In our October Newsletter, Reducing Risk to a Safer Portfolio Speed, we explained how stock market driving conditions were more hazardous and why it was prudent to maintain a conservative investment posture. We were confident the defensive stance would be a sound decision, but did not know exactly when it would be needed. As it turns out, stocks were synchronized with the Times Square Ball in New York City, when both dropped precipitously as the New Year began. This wicked decline spanning the first six weeks of 2016 was the worst start to a new year EVER! However, your portfolio was well protected during this dramatic decline. Most importantly, our typical client earned positive returns while taking less than half the risk of the market during the first quarter.

Introducing the “Stock Speedometer”

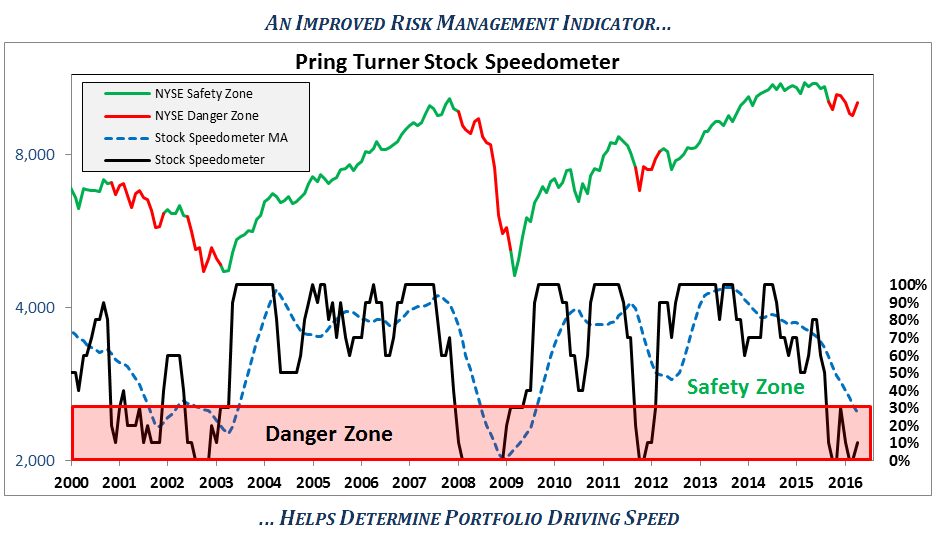

For nearly four decades, we have been on a never ending quest to better protect your portfolio and wealth, and are pleased to introduce you to another improvement. This recent refinement builds upon our long standing and successful barometer work. We call it our Stock Speedometer, which is a combination of a wide range of market indicators. Historically higher readings (maximum 100) have led to better returns for the average stock; conversely, lower readings (minimum 0) have led to poorer returns. The speedometer is designed to identify the primary environment of the stock market. Similar to your car speedometer, it signals how fast or slow we drive your portfolio. As the Speedometer changes we make important portfolio adjustments in order to better navigate the financial road conditions ahead.

The Stock Speedometer has two crucial zones: a “Safety Zone” and a “Danger Zone”. Since 2000, the New York Stock Exchange (a broad proxy for U.S. Stocks) returned +12% per year on average with the speedometer in the positive or Safety Zone. In comparison, the New York Stock Exchange has declined -21% per year on average with the speedometer in the negative or Danger Zone. Danger Zone readings do not come around very often (roughly ¼ of the time), but when they do it is imperative to execute a defensive investment game plan.

The latest reading for the Stock Speedometer is 10. The bad news is this is a Danger Zone reading; the good news is that over the past month it has actually improved from zero. In order to reach the Safety Zone the needle on the speedometer must return to 30. As disciplined investment managers we will maintain the conservative stance in your portfolio until we see this improvement. Whoever penned the phrase, “Patience is a virtue”, must have had stock investors in mind. We are strong believers in the value of patience and investors who stick to their long-term disciplines will be rewarded with investment success.

The current Danger Zone reading of our Stock Speedometer is a major reason why you are temporarily defensively positioned with higher cash and bond levels. These tactics should help temper your portfolio from market declines and will also allow us to take advantage of promising new investment opportunities in the future. As investors, we will all come across an occasional pothole on our investment journey. Our job is to use risk management tools to steer you clear of those hazards, so you travel on a safe and smooth financial highway towards your most precious life goals.

