Economic growth is chugging right along on a slow but steady path higher, supporting the positive investment backdrop. Furthermore, the Federal Reserve implemented a “midcycle adjustment to policy” by reducing interest rates in late July and, as an added insurance policy to keep the economy on a sustained growth path, dropped them another notch in September. There is potential for yet another stimulative rate cut later this year.

Relative to other alternatives, we believe high quality, dividend paying stocks like the ones represented in your portfolio shine in comparison. Indeed, it has been another good quarter and wonderful year, for conservative investors like you who emphasize quality, value and income. While there will always be intermittent bouts of financial market weakness, we believe evidence favors further gains.

Why a Recession Is Not Imminent

Amidst the continued drumbeat of negative financial forecasts and calls for recession, we respectfully disagree. The reason why is historically speaking, recessions are caused by excessively tight monetary policies and, in turn, tighter bank lending conditions: neither of these circumstances are present today. In fact, interest rates have declined to very low historical levels, which is sustaining economic growth. For instance, the recent resurgence in mortgage refinancing is leading to renewed housing activity. Additionally, banks have plenty of excess capital on hand and are happy to lend it out to qualified borrowers. Granted, there are other less rosy factors to consider, like an escalating trade dispute with China and recurring concerns of a global growth slowdown. Nevertheless, the U.S. economy continues along a moderate growth path. In short, with interest rates at ultra-low levels and accommodative credit conditions, we believe a U.S. recession is not imminent. The more likely scenario is that after a short pit stop to refuel, this 10-year economic expansion has even further to travel.

Reasons to Stay Optimistic

In July, we hosted a webinar explaining our latest economic and market outlook. Here are the three main points that we covered and why we think it is still a good idea for investors to stay optimistic. These points remain equally valid today.

1) Several leading indicators for the economy are beginning to show renewed upward momentum. For example, the Pring Turner Recession Watch Indicator (featured in our July newsletter) continues to give an “all-clear” signal for the economy.

2) The economy appears to be in the process of completing the 3rd mid-cycle slowdown of this 10-year economic expansion, which would likely be followed by another extension to this exceptionally long business cycle. Signs of renewed strength include recent new all-time highs in household net worth, core retail sales, U.S. corporate profits and stock prices.

3) In today’s historic low interest rate world, a focus on high quality stocks with growing dividends provides great value. For instance, the 10-year U.S. Treasury bond pays a fixed rate of 1.52% today[2]. Compare that to your stock portfolio with a diversified mix of financially strong companies yielding on average better than 3%[3] Better still, your companies are consistently raising their dividend payments. By our calculations, over the past year they have increased payments to you by more than 13%[4] on average. To put that in perspective, if dividend growth continued at that rate over the next decade, your stocks would be yielding over 10% at current prices[5], while a 10-year U.S. Treasury purchased today will still be paying you just 1.52%.

The choice for long-term investors is obvious—the superior quality stocks held in your portfolio offer far better current income and growth prospects than treasury bonds.

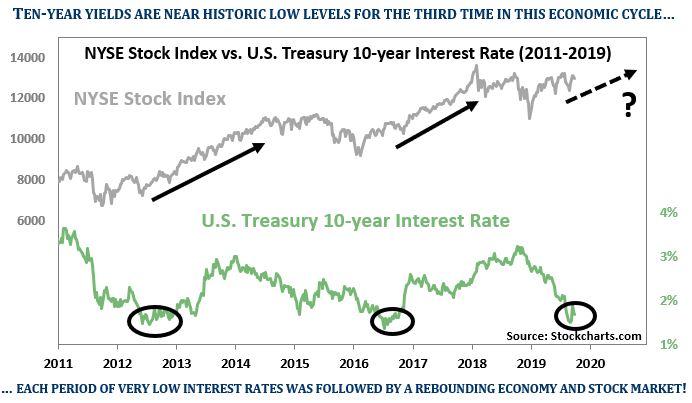

Low Interest Rates Lead to Rebounding Economy and Higher Stock Prices!

To further illustrate our optimistic view, the chart below compares the relationship of interest rate movements to the stock market over the last decade. This year, interest rates on