It is certainly possible for the Federal Reserve, as the biggest player on the block, to lower money market rates over the course of the next few meetings. However, if it turns out to have been orchestrated out of political expediency rather than as stimulation for a weak economy, inflation will result.

We saw a similar movie in August 1971. At that time President Nixon declared that the United States was suspending convertibility of the dollar into gold. That meant it was no longer backed by the yellow metal but by confidence the government would do the right thing. Overnight the monetary goalposts were widened, as the Federal Reserve became ever more vulnerable to political manipulation.

The credit and commodity markets started out quietly enough. The yield on 3-month commercial paper dropped from 5.7% in August 1971 to 3.9% in February 1972, the low for the cycle. Rates eventually peaked at 11.7% in July 1974. Industrial commodities were also subdued until February 1972, when the CRB Spot Raw Industrials clocked in at 101.7. By April 1974 though, the Index had more than doubled to 228.5. The moral of the story is that it is possible for temporizing to succeed in the short run, but the missing discipline is ultimately provided by Mr. Market.

Circumstances are different today, but the damaging consequences of lowering the institutional guard rails of monetary discipline still looms. Consider a few recent examples where central bank independence was jeopardized and its effects on the CPI: Turkey (CPI 85% late 2022), Argentina (CPI 140% 2024), and Egypt (CPI 35% 2023).

We are not forecasting such extreme consequences for the US. Nevertheless, there are numerous signs from both commodity and non-commodity markets indicating that prices are headed higher, regardless of whether rates are lowered or not. If they are cut prematurely though, it will be like adding gasoline to the fire.

Commodities vs the CPI

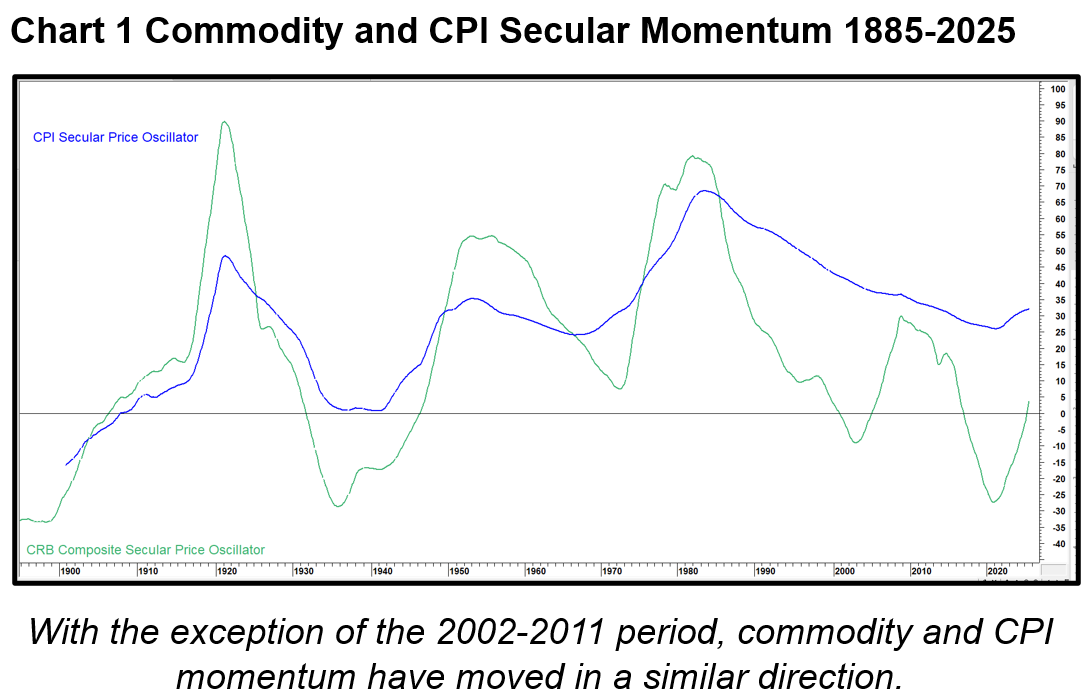

That’s important because trends of rising commodity prices have a history of eventually affecting swings in the year over year CPI. Chart 1 compares our secular price oscillator for commodity prices to a similar measure constructed from the CPI. Two things stand out. First, both series tend to move in a similar direction. Second, commodities more often than not take the lead at major turning points. The notable exception is the 2002 rally, which was not reciprocated by the CPI. A smaller discrepancy also arose in the late 1990’s. The recent upside reversal in the commodity oscillator has been joined by that for the CPI, indicating that a new secular uptrend began in the early 2020’s.

