2018 started off with a very strong January for stock investors and finished with December being one of the weakest months in many years! Indeed, this was a year of extremes despite a very favorable economic backdrop. If you knew 12 months ago that the economy would deliver its best annual showing of the past ten years, consumer confidence would reach an 18-year high and unemployment would sink to a 49- year low, you might assume it would be a good year for investors! Instead, stocks, bonds and commodities all declined in value, thus making it a very challenging year. Your portfolio was not immune from the fourth quarter rout, but our typical account held up much better than the broad stock market indexes. On average, you own higher quality stocks that offer better value and generate higher levels of income than the average stock. Extra cash levels and your government bond holdings, which performed well during the dramatic market decline, helped to lessen the impact. Our strong belief is this temporary stock market setback sets up for a stronger period ahead from which you can recover and build wealth.

2019 Outlook

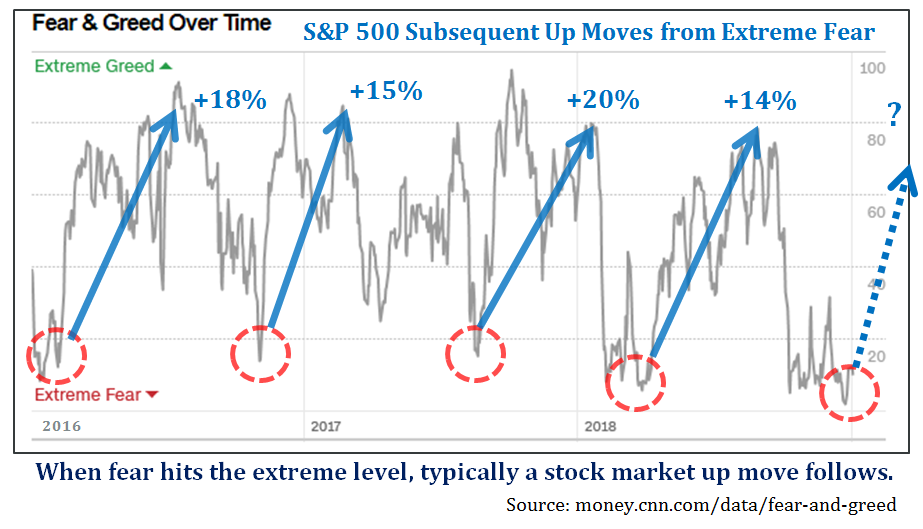

One reason why the stage is set for a great start to 2019 is there is extreme investor fear today. We have often stated that “the stock market is simply fear and greed superimposed over the business cycle.” During last month’s market-sinking spell, we issued a special bulletin in which we introduced CNN’s Fear and Greed Index. This index provides a proxy of investors’ emotions which cycle back and forth to both extreme. Remember, as investors, it is often more profitable if you turn your emotions upside/down. Our positive outlook is anchored by the fact favorable stock market returns have followed extreme “fear” levels such as we have experienced lately. Simply put: as investor emotions rebound from extreme “fear” levels, the pendulum generally swings back with better stock market returns and highly profitable up-moves.

What happens after the potential stock market advance will depend on the outcome of competing economic and geopolitical forces (listed in the table below). You may have to endure periods of volatility on the way to achieving higher wealth levels as investors continue to weigh these influences. Despite our optimism for 2019’s start, we are sensitive financial markets have some possible negative issues to work through before signaling the “all-clear” for the entire year. That said, the main observation and good news is that we still see no U.S. recession for this coming year. Stock prices have very likely over-reacted to various gloomy headlines. In the end, stocks offer attractive valuations compared to other investment alternatives. In a still low-interest rate world with bond yields falling once again, high quality stocks with above average dividends look attractive by comparison.

To sum up our outlook, this business cycle was born in June 2009 and, although mature, it looks set to achieve a longevity record later this year. There is no doubt that economic growth is slowing from last year’s healthy pace, but the U.S. expansion will likely continue. Growth is supported by solid employment statistics, strong consumer spending, and corporations are prepared to spend some of their substantial cash balances on capital goods and increased stock buyback plans. We expect the Federal Reserve will pause on any further interest rate hikes until visible signs of inflation resurface.

INCOME: THE UNDER-APPRECIATED INGREDIENT TO LONG-TERM SUCCESS

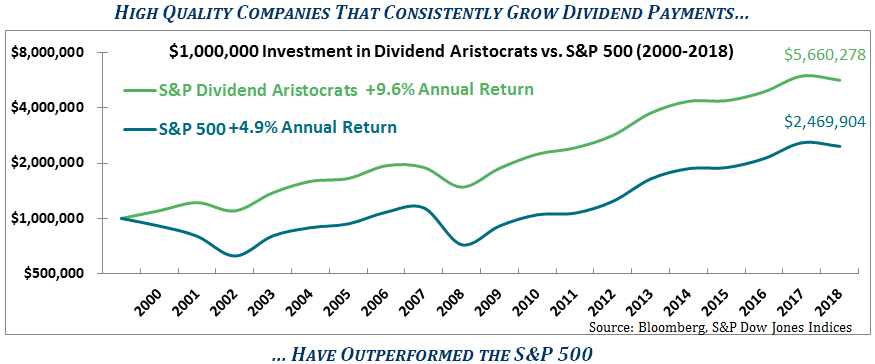

Quality, Value and Income are 3 key factors emphasized to protect and grow your portfolio. Income is often the under-appreciated factor. The chart below illustrates the power of dividend growth over time. Since 2000 the S&P Dividend Aristocrat Index, comprised of companies that have consistently grown dividends for 25+ years, has significantly outpaced the S&P 500. Similar to the Dividend Aristocrat index, your portfolio generates substantially higher income than the overall market while providing consistent dividend growth and safety.

A highly selective and robust process is utilized to place growing dividend income into your portfolio. Higher dividends, with a margin of safety, and history of yearly increases is a wonderful recipe to generate healthy total returns over the long-run. One additional advantage to your higher yielding stock portfolio is that solid dividend income acts as a downside shock absorber when the markets go through their periodic declines, such as you experienced last quarter. As the chart on page 2 illustrates, stocks that pay an attractive and safe dividend generally hold up better when markets drop. In turn, this stability and dependable income stream is designed to reward you while you wait patiently for long term capital gains to accrue.

Summary

As the New Year begins, we believe stocks are in the early stages of a strong rally after the dramatic fourth quarter plunge. Investor psychology is still firmly in the “Fear” zone and we fully expect this nascent rally to have more staying power. History shows that in the aftermath of nasty market declines, such as the last quarter, periods of above-average returns are quite common. Be assured, we will be watching carefully in the weeks ahead to see if financial markets can maintain healthy upside momentum or if more defensive steps should be taken to further protect your portfolio. We appreciate your patience and will keep you informed of any changes to our outlook.

Thank you for your continued confidence and trust, as we begin our 42nd year helping wonderful clients like you. Here is a toast to better investment returns, and a Happy and Healthy 2019!

Photo by NordWood Themes on Unsplash