We are pleased to report new all-time high portfolio levels for typical accounts (adjusted for withdrawals), especially given the many challenges facing the markets. The stock market moved erratically higher during the quarter despite geo-political saber-rattling, political mud-slinging, hurricane disasters and the Federal Reserve’s slow but persistent action toward a more restrictive monetary policy. Bull markets have long been known to “climb a wall of worry” and the current one serves as another prime example of this. Better yet, as you begin the final stretch of the year, we continue to believe there is additional upside potential ahead. Why?

1.) For the first time since the end of the financial crisis of 2008, the global economy is expanding in a synchronized fashion. We wouldn’t characterize it as a massive boom, but manufacturing data from Europe, Asia, Latin America and even Japan are showing their strongest readings in many years.

2.) Corporate profits are expanding and an agreement on major individual and corporate tax reform could be a catalyst for even stronger profit growth. Depending on the final version of any legislation, this action will likely extend the business cycle expansion.

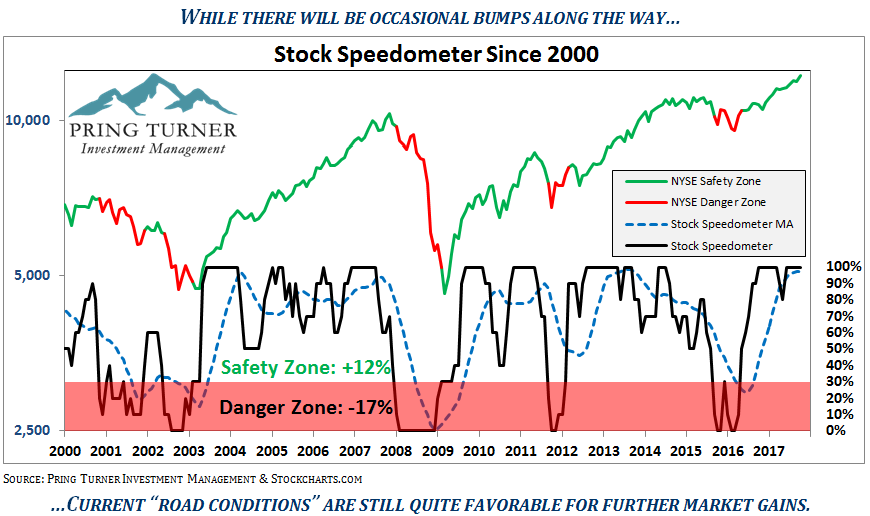

3.) Importantly, the most recent reading of our primary stock market risk assessment model (the Stock Speedometer) is quite encouraging. The speedometer shows us what speed we should drive your portfolio. Currently, it continues with its maximum positive reading.

Hurricanes and Portfolio Risk Management

Our hearts and warm thoughts go out to everyone affected by damage from hurricanes Harvey and Irma. This is especially so for our clients and partner, Martin Pring, who lived within Irma’s path. Fortunately, unlike some other natural disasters, hurricanes can be reasonably predicted a number of days ahead of time. Weather professionals at the NOAA Hurricane Center utilized forward-looking models to assess risks so local citizens could enact disaster preparation plans. The devastation to property and lives could have been much worse without the advance warnings and prudent planning to best mitigate storm risks. Very serious and dangerous hurricanes that come around every few years are a fact of life for residents in southern states, but prior planning and proper risk management can help folks minimize the threat of loss.

Prior planning and proper risk management are equally crucial for your valuable investment assets. Occasional severe bear markets are a fact of life, and stormy down market periods can devastate investment portfolios in a very short period. Rest assured we are always on “financial hurricane watch”. Our investment team carefully monitors forward-looking models like the Stock Speedometer, which signals when it is appropriate to protect your portfolio from approaching “financial storms” or bear markets. Simply put, the goal of our active strategy is to protect and prepare you for all market environments. Nobody can predict the future exactly, but you can take extra comfort in knowing you have a diversified, high quality investment portfolio with many layers of built in protection. The end goal is to generate reasonable returns while minimizing risks, allowing you to safely weather any storm with peace of mind.

A Wonderful Reminder

Often we can get overly absorbed in the granular details of investment decision making that we lose sight of the “true mission.” Last month, a longtime client and her daughter visited our office and their heartfelt gratitude for our 30+ year relationship served as a wonderful reminder of why we come into the office every day. Helping you achieve your life goals with financial peace of mind is our true mission! Peace of mind for this particular client was the long-term consistency and the seamless continuity of financial service when her husband became ill and later passed on. Their successful financial journey was a total team effort, as they treated their retirement nest egg with respect and honor, while we protected and grew their valuable assets.

Your trust and confidence inspire us every day to safely grow your wealth. Financial peace of mind for you and your family is the ultimate goal. As always, please contact us should you have any questions or if there are any changes in your personal circumstances. Thank you.

Setup an Appointment with a Pring Turner Financial Advisor today:

DISCLOSURES:

Pring Turner Capital Group (“Investment Advisor”) is an investment advisor based in Walnut Creek, CA. The Investment Advisor is registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Investment Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments.In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Investment Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. Past performance is no guarantee of future results. ©2017 Pring Turner Capital Group Walnut Creek, CA. All rights reserved.