Bottom line: while stock prices may take a short-term breather, we expect your portfolio to keep rolling right along.

This past quarter, stock prices continued to advance as concerns about a spreading banking crisis eased. However, the market gains in the first half of 2023 can best be characterized as “uneven”, with mixed results for the average stock. Many of the losers from last year turned into winners this year, and vice versa. This divergent behavior similarly describes the economic landscape, with the service side of the economy booming while manufacturing retrenches. This mixed economic behavior is often labeled as a “rolling recession”, where sectors slow down sequentially rather than all at once. The good news is that this type of behavior may postpone the widely anticipated recession until later in the future. Bottom line: while stock prices may take a short-term breather, we expect your portfolio to keep rolling right along.

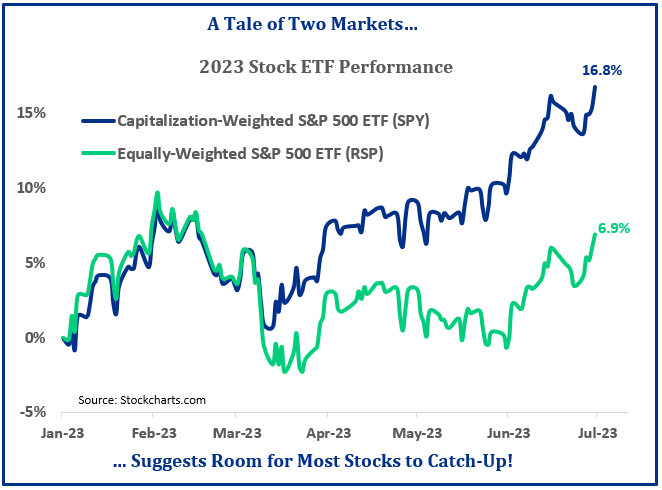

An Uneven Stock Market

At first glance, stock prices had a very strong first half of the year. Looking under the surface, however, the impressive gains were primarily driven by just five mega-cap technology stocks. These stocks lead to double-digit gains in the capitalization-weighted S&P 500 ETF (SPY). Conversely, the equally-weighted S&P 500 ETF (RSP), which assigns equal weight to each of the 500 stocks, shows much lower returns (see chart for details).

The unusually wide divergence in returns between these two ETF’s, despite having the same 500 stock components, can be attributed to the significant influence of Tesla, NVIDIA, Google, Amazon, and Microsoft. These “Big-Five” technology stocks collectively account for almost one-quarter of the S&P 500’s capitalization. In essence, the S&P 500 is much less diversified and riskier than it appears. In stark contrast, the performance of the other 495 stocks in the index was modestly positive year-to-date. The key point to emphasize is that diversified portfolios, such as yours, with relatively equal weights assigned to each stock, have not kept up with the capitalization-weighted S&P 500 index in the current year.

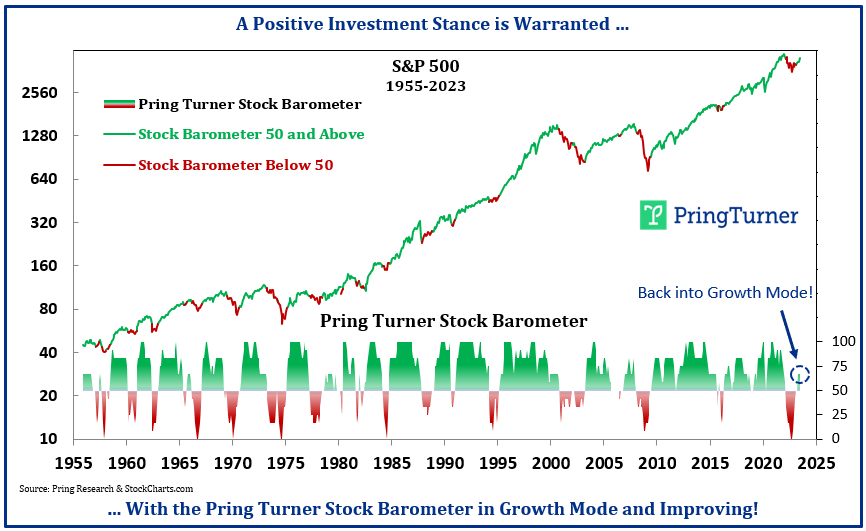

So, the question is: Will the rest of the market catch up to the top five mega-cap stocks, or will the heavyweights catch down to all the others? Our view is that it is likely the broader market will join the party and help propel the overall market and your portfolio higher. Buttressing this thesis, several of our primary trend stock market indicators have recently turned positive, as highlighted in our June client webinar. For instance, we featured our Stock Barometer as one of the indicators supporting an optimistic outlook (see chart).

The Pring Turner Stock Barometer is comprised of six different components and has done a good job of keeping us invested during favorable periods. More importantly, it has helped us be more conservatively invested during the occasional challenging bear markets, like the one experienced in 2022. The recent positive and improving signal from the Stock Barometer indicates a more favorable market environment, providing one of several good reasons to remain optimistic.

