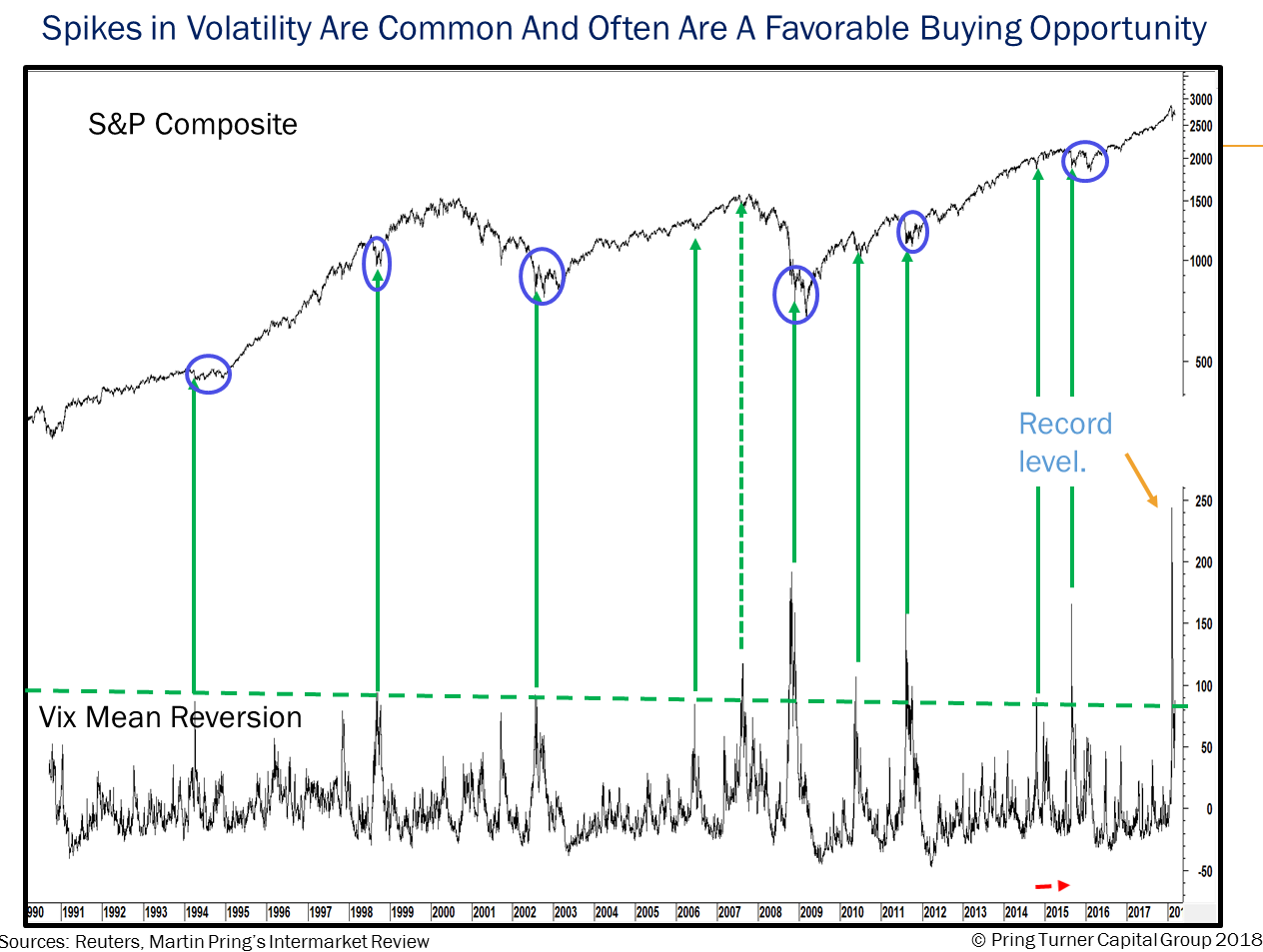

Stocks are experiencing their first significant correction after a steady 15 month rally. Does this recent bout of volatility change our long-term positive outlook for the stock market? In a word, no!

The recording contains approximately 30 minutes of prepared content and another half hour of questions and answers.