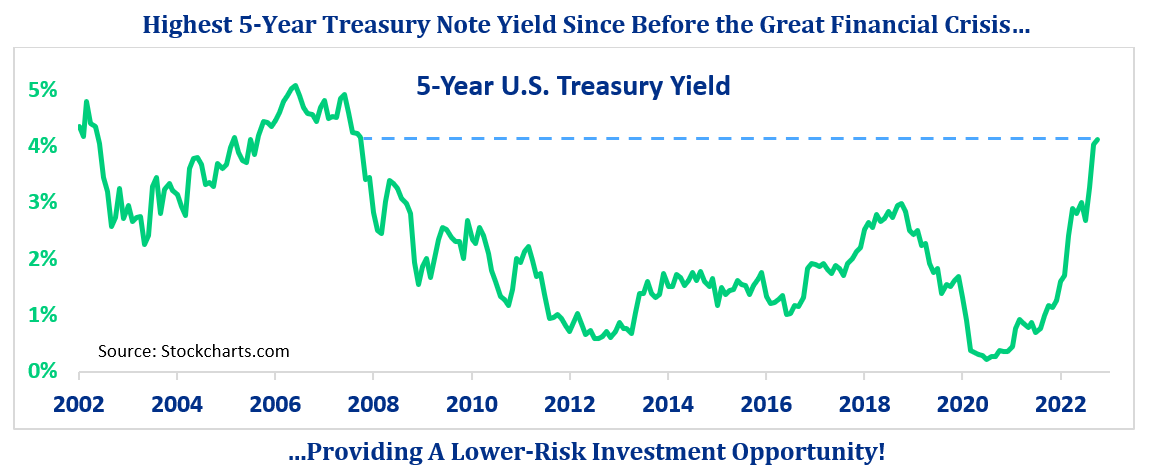

For example, as this year began, money market funds were paying close to zero and five-year U.S. Treasury Notes paid a paltry 1.25%. Nine months later, the five-year Note now yields about 4.15% — more than three times the income. You can appreciate how those 1.25% Notes purchased earlier this year are less attractive in today’s higher rate environment. That explains why, as interest rates go up, bond prices go down. Given the sharp spike in rates, this year goes down as one of the worst periods for bond prices in history!

When interest rates are low, bonds offer limited opportunity and carry above average risk. Investors who did not understand the risks in bonds fell into a “yield trap” and experienced a costly lesson. The trap was believing longer-term bond funds were safe investments, even with interest rates at historic lows. But you dodged the yield trap by avoiding long-term bonds and owning only minimal amounts of shorter-term Treasury Notes.

That said, the tables have turned full circle for bond investors as yields reach levels not seen since before the Great Financial Crisis. The Federal Reserve is on a mission to cool off inflation by raising interest rates, even at the risk of recession. We believe, with the aggressive interest hikes this year, the Fed has already accomplished their goal of slowing the economy down. When inflation and interest rates eventually peak for this cycle and move lower, bonds will appreciate in value. The next low-risk investment opportunity is to take advantage of this year’s higher interest rates by locking in yields and riding bond prices higher. Our game plan is to continue gradually adding to your short-to-intermediate term bond ladder. By design, your bond investments have staggered maturity dates, providing a safe way to capture additional income returns, while protecting your principal as interest rates climb.

Hurricanes and Portfolio Risk Management

Our hearts and thoughts go out to everyone affected by Hurricane Ian. This is especially so for our clients and partner, Martin Pring, who lived within Ian’s path. Fortunately, unlike some other natural disasters, hurricanes can be reasonably predicted multiple days ahead of time. Weather professionals at the NOAA Hurricane Center utilized forward-looking models to assess risk, so that local citizens could enact disaster preparation plans. The devastation to property and lives could have been worse without the advanced warnings and prudent planning here. Significant hurricanes are a fact of life for residents in the Southern States, but proper risk management helps them minimize the threat of loss.

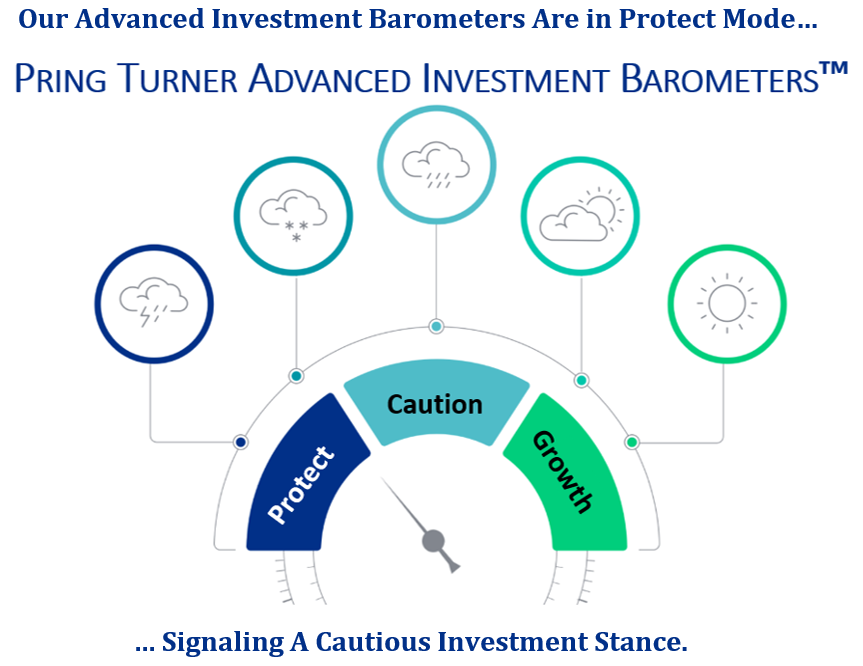

Similarly, prudent planning and proper risk management are crucial for your valuable investment assets. Occasional severe bear markets are a fact of life and stormy market periods can quickly damage investment portfolios. Rest assured, we are always on “financial hurricane watch”. Our investment team carefully monitors forward-looking models like our Advanced Investment Barometers, which signal when it is appropriate to protect your portfolio from approaching “financial storms” or bear markets.

Where are we today? Our barometers started the year with sunny skies and portfolios positioned in “Growth” mode. The barometers ultimately moved down to “Caution” and are now into “Protect” mode. All the while, we incrementally trimmed back stock holdings and raised extra cash levels for you. Then, as interest rates rose and U.S. Treasury Note yields became more attractive, we added to your short-to-intermediate term bond ladder.

With our barometers still in “Protect” mode, additional defensive steps may be in store. These increasingly defensive steps help stabilize portfolios, temper any further market declines, and give us extra cash to invest in new low-risk investment opportunities as the backdrop improves. When the skies clear and our market barometers once again point to “Growth” mode, we will be prepared to take advantage of the many bargain prices that are beginning to show up.

Until then, as interest rates move higher, bond prices present an attractive opportunity. Once interest rates peak for this cycle, bonds will be the first asset class to perform well. Then, stocks will follow and be in position to initiate the next sustainable bull market. Patience will be rewarded!

Summary

Simply put, the goal of our active investment strategy is to protect and prepare your portfolio for all market environments. Nobody can predict the future exactly, but you can take extra comfort in knowing you have a diversified, high quality investment portfolio with many layers of built-in protection. The end goal is to generate reasonable returns while minimizing risks, allowing you to safely weather financial storms with peace of mind.

Thank you for your continued confidence and trust. Please also feel free to contact us should you have any questions or if your circumstances change.