Wow, in 2021 inflation surged to its highest rate in 40 years! This might not be a huge shock if you shop for groceries or fill up at the pump, but should you be concerned? While there is a lot of talk about it these days, inflation is not a new problem. There are years when its lower, and years like 2021 when its higher, but its ever present. Inflation is a saver’s worst enemy, and combatting it is crucial.

How can you protect yourself from it? One of the best defenses against inflation is to own businesses (ie stocks). It’s easy to forget that a stock is more than a ticker symbol with a constantly changing price. It is really a partial ownership interest in a business. At Pring Turner, we seek to invest in the best companies which possess stable and durable business models.

In this post, we share an example of the potential merits of investing in higher quality business. Streaming and royalty companies (both referred to as “streamers” here) provide early-stage financing specifically for mining development. These companies possess simple and profitable business models that capture the benefits from rising metal prices while minimizing the drawbacks. In exchange for their initial investment they receive either a royalty payment on future production or a “stream.” A stream is the right to purchase a percentage of future production at a very low fixed price for the life of the mine. In simple terms, streamers share in the success of mining projects without incurring any of the ongoing operating risks.

6 Key Streamer Advantages

1) After initial funding of a project, they have no further obligation to ongoing expenses. They simply get the opportunity to share in the revenues of the mine.

2) The largest streaming companies have seasoned management teams and use their industry knowledge to pick and choose only the strongest partners and projects with the best prospects.

3) Streaming agreements are attached to the land, not the operator. In the event of a bankruptcy or a change in operators, the agreement still stands – further protecting the streaming company from business risk.

4) Optionality, or a free pass into the future (more on this advantage later).

5) Streamers diversify their investments over dozens, even hundreds of projects and jurisdictions, far more than the individual mining company whose exposure may be limited to a handful of mines.

6) The largest and most established streamers pay reliable and growing dividend income. Share prices can correct and go sideways, but these dividends can keep rolling in.

Optionality: Big Upside Potential with Limited Downside

A key streamer advantage, optionality, means agreements generally last for the duration of the mine operation. A mine typically starts out on a small scale, but through further exploration of the land, can become a bonanza to the streamer as payments grow over a period of years or even decades.

The classic optionality story is Franco-Nevada Mining Corporation Limited’s original $2,000,000 investment in 1985 for a royalty on a Nevada mine, the Goldstrike. More than three decades later, the Goldstrike royalty has produced over $1,000,000,000! ONE BILLION DOLLARS. Have you ever stopped to consider how much money a billion dollars is? Ponder this: if you were to spend $1,000 a day every day from the time Jesus was born until today, you still would not have spent a billion dollars. Big upside potential with limited downside – that is optionality!

In an interview, Pierre Lassonde, chairman of Franco, reported, “If someone hands you a free perpetual option on 6 million acres of land … don’t you think that at some point, you’re going to get lucky?” This concept is one of the most important and exciting possibilities in the life of a streamer, and profitability for their eventual returns. As Forrest Gump might say, streaming deals are like a box of chocolates, you never know what you’re gonna get.

Long-Term Streamer Outperformance

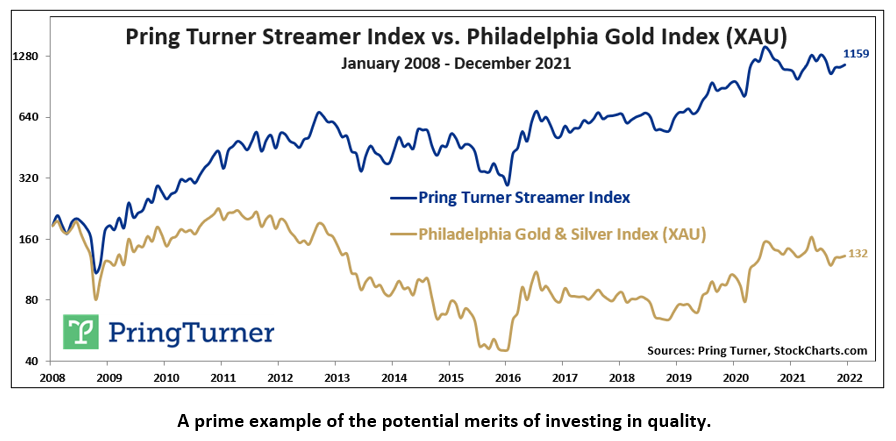

In 2016 we created the Pring Turner Streamer Index (equally weighted comprised of the three largest streaming companies). The chart below illustrates the superior streamer business model with the Pring Turner Streamer Index consistently outperforming the XAU Gold and Silver Index (an index of thirty previous metal mining companies) since 2008. Importantly, this performance advantage was generated within both up and down markets for precious metal prices.

Streamers are unique companies which possess very predictable and profitable business model that should help shield shareholders from inflation. These companies reduce much of the risk of investing in precious metals because they give investors a more diversified portfolio of mine holdings, limited financial and legal exposure, plus all the upside of optionality.

Conclusion

The danger of inflation is not new, and combatting it at Pring Turner is a crucial part of our investment selection process. Over the long run, stocks have done a great job protecting and growing wealth despite the ravages of inflation. This is a big reason why we seek to invest in the best companies which possess stable and durable business models. The Pring Turner Streamer Index’s near 9x higher returns relative to the average mining company since January 2008, is a prime example of the potential merits of investing in quality.

Did you like this article?

Footnotes:

Photo by Sharon McCutcheon on Unsplash

DISCLOSURES: Pring Turner Capital Group (“Advisor”) is a financial advisor based in Walnut Creek, CA. The Advisor invests on behalf of individuals, organizations, and other financial advisors that appreciate a conservative and active investment style that aims to deliver consistent results without taking undue risk. The key objective of the Advisor’s investment philosophy is to not lose big during major market declines, making it easier to compound wealth over the long run. The Advisor is registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2022 Pring Turner Capital Group. All rights reserved. The Pring Turner Streamer Index is an equally weighted stock index comprised of the three largest publicly traded precious metals streaming companies. The index includes: Wheaton Precious Metals (WPM), Franco-Nevada Corp (FNV), and Royal Gold, Inc. (RGLD). The index is designed solely to track the stock performance of the precious metals streaming subindustry. The Pring Turner Streamer Index is calculated on a total return only basis and is not assessed a management fee.