Comparing Investment Styles: Value vs. Growth

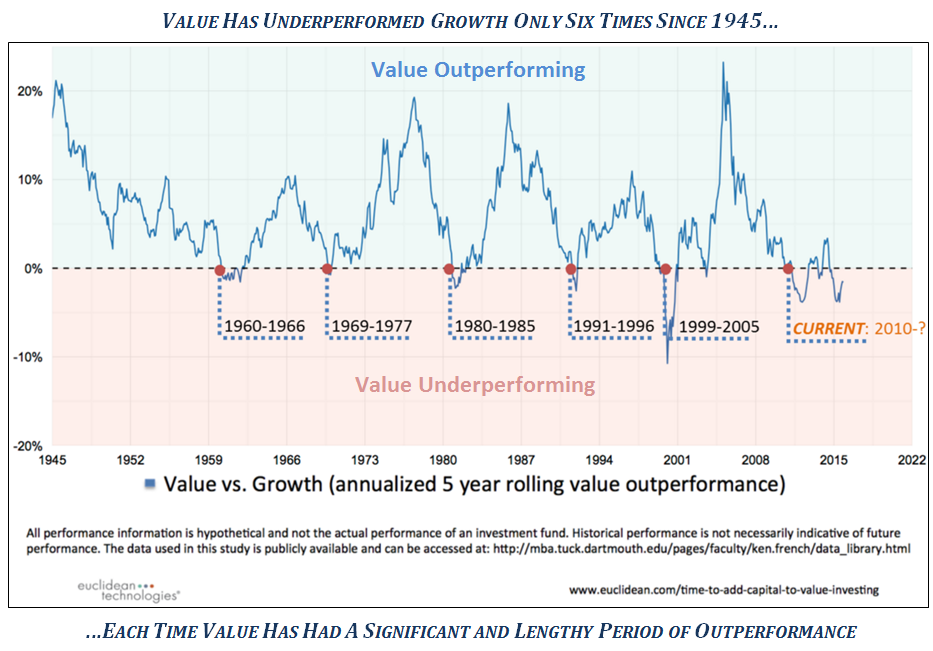

Long time clients have heard our investment mantra “Quality –Value – Income” over and over again. In this letter, we will dig deeper into the merits of value investing. You could fill an entire library with academic studies that demonstrate a disciplined value approach gives far superior returns with less risk than a growth approach. In other words, growth gets the glamorous headlines, while value quietly gets the better results. Our clients’ long-term track records demonstrate that when you combine a playbook for both offense and defense, along with disciplined value investing, investors can achieve solid risk-adjusted returns. Of course every few years we expect to encounter some rough patches. Even the most successful investment strategies will temporarily fall out of favor and their followers may lose patience. Such has been the case in recent years as value investing has experienced its longest dry spell in over 70 years. So, what can value investors expect looking forward?

The next chart compares these two investment styles and illustrates that every period of under-performance for value vs. growth investing in the past 70 years has experienced a return to value’s pre-eminence with strong absolute and relative performance. We believe the environment today is quite similar to the early 2000’s following the dot.com bust when leadership changed and value stocks outperformed for a number of years. Evidence is building that value is starting to once again reassert its long-term dominance of roughly 5% annual out-performance. As value investors we can all look forward to a return to better results on the road ahead.

Protecting and growing your wealth is our foremost mission and keeps us excited and challenged every day to deliver on that commitment. The new Speedometer is just one example of our commitment to continually build a better decision-making process, resulting in even more attractive returns with less risk for you. In addition, a renaissance of value leadership is a welcome event that will provide a tailwind for your portfolio. We look forward to making decisions for you today where, in the face of an unknown future, we confidently and optimistically expect a positive outcome.

For those looking for more timely insights, we invite you to visit our new improved website at pringturner.com. Specifically check out the “Keeping You Informed” page, our journal of quick observations designed to keep you informed and help you make sense of Wall Street. As always, if there are any questions or changes in your situation, please contact us. Thank you again for your confidence and trust in our relationship.

Summary

- Our typical client earned positive returns while taking less than half the risk of the market during the first quarter.

- The current Danger Zone reading of our Stock Speedometer is a major reason why you are temporarily positioned defensively with higher cash and bond levels.

- Our job is to use risk management tools to steer you clear of hazards, so you travel on a safe and smooth financial highway towards your most precious life goals.

- Get ready value investors for a significant recovery and strong returns in the years ahead.

Click the link below to download the PDF version of this newsletter

Keep Those Seat Belts Fastened Pring Turner April 2016 Newsletter

DISCLOSURES: Pring Turner Capital Group (“Advisor”) is an investment adviser registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2016 Pring Turner Capital Group. All rights reserved.