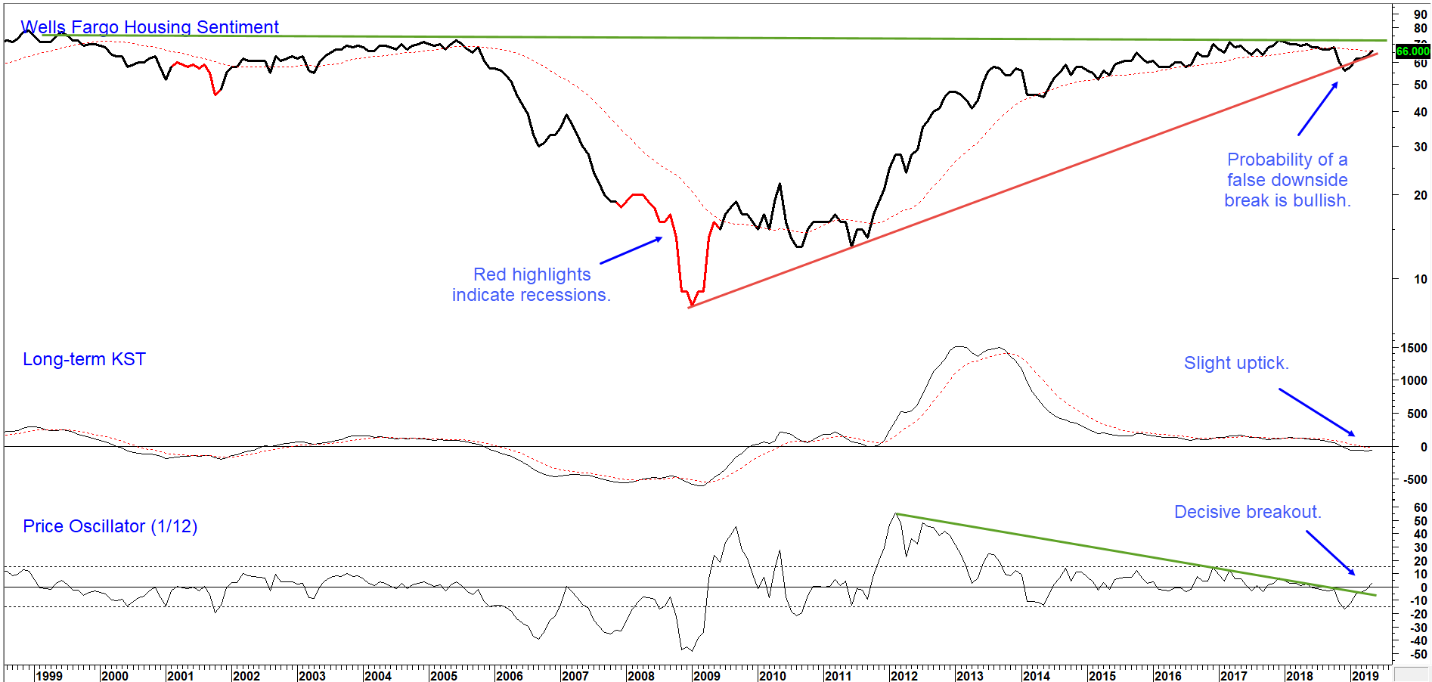

The Wells Fargo Housing Sentiment normally peaks well before recessions. It typically coincides or leads housing starts and is poised to break out to new high territory. A KST (smoothed long-term momentum) uptick and a trendline break by the price oscillator suggests it will.

Wells Fargo Housing Sentiment 1998-2019

Sources: National Association of Home Builders, Pring Research

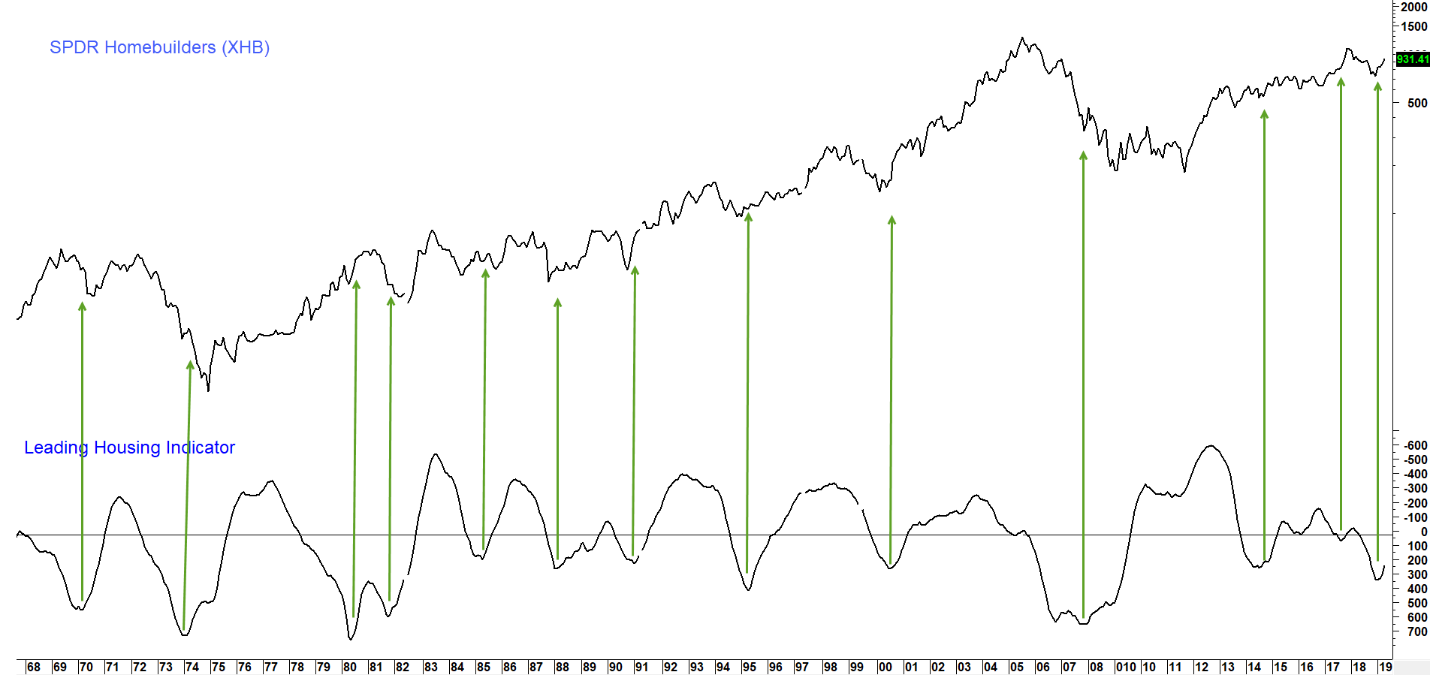

My Leading Housing indicator is constructed from the relationship between housing starts and swings in interest rates. This series has just turned up in the last couple of months. The green arrows show that, except for the unduly early 2007 reversal a rise in the indicator has typically been followed by a rally in the homebuilders.

Sources: Reuters, Pring Research

Cover Photo by Henry & Co. on Unsplash

Disclaimer: The views expressed herein represent the opinions of the Investment Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. Neither the Investment Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein.