Would you rather be given $5,281 or $1,000? But here is the catch…

If you are a Netflix enthusiast like me, you have probably seen the trailer for, You vs. Wild. It’s a new interactive series where you and Bear Grylls complete epic missions in the harshest environments on earth. You make decisions, Bear makes it happen. Make the right choices and you’re a hero. The wrong ones, a zero. As I watched the first episode, I felt like a fifth grader reading a “choose your own adventure book.” It was awesome and inspired me to write this post.

Now back to the game. $5,281 or $1,000? Even if finance isn’t your strong suit, the answer is obvious. Is something wrong with the number 5,281? Not to my knowledge. Only thing I know about that number is its exactly how many feet there are in a mile! What’s the catch? You don’t get the money now. Instead, I will invest it in stocks on your behalf for the next 30 years. If you choose $5,281, it will be invested in a diversified basket of low quality stocks. Choose $1,000 and it will be invested a diversified basket of high quality stocks. After 30 years you get all the proceeds.

At this point I bet you figured out the crux of your decision. Does starting with over 5 times more money make it worthwhile to invest in low quality stocks? Or conversely, will investing in high quality make up for the disadvantaged starting point? Quality is clearly a factor, so what does it mean?

It’s easy to forget that buying stocks is actually becoming an owner of a business (you get much more than just a volatile ticker symbol). High quality companies tend to grow their earnings consistently regardless of the underlying business atmosphere. Low quality companies can also make money when the economy is strong, but under harsh business conditions they tend to make less money (or even lose it). Long story short: high quality companies consistently grow profits, while earnings of low quality companies are consistently inconsistent.

Are you ready to play?

Would you rather receive the payout from…?

A) $5,281 invested in low quality stocks over the next 30 years?

B) $1,000 invested in high quality stocks over the next 30 years?

A or B? What is your gut telling you?

Last note before you make your decision. To be fully transparent, I am going to tell you exactly what each basket of stocks is going to return over the next three decades. The high quality stock basket will return 14.9% annually, with low quality stocks returning 8.7%. To put that in perspective, after the first year, option A will be worth $5,740 (up $459), with option B worth $1,149 (up $149). The $5,281 choice increased its advantage by an additional $310 in year 1. The additional capital more than made up for the lower percentage returns.

You are armed with all the crucial information, it’s final decision time. The choice is yours and yours alone. Are you going with A or B?

Write it down.

Do it now.

Just go with your gut.

Don’t fire up excel and cheat.

Remember it’s just a game.

Ready?

After 30 years your investments would grow to…

$64,506 and…

$64,506!

Not a typo. In the end both options were the same! $5,281 earning 8.7% over 30 years turns into $64,506, just as $1,000 earning 14.9% over 30 years does. Did this surprise you? Are you more shocked that they ended up being equal or by how much the investments grew? Compound interest is truly an incredibly powerful force over a long time horizon and is why it is a crucial step in the 3 Simple Steps to Become A Millionaire.

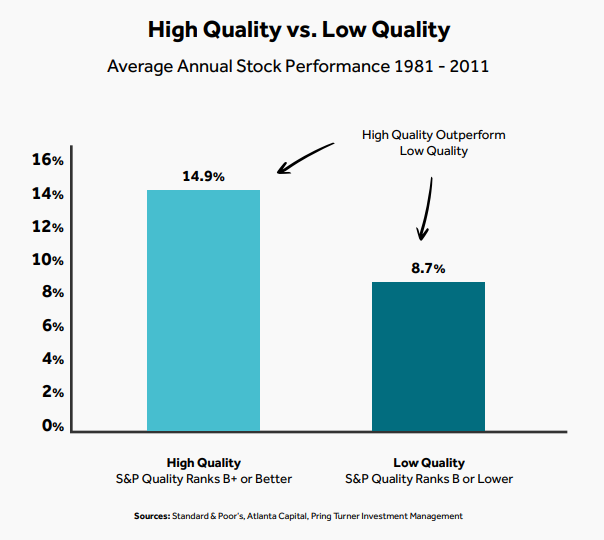

I know what you are thinking… “nice game Jim, but is this even realistic?” Is there any validity to your game? Prove it… you say? For proof, I turn to one of the oldest financial market research providers, Standard & Poor’s. In 2011, they published a study, that compared high quality and low quality stock returns over the prior 30 years. The verdict? High quality stocks earned average annual returns of 14.9% significantly outperforming its low quality counterparts at 8.7%.

In this “choose your own adventure” game, there was no right answer. Both choices led you to the same destination. However, just as Bear Grylls learns from his past adventures, you too can learn from this adventure.

Key Takeaways

-

Investing over 30 years can be extremely rewarding.

-

In the long run, investment returns are more crucial than the amount of money you start with.

-

Historically, high quality stocks have dramatically outperformed low quality stocks.

Investing is simple but not easy. Take advantage of these lessons to improve your decision making. Over time they should help you get the most out of your hard earned money, so you can enjoy a more rewarding life journey.

Note: In my next post I plan on covering ways you can invest in high quality stocks. If you’d like to receive future posts by email, please subscribe to the newsletter below.

Did you like this post? unCOMMON CENT$ is my weekly email newsletter and I want to share it with you. It’s a collection of all the uncommon financial secrets I’ve learned recently. It’s the best way to keep up with all my new articles. Please sign up for this free newsletter below.