Gold leads Commodities

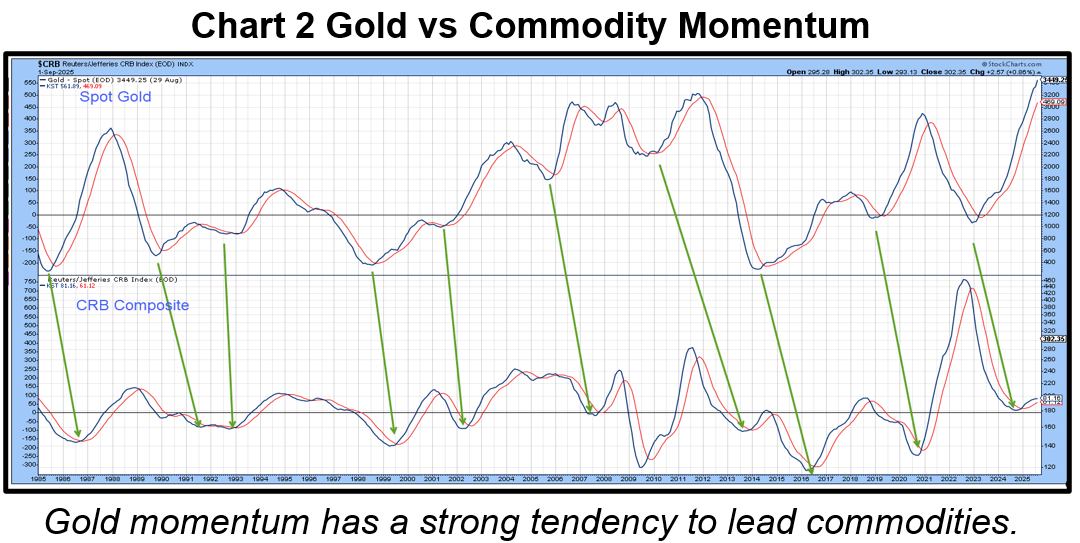

Before we zero in on commodities themselves, it’s important to understand that their bull markets are often led by gold. In that respect Chart 2 displays a long-term smoothed momentum for both gold and the CRB Composite. The arrows connect the momentum lows and have a strong tendency to slant to the right, indicating that gold is usually in the lead. Both series are currently rising, with gold momentum at a post 1980 high, all of which suggest higher commodity prices.

