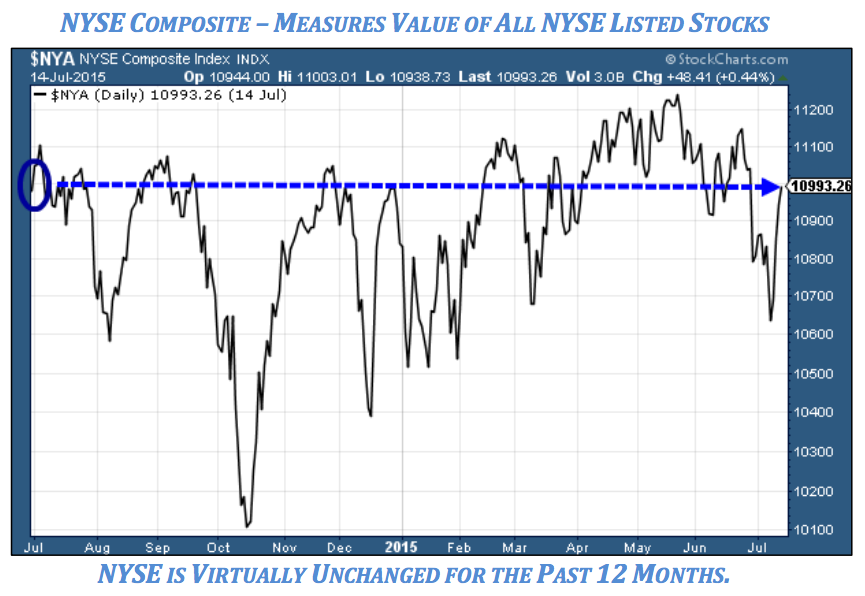

For the stock market, it was a most deceiving first half of the year, punctuated with a real-life Greek drama. The quarter ended with the S&P 500 price average virtually unchanged for the past six months. In fact, by some measures, the broader stock market has not changed much at all from the second quarter of 2014. However, this rather muted performance hid the fact there was plenty of downward movement going on under the surface. For example, the energy sector experienced a complete bear market beginning last summer dropping nearly a quarter in price. Importantly, the economically sensitive Dow Jones Transportation and interest rate-sensitive Utility averages suffered double-digit price declines from recent highs. Despite mild S&P price appearance, thanks to the strength of a few very heavily weighted issues, we characterize much of the market as being in a “stealth” correction. In simple terms, market action has been much weaker than it appears on the surface and portfolios reflect the underlying weakness. This disparity in market action presents an interesting junction in the stock market.

The Burning Question

Are prices ready to break out of the range to the upside or downside? Our current view is to stay optimistic since the outlook for the economy is still encouraging. Thanks in part to continued employment gains, higher consumer confidence and improved spending, our gauge of leading economic indicators project further growth for the remainder of 2015. Additionally, many short-term technical market indicators have reached oversold and attractive levels. These “green lights” signal a potential rebound for stock prices in the weeks ahead. Market behavior over the course of any rally from here will go a long way to determining just how much life may still be left in this rather mature bull market. Positive for now, we remain watchful for any signs of change in the evidence.

At the same time, it is worth noting that some of our long-term market indicators are starting to flash early warning yellow lights. Just how might the stock market tolerate the first interest rate hike by the Federal Reserve in more than seven years? And what if the economic debacle in Greece spreads to other weak European Union members? Will recent turmoil in China affect global financial markets? Nobody can say for sure, but should longer term market indicators move our warning lights from yellow to red, we are prepared to move into a much more defensive posture in portfolios.

Interest Rates on the Rise

Turning to the bond market and interest rates, the Treasury bond market was especially weak and showed its first quarterly price decline since 2013. Long-term interest rates spiked higher and as interest rates rose bond prices declined. Income producing stock stalwarts like utilities and REITS were hit pretty hard in sympathy with bond prices and this affected portfolio performance. Long-term bonds are now discounting the inevitable, but likely slow yet volatile path back to ‘normalization’. Normalization is the term to describe the level of interest rates that would exist without the Federal Reserve’s artificially low zero interest rate policy (ZIRP). After more than six years near zero percent to resuscitate an excruciatingly weak economy, the Fed is set to begin a path (perhaps taking several years) to raise short-term rates beginning later this year. As we laid out in our bond ladder strategy update a few months back, we have already taken steps in your portfolio to both protect and take advantage of a rising interest rate situation. You have low bond exposure and also short duration (maturity) that will sail through any volatility associated with rising rates. If interest rates steadily rise, this flexible strategy will allow us to take advantage of those higher interest rates. As these short term bonds mature and are reinvested into the next maturity date on the ladder, the portfolio will see a steady rise in overall income. Our expectation is sometime in the future the bond market will again provide a nice window to lock in higher yields. These pro-active tactics allow us to manage risk and take advantage of future opportunities.

Financial Markets – Finely Balanced Forces

We believe the answer to successful investing throughout a full multi-year bull and bear market investment cycle is to take an active management approach that balances both protecting and growing portfolios. This approach is especially critical today, given that financial markets are finely balanced between both positive and negative forces. While acknowledging atypical portfolio underperformance over the last ten months, Pring Turner’s long-term portfolio results show solid risk-adjusted returns.

Click the following link to download the PDF version of the newsletter:

Download PDFDISCLOSURES: Pring Turner Capital Group (“Advisor”) is an investment adviser registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2014 Pring Turner Capital Group. All rights reserved.