Despite troubling headlines of ongoing virus concerns and terrible unemployment numbers, the stock market pivoted direction in late March and embarked on its best quarterly performance since 1998. In our view, the biggest factor in reversing the first quarters’ deep bear market decline was the swift and enormous monetary and fiscal stimulus provided by the Federal Reserve and Congress. These measures have so far totaled over $7 trillion and make the response to the 2008 global financial crisis pale in comparison!

We anticipate that high levels of volatility will remain for the greater part of 2020, due to continued virus uncertainty, a slowly phased-in economic reopening and bitter election year political wrangling. While past performance does not guarantee future results, we have weathered many other challenging periods over the decades. Rest assured, your investment portfolio made substantial gains this quarter and is well-prepared for the environment at hand. Any short-term volatility will be used as a long-term opportunity to further grow and protect your wealth.

NAVIGATING AROUND THE VOLATILITY

No doubt, market volatility has spiked higher this year after a relatively tame 2019. Of course, there are few complaints when markets are volatile to the upside, but even experienced investors’ nerves can get frayed when prices race to the downside. Successful investing requires emotional fortitude and it is important to not let day-to-day volatility alter your long-term investment approach.

Volatile times demonstrate the true advantage of the active and careful risk management tactics employed to smooth out the inevitable ups and downs. Your portfolio utilizes our time-tested business cycle investment strategy, which is designed to focus on longer term cyclical trends and continuously adapts to changing financial markets conditions. The overriding goal is to protect your valuable assets through rough periods and grow them during the favorable part of the cycle.

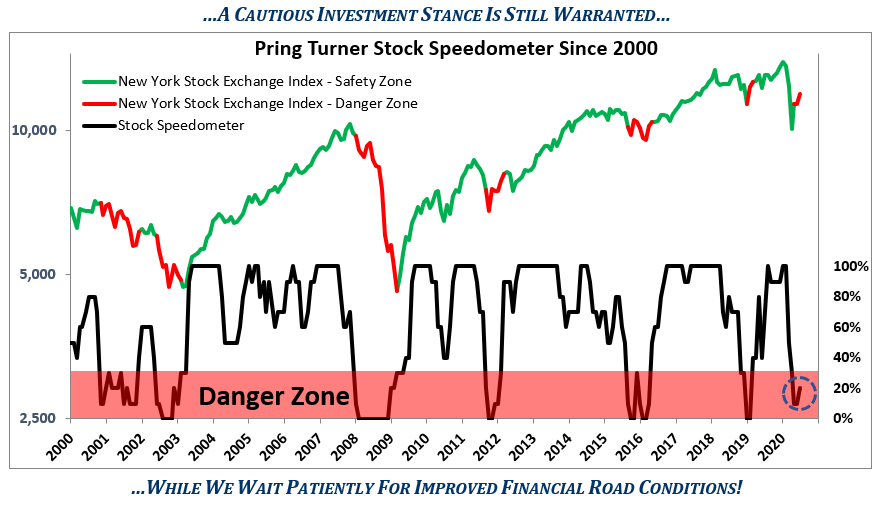

One important tool utilized to gauge risk is our Stock Speedometer (below), which is a combination of a wide range of market indicators. The speedometer is designed to identify the primary environment of the stock market, either favorable or unfavorable. Similar to your car speedometer, it signals how fast or slow we drive your portfolio. Historically higher readings (maximum 100) have led to better returns for the average stock; conversely, lower readings (minimum 0) have led to poorer returns. The latest reading for the Stock Speedometer is 20. The bad news is this is a ‘Danger Zone’ reading during which stock returns have historically been poor; however, the good news is that over the past month it has improved from 10 to 20. Stay tuned as we patiently wait for further improvement and a return to more favorable conditions.

Investment Game Plan

The major stock indexes appear to be strengthening on the surface but, on closer inspection, they have been bolstered by the outperformance of a relatively few ultra-large technology companies. In other words, the average stock has not kept pace with the furious rally of a select few. It would be a much healthier sign and better for diversified portfolios like yours, if market strength started to broaden out with more sectors participating. Legendary Wall Street strategist Bob Farrell put it this way:

“Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.”

As dictated by the continued cautionary signal from the Stock Speedometer, you have a defensive investment stance. To use a metaphor regarding today’s recessionary environment and less favorable visibility, we have lowered risk by slowing down your portfolio driving speed.

The plan is to keep a reduced allocation to a diversified group of high-quality stocks that possess dependable earnings and above average income. These companies are selected based on their long-term durability to weather the short-term economic uncertainty. These are “core” holdings that make up the foundation of your portfolio –many belong to a select club of elite businesses or “dividend achievers” that have raised their dividends over many years. Historically, these are the types of companies that decline less than the overall market during major bear markets yet are amongst the first to participate in the new bull market that always follow. For these reasons, you should sleep better at night knowing you own quality companies and have a higher level of cash in your portfolio for added protection.

Summary

Protecting and growing your wealth is the foremost mission and keeps us excited and challenged to deliver on that commitment every day. This mission is as challenging as ever, considering we are all in the midst of unknowable virus-related news developments, unending negative election rhetoric and volatile financial market action. Our job is to use the assortment of risk management tools like the Stock Speedometer, developed over the firms more than forty-year history, to help steer you clear of those hazards. A cautious approach is still warranted for now, while we wait patiently for improved financial road conditions that will signal the next low-risk wealth building opportunity for you.

We would like to take this opportunity to welcome all the new members to our growing client family, many of whom were introduced by you. Thank you for the trust you and your family have placed with us.

As always, please feel free to contact us should your circumstances change or if you have any questions.

Congratulations (once again) to Genna and Jim!

We are most happy and proud to announce a new addition to the family as Genna and Jim welcomed a new baby girl into the world. Lauren Alexandra Kopas was born on May 31st, weighing in at 6 lbs. 7 oz.—mom, dad, siblings (Kate, Charlotte, and Patrick), and baby are all doing beautifully! Please join us in celebrating the newest financial advisor (in training).

Did you like this article?

Footnotes:

Photo by Nicolas Cool on Unsplash