The Business Cycle Votes for Commodity Price Inflation

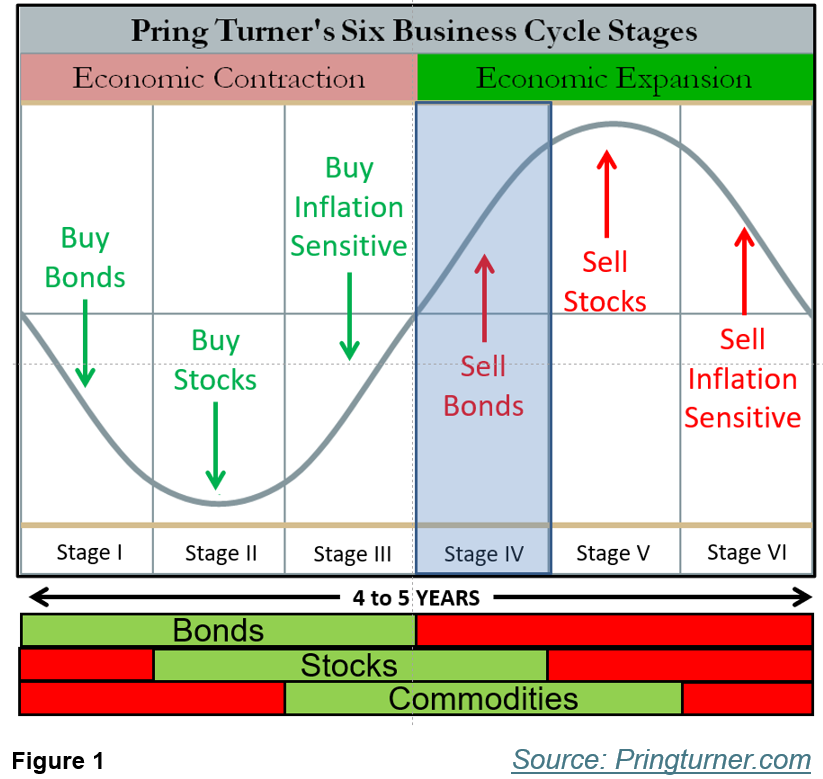

The business cycle is continually transitioning through a set series of chronological sequences, as demonstrated in Figure 1. For a comprehensive explanation please refer to this article. Bottom line is that the cycle rotates through inflationary and deflationary seasons, which we call stages. The cycle, according to our models, is currently in Stage 4, which is the most inflationary. By way of example, copper, crude and gold averaged monthly annualized gains of 24%,16% and 14% respectively for all of the Stage 4 periods since 1955.

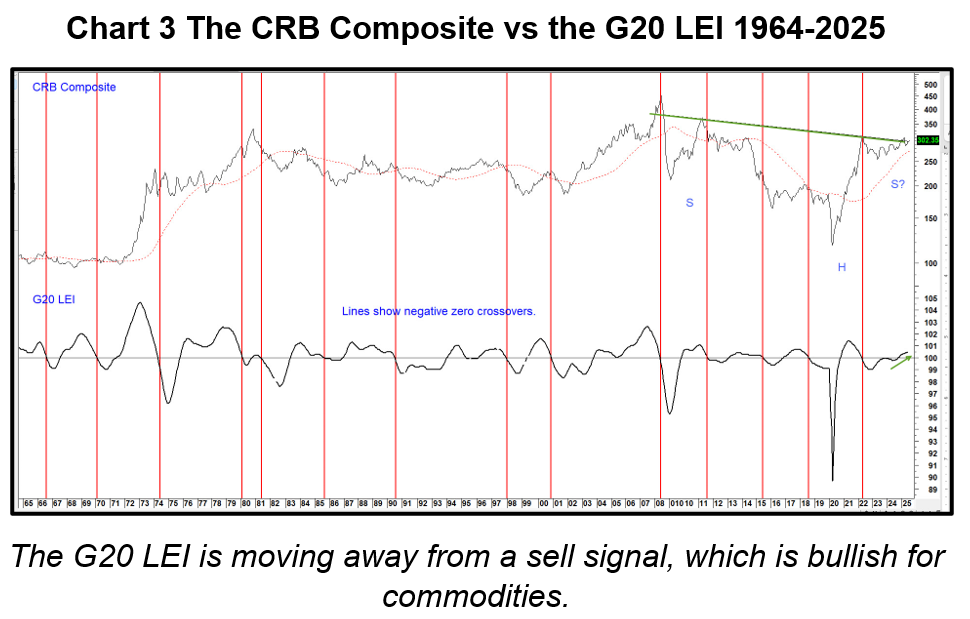

Commodity prices are influenced by global economic forces. Consequently, the lower window of Chart 3 compares the CRB Composite to the G20 Leading Economic Indicator. The red vertical lines approximate negative zero crossovers, which are typically followed by a decline in the commodity Index. The indicator is currently in a rising phase, which signals an improving global economy and likely break by the CRB above the 2008-2025 resistance trendline. It is effectively the neckline of a giant pattern, known to technicians as an inverse head and shoulders. A breakout would likely be followed by a substantial advance.

