This year, we celebrate 45 years in business and could not be more proud of this team and are honored to have worked with some of the best clients. YOU are the reason we’re able to celebrate this milestone and we are incredibly grateful. Our tagline “Quality, Stability, Confidence,” not only encapsulates the individuals that make up the Pring Turner team and our investment strategies, but our client family as well. Here are some key takeaways from our 2022 client event:

Business Cycle Update

Pring Turner has utilized the same principled decision-making process for the last 45 years.

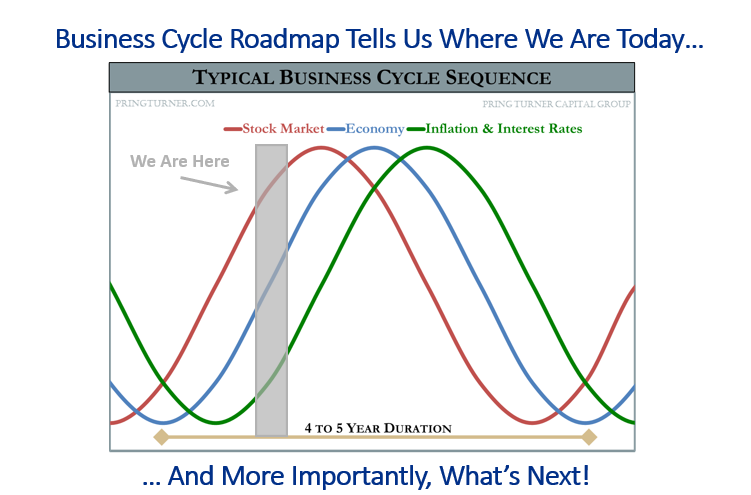

The business cycle serves as a roadmap and drives our investment process. This simple, yet elegant chart illustrates the relationship between stocks, bonds, inflation-sensitive assets and the economy. The diagram demonstrates a typical business cycle path with stock prices leading the economy while interest rates and inflation tends to lag. This sequence is pretty consistent as research going back to the 1850’s demonstrates. Each cycle has its own unique personality and no two are identical, but the basic sequence plays out in a logical manner. Where are we today?

Our Advanced Investment Barometers enable us to carefully assess these financial patterns and develop investment strategies. These barometers place us in the gray shaded area. Today, the stock market, economy, and inflation are all rising together. The goal of this approach is to anticipate market changes so we can guide clients into optimal investment positions. The prevailing “wisdom” is that you must take greater risks to reap greater rewards. We’ve thrown that tired adage out the window.

Inflation

Wow, in 2021 inflation surged to its highest rate in 40 years! This might not be a huge shock if you shop for groceries or fill up at the pump, but should you be concerned? While there is a lot of talk about it these days, the danger of inflation isn’t new, and combatting it at Pring Turner remains a crucial part of our investment process.

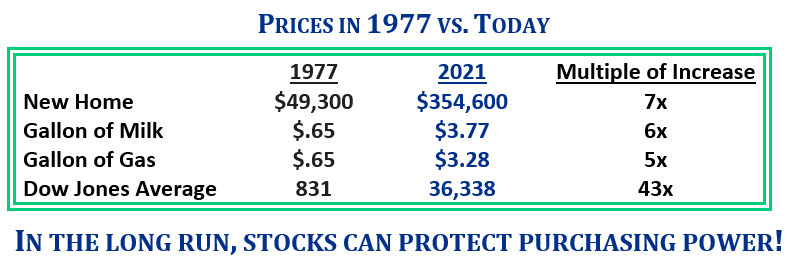

There is a lot of talk about inflation these days, but this is not a new problem. The table below compares the cost of a few common items in 1977 to today. We thought it would be fun to look back at the history of our firm, to 1977, and compare price changes. Homes, Milk, and Gas have grown in price by 7-fold, 6-fold, and 5-fold respectively. Better yet, the Dow Jones average, a proxy for high quality stocks, went from just about 800 to over the 36,000 level at the end of last year—that’s a 43-fold increase in value! Sure, there may be temporary periods where stocks may falter during periods of inflation—but in the long run stocks can protect your purchasing power.

At Pring Turner, over 45 years, we’ve been through all kinds of challenging periods, inflation, disinflation, wars, tech and housing bubbles, the great financial crisis, and even a global pandemic. That is exactly why we have an active investment process and disciplines to navigate safely through the inevitable rough stretches. Our ultimate goal: to beat inflation and protect and grow your portfolio while reducing the risks.

Relationship between the Economy & Stock Market

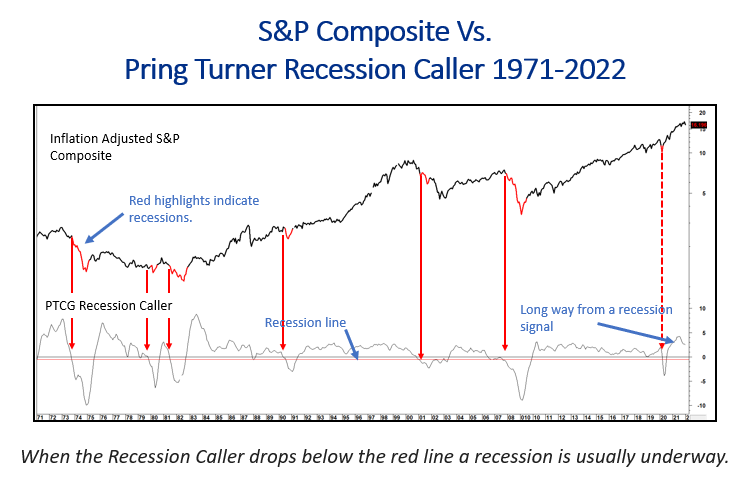

The relationship between the economy and the stock market is crucial. Since 1955, there have been several corrections (-10% to -20%) drops for the stock market. These typically occur during economic slowdowns and mild recessions. On the other hand, stocks can drop significantly (-40% to -60%) during deep recessions. Currently, interest rates are rising and inflation at its highest level in 40-years, what are the chances of a recession?