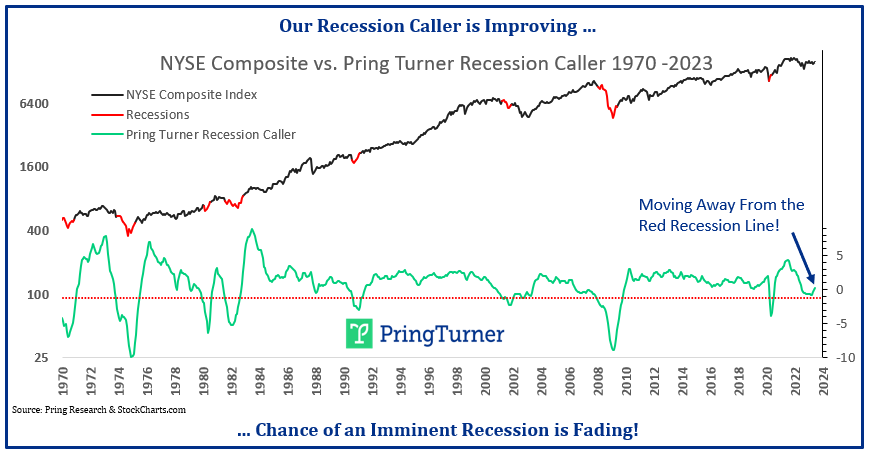

Declining Odds of Recession

Another encouraging sign for the financial markets is the steady improvement in our proprietary Pring Turner Recession Caller. This reliable forecasting tool is based off of four component indicators that are sensitive to trends in crucial segments of the economy, namely Housing, Employment, Retail Sales, and the S&P 500.

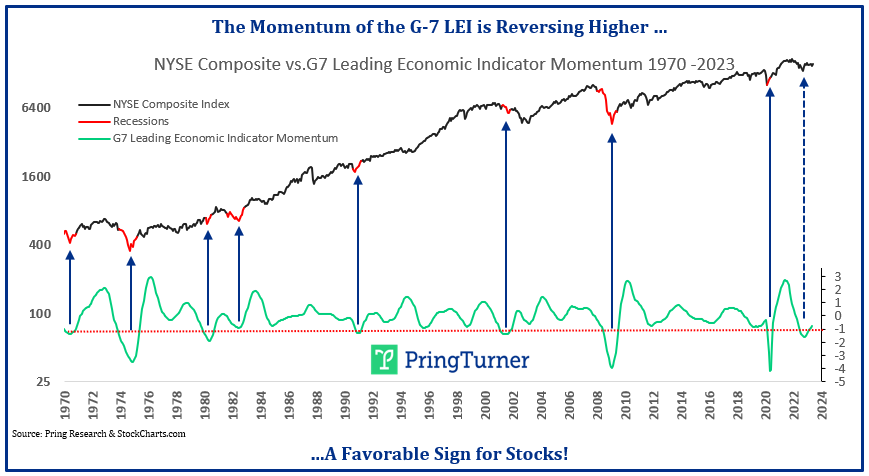

The latest reading of this forecasting tool shows the indicator turning up after hovering near the red recession line for several months. This stands in contrast to the ongoing predictions of an impending recession made by many over the last fifteen months. The recent improvement in our Recession Caller suggests that the risk of recession has started to diminish. Furthermore, this improving economic outlook is reinforced by the message provided by the momentum of the G-7 Leading Economic Indicator (LEI). The G-7 represents the seven largest developed economies globally, and it serves as a valuable gauge for assessing whether global economic momentum is trending higher or lower in these heavyweight countries.

In the past four months, the momentum of the G-7 LEI has steadily advanced, providing further support for an improving business cycle outlook and a continued uptrend in the stock market. This indicator was also featured in our recent client webinar. If you have not had the opportunity to review the executive summary or watch its recording, please visit our website for more information.

Summary

Stock prices delivered positive returns during the first half of 2023. However, it was a tale of two markets, with the S&P 500 being lifted primarily by five very large technology stocks. Meanwhile, the remaining 495 stocks in the index achieved more modest results. Therein lies an opportunity. We believe that the rest of the market is poised to catch up with the performance of the “Big-5” stocks. Although a short-term correction is possible, we will continue to actively seek opportunities to add attractive investments to your portfolio. Our job is to diligently search and screen for new investments that meet our strict disciplines of quality, value, income, and show potential for reasonable returns with reduced risk. In short, we will continue to do what we have always done: protect your hard-earned capital and grow it steadily and prudently.

We appreciate the confidence you have placed in us to manage your wealth. If there are any changes in your circumstances or if you have any questions about your portfolio, please do not hesitate to reach out to us.

Thank you once again for your trust, and we look forward to serving you faithfully in the future.