The Primary Trend for Industrial Commodity Prices

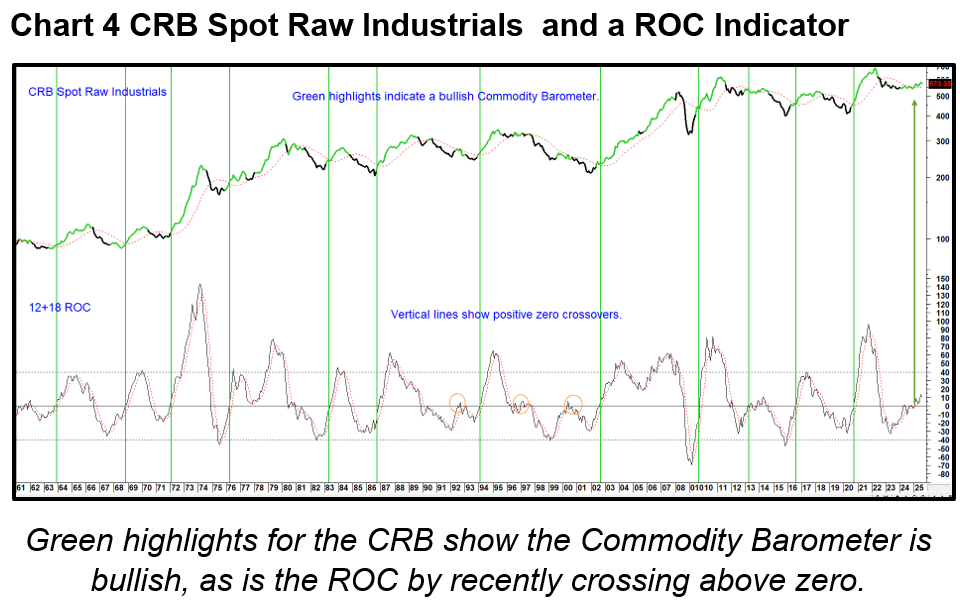

Chart 4 compares the CRB Spot Raw Industrials to an indicator combining a 12- and 18- month rate of change. It goes positive for commodity prices as it crosses above zero. Previous signals have been identified with a vertical green line and have been consistently followed by a significant commodity rally.

Furthermore, when the Index itself earns a green highlight, it tells us that our Commodity Barometer is bullish by clocking in at 50% or more. At the end of August, this model was at its maximum 100% reading. Since the ROC recently crossed zero, both indicators in Chart 4 are positive.

The Stock Market Votes on Commodity Prices

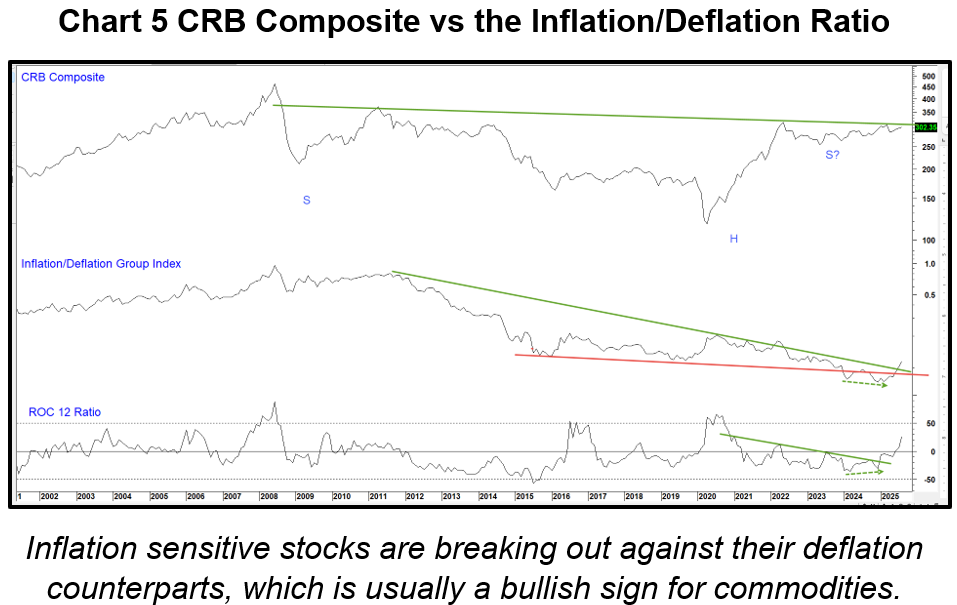

Chart 5 compares the CRB Composite to our Inflation/Deflation ratio. It represents one relationship by which the stock market anticipates fluctuations in inflationary and deflationary forces. It doesn’t correlate perfectly with swings in the CRB Composite but does track the vast majority of its primary trends. For the record, the Inflation Index consists of four industry groups that benefit when commodity prices rise. On the other hand, the Deflation Index is constructed from groups that are interest sensitive and defensive in nature.