Our Recession Caller Indicator consists of several indicators like housing, retail sales, and so forth. This indicator enables us to better gauge market pressures and determine the likelihood we are headed for a recession. Based on its current trajectory this indicator is a long way from signaling a recession. That suggests a major stock market decline is unlikely, but certainly doesn’t eliminate the possibility of a more modest decline. There are hints that the economy may be beginning to slow down and historically this has resulted in temporary 10% to 20% drops in stock prices. The good news is that today the S&P 500 has already experienced a greater than 10% drop. So, we may already be through a significant part of the decline driven by the recent slowdown.

Quality – An Additional Layer of Protection

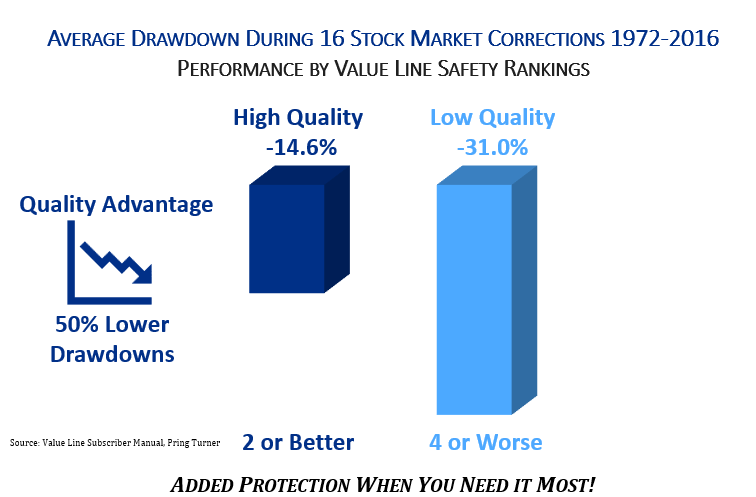

What are the benefits to emphasizing quality investments? Research has shown that high quality stock investments have outperformed over the long run. For example, the financial agency Standard and Poor’s ranks stock from A to D based on the quality of the company, like a report card. Their studies have consistently shown that companies ranked B or better (high quality) outperform those ranked B- or worse (low quality). This study covering the last 30 years shows the quality advantage works out to about +1% per year. But even more importantly, high quality stocks also provide less risk during market downturns.

A separate study from Value Line, an independent research firm, rank stock quality from 1 (highest) to 5 (lowest). In their study going back to the 70’s, during the last 16 major market drawdowns, high quality stocks only declined by -14.6%, while the lowest quality declined by -31%. That works out to about 50% less risk during these major market declines. That’s important for a few reasons:

1—it makes for a smoother, less emotional journey for you.

2—if you go down less in difficult periods, it’s much easier and quicker to get back to new all-time highs in your portfolio during the next good period.

So, in essence, you really can have your cake and eat it too.

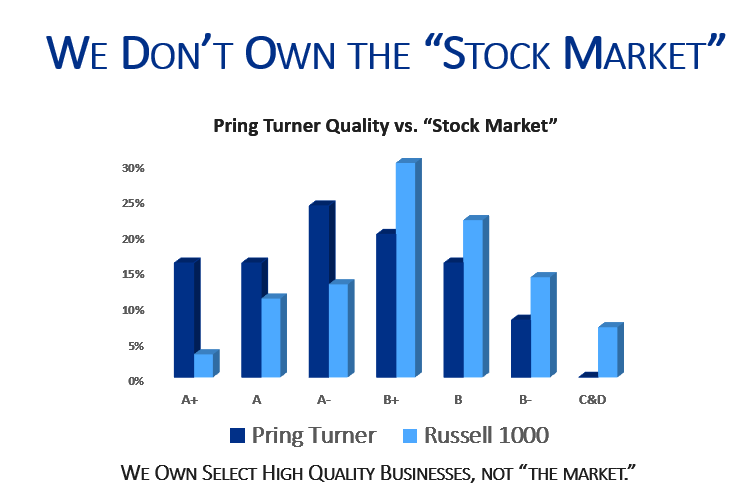

We Don’t Own the “Stock Market”

Let’s compare a stock market index covering 1000 of the largest companies, the Russell 1000 (light blue), to a typical conservative Pring Turner portfolio (dark blue). Here you can see the typical Pring Turner portfolio is more heavily weighted to the B+ or better. The key takeaway is, we own a select group of high-quality businesses, not “the market.”

Summary

At Pring Turner, over 45 years, we’ve been through all kinds of challenging periods, inflation, disinflation, wars, tech and housing bubbles, the great financial crisis, and even a global pandemic. That is exactly why we have an active investment process and disciplines to navigate safely through the inevitable rough stretches. Our ultimate goal: to beat inflation and protect and grow your portfolio while reducing the risks. We appreciate all your support and confidence all these years! Thank you!