Nobody can predict exactly when the global pandemic will pass or when a significant portion of the idled U.S. workforce can start getting back to work. That said, it is encouraging to see parts of Asia where the crisis started, including China itself, already gearing back up and their markets beginning to stabilize. Investors, having braced for the worst possible outcome (in some cases, the end of the world!), may find out that this worst outcome is just not going to happen.

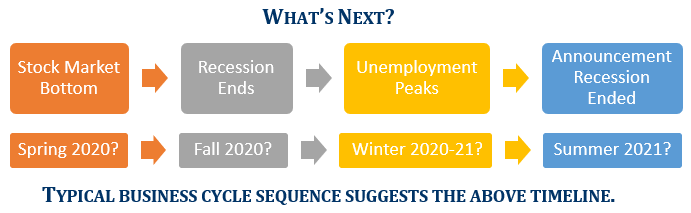

More likely, after a sharp but relatively short U.S. economic decline in the next quarter or two, a rebound will lead to a durable new cyclical bull market for stocks. The good news is that the stock market, as a leading economic indicator, will rally well ahead of the economy. Historically, the sequence of events for a business recovery is first the stock market bottoms and then the recession ends 4-6 months later. Next, the unemployment rate (a lagging economic indicator) continues to move higher well after the recession ends. Eventually, the economic expansion will deliver job growth. Finally, sometime after unemployment peaks, the official end of the recession is announced—long after the stock market has bottomed. Investors waiting for the comfort of an “all-clear” announcement will have missed a huge portion of the stock market advance!

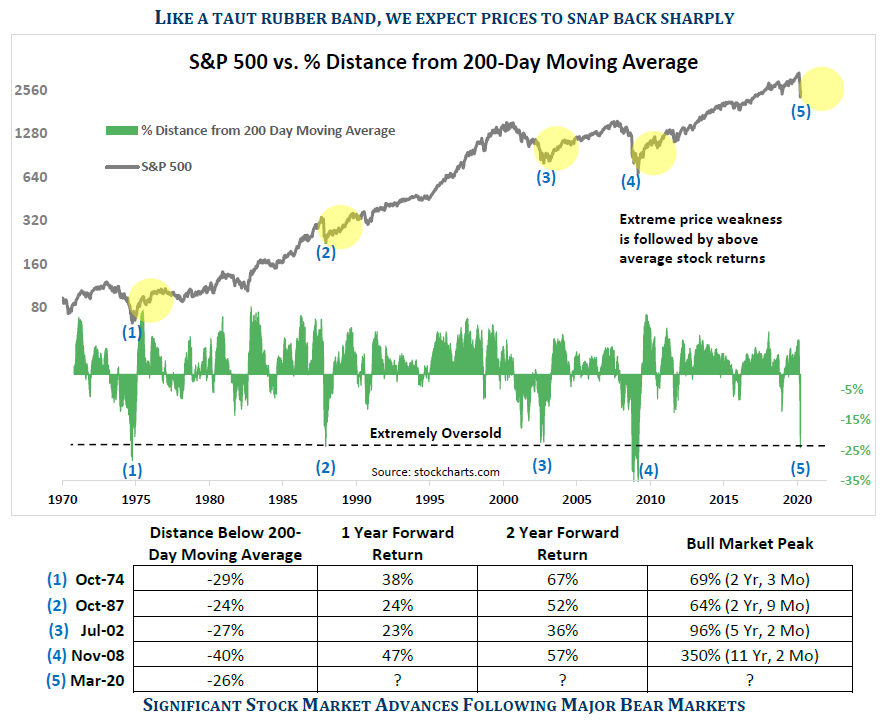

Historic Bear Market Declines Lead to Above-Average Portfolio Performance

This recent market plunge has again created a rare oversold condition (only 5 times in 50 years) where prices have dropped more than 25% below their average price over the last year (200-day moving average). This decline parallels the experiences and alarming news stories during other panics and major bear market lows as in:

- (#1) 1974—Arab Oil Embargo, New York City Near Bankruptcy, Watergate Scandal

- (#2) 1987—Fed Raises Interest Rates, “Program Trading” Leads to Stock Market Meltdown

- (#3) 2002—Tech Bubble Bursts, 9/11 Attack, Corporate Accounting Scandals, Iraqi Conflict

- (#4) 2008—Housing Collapse, Banking Crisis, Surging Oil Prices, Wall Street Failures

- (#5) 2020—Global Coronavirus Pandemic, Oil Price Collapse, Partial Economic Shutdown

The data and charts above illustrate and support our optimistic long-term outlook, despite recent investor feelings of doom and gloom. Our research clearly calls for above-average returns over the next several years.

Summary

Recent virus-related events and financial market turmoil are raising anxiety levels for all investors. Rest assured, we have helped clients survive and ultimately prosper through four decades of other acute crises and panics. The difficulty we all have is to get past the present fear and look ahead to the time when the panic passes. Some of our clients have not experienced the emotions of a bear market of this type, while some of our long-term clients have seen several. Our own experience tells us that every time volatility, turmoil and emotions run this high, a major investment opportunity is close at hand. That is one reason why we are optimistic that today’s crisis will eventually taper off and the financial markets will advance strongly in the years ahead. History is on our side, as major market advances typically start amid all the turmoil.

We have managed client portfolios through many other crises and are confident that our experience, conservative philosophy, and pro-active investment disciplines will see your portfolio through today’s difficult environment. Our expectation is to see new benchmark highs in your wealth in the next bull market.

Thank you for your patience and continued confidence during these challenging times. We will do our best to keep you updated on our current thinking throughout this period.

Special Alert Regarding Required Minimum Distributions (RMD’s)

One important provision of the recently passed Coronavirus Aid, Relief, and Economic Security (CARES) Act allows retirees to waive the Required Minimum Distributions (RMD’s) from their IRA plans this year. Retirees subject to RMD’s have the flexibility to determine how much, if anything, they would like to withdraw from their IRA’s in 2020. The current thinking, subject to IRS clarification, is that inherited IRA holders may also forgo RMD distributions this year. In lieu of this new option, you may want to contact your tax preparer to decide the optimal tax strategy in your personal situation. Please know that we are glad to offer our own assistance and coordinate efforts with you and your tax professional.

Did you like this article?

Footnotes:

Photo by Lucy Chian on Unsplash