As mentioned in our July client letter we suggested the stock market correction that began in May was likely only partially over. We stated “over the next few weeks there will be additional zigzagging as market leadership shifts take place”. Indeed, July finished on a strong note, August suffered its largest monthly loss in over a year, September saw prices rebound again only to weaken at the end of the month and into October.

The longer term momentum of the stock market is still up but investors may have to withstand a bit more indigestion before the next intermediate advance takes hold. More importantly, the stock market during this correction has experienced significant sector leadership changes. Previous leadership, for instance the early cycle sectors including banks, REITS and utility companies, has weakened considerably. Emerging leadership is now shifting into mid and late cycle areas including industrial, manufacturing, technology and energy companies. The current Stage 4 of the business cycle historically favors these new outperforming groups many of which are inflation beneficiaries.

One important inter-market relationship that illustrates the Stage 4 leadership changes is our “Ultimate Inflation-Deflation” ratio (top of page 2). This measure compares the CRB Spot Raw Material Index (Inflation Sensitive) with the iShares 20-year Treasury Bond ETF (TLT) (Deflation Sensitive). When this relationship is moving higher inflation sensitive investments (commodities) are outperforming deflationary sensitive investments (bonds) on a relative basis, and when this ratio is moving lower, deflationary sensitive securities (bonds) are outperforming inflationary sensitive investments (commodities). History illustrates upward reversals typically indicate multi-month or even multi-year strength in commodities. The most recent information illustrates a breakout of this ratio after vacillating the past 12 months. This behavior confirms our opinion that the inflation sensitive sectors are poised to lead the market forward.

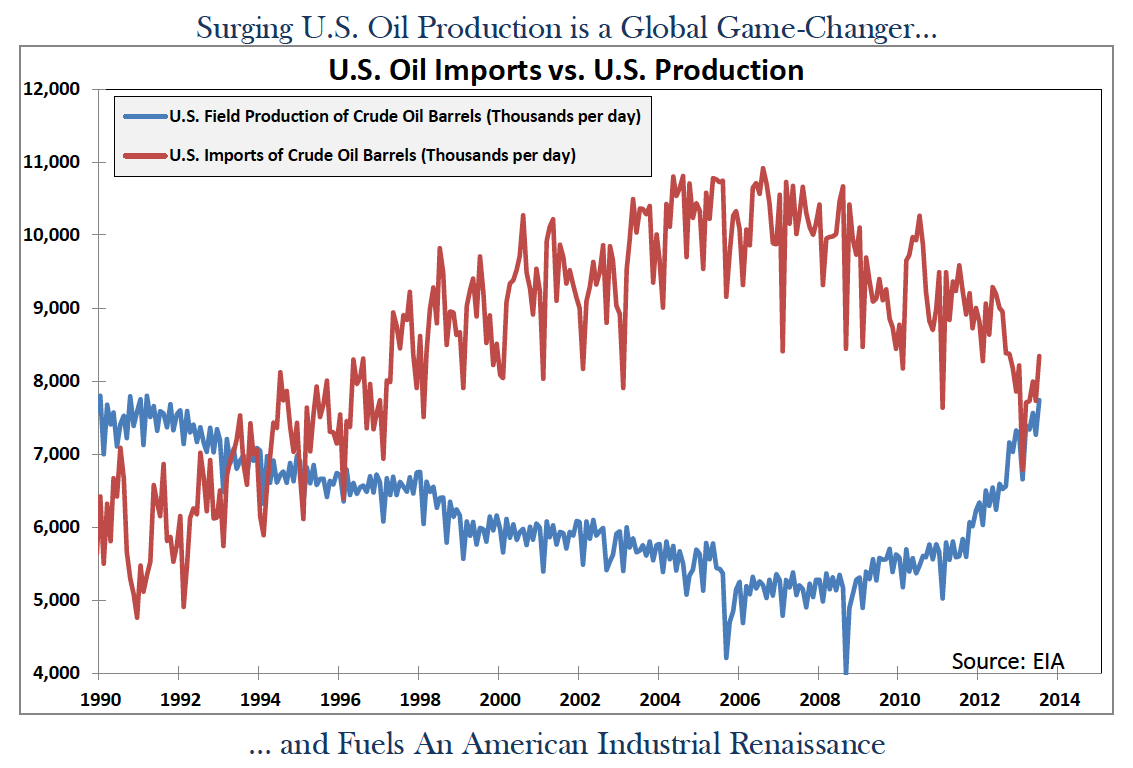

In addition to being favored in this part of the cycle, these sectors have strong long term fundamentals in their favor as well. We would like to elaborate on one very encouraging, game-changing, global economic event—namely America’s drive toward energy independence. A significant event will transpire this month or next and will have implications for the global economy far beyond most investors’ comprehension. America will flex its energy muscle very soon when domestic oil production exceeds imported oil – for the first time since the early 1990s! Consider U.S. natural gas and crude oil production peaked in the early 1970s and slowly declined until about 2006. In the past half dozen years domestic production, thanks to revolutionary technology taming ‘unconventional’ fields, has surged dramatically, completely reversing a nearly 40 year decline in U.S oil and gas output.

Texas alone has doubled production in the past 27 months and will likely stand by itself as the 9th largest producer in the world by year-end. This production surge is only in its early stage with many years of increasing output ahead. The U.S is already the world’s largest producer of natural gas. Sometime in the next 4 to 6 years the United States will most likely take over the mantle from Saudi Arabia as the world’s biggest oil producer. Dependency on foreign energy is being radically reduced for the U.S. Just six years ago we needed to import more than 10 million barrels each day from O.P.E.C and others while we struggled to produce 5 million barrels at home. Since then we have reduced import dependency by nearly 3 million barrels per day by increasing domestic output 50% to over 7 ½ million barrels and with further improvement promised.

Investment Implications

What are the implications for investors from this modern day gold rush – only black gold this time? Just a few years ago it was expected America would need to import natural gas to meet her growing energy needs. But after new technologies were developed the production faucets opened up and have irreversibly turned for the better. Liquefied natural gas facilities will be built near our ports so that gas we produce for less than $4 per million BTU can be shipped to Europe where gas is selling for $12 or to Asian markets where gas is priced in the $16 plus range.

What are the implications for our economy? For starters, the boom is adding millions of jobs to the economy, initiating a manufacturing renaissance, improving the balance of trade payments, and drastically reducing OPEC’s oligopoly power. Those are just a few of the world game-changing investment considerations!

From our point of view as portfolio managers, we believe technology and innovation are going to spotlight more attention and drive investment profits to the providers of drilling technology, domestic oil and gas producers, pipeline carriers, and especially the equipment service companies. Pring Turner portfolios already benefit from this new domestic energy boom and we look forward to further adding companies that profit from this tremendous global shift in energy production.

Looking Ahead

We have had a particularly cautious approach to the stock market the last several months. Last quarter we suggested the market began a correction in May. Since then major stock market indexes have entered into a wide trading range and the average common stock has made no net progress. Leadership changes often take place in the midst of market corrections and help identify new emerging leaders. We are witnessing that change currently. The goal during this correction is to take advantage of these new leaders breaking out from the pack.

Our plan is to gradually adjust portfolio allocations by reducing cash positions and bringing the stock allocation higher. We welcome the opportunity to add quality stocks with attractive valuations and strong fundamentals that take advantage of the inflationary part of this business cycle.

Thank you for your confidence and placing with us the important responsibility of protecting and growing your wealth. Please let us know if your circumstances should change or if you should have any questions regarding your portfolio.