The ratio has been uncharacteristically slow to participate in the post 2020 CRB rally, but recent action hints of a catch up. That’s because it has just violated the secular down trendline and tentatively regained the extended red breakdown trendline. Momentum action has also been positive, so further gains are likely.

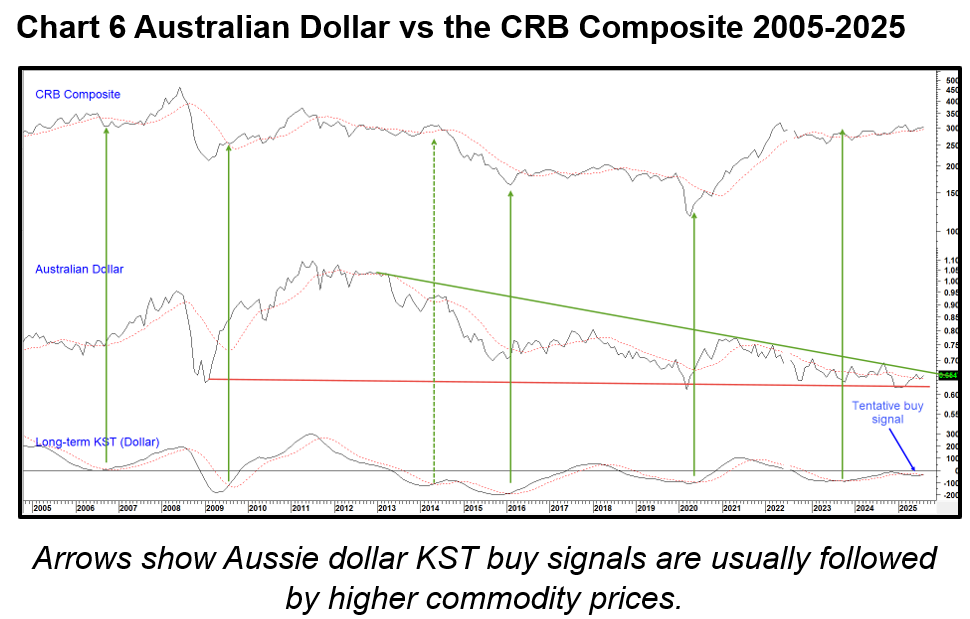

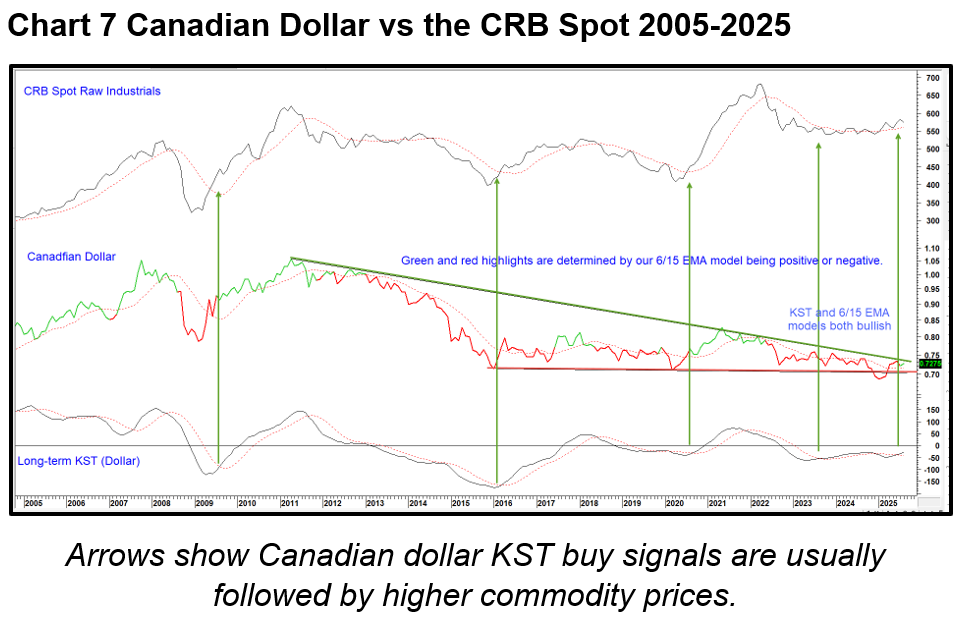

The Currency Market Votes on Inflation

The currency market, in the form of Canadian and Australian dollar long-term smoothed momentum (KST), has proven to be an excellent precursor of commodity bull markets. This is demonstrated in Charts 6 and 7 by the green vertical arrows. Both resource sensitive currencies have recently triggered a KST buy signal. However, the currencies themselves have continued to trade in a narrowing multi-month trading range. Recent positive momentum indicates the likelihood of an upside resolution. However, whichever direction they decide to break is likely to be followed by a substantial move.

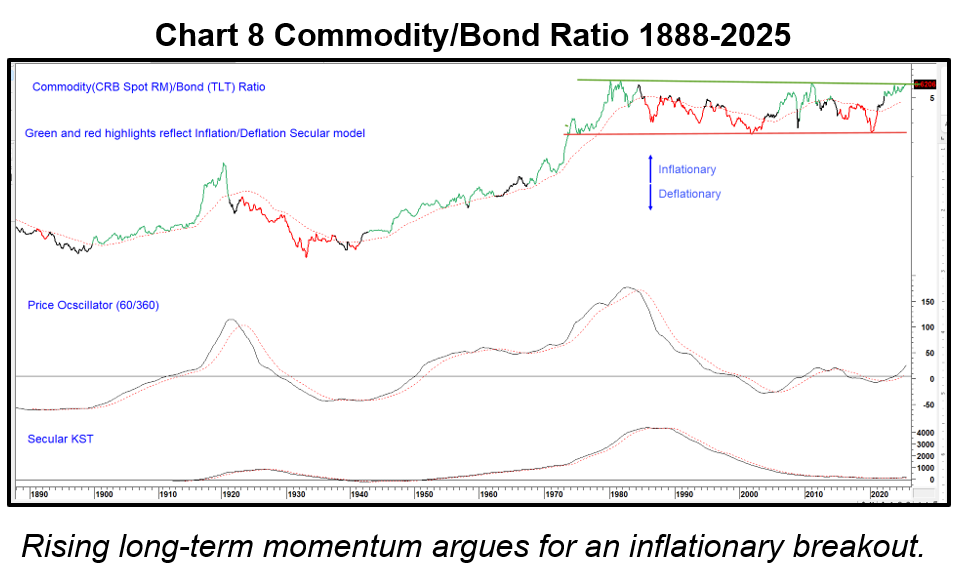

The Ultimate Inflation/Deflation Relationship, the Commodity Bond Ratio

The Commodity/Bond ratio (CRB Spot Raw Industrials/iShares 20-year + Treasury Bond ETF) is arguably the ultimate arbiter of the battle between inflationary and deflationary forces in US financial markets. This relationship has been locked in a trading range since 1980 but now looks as if it is about to experience an upside (inflationary) breakout. There are two principal reasons for expecting such an outcome. First the positive arguments, which have already been put forward. Second, our secular model, which is based on the price oscillator in the middle window of Chart 7 and the 96-month displaced moving average of the ratio, is bullish as is the secular KST.

Conclusion

We think commodity prices are headed higher, regardless of whether the FOMC lowers rates in September. If they are lowered though, it will add fuel to a fire that has already begun to smolder, sending commodity prices and bond yields to higher levels than would otherwise have been the case. If the Feds lack discipline Mr. Market will be happy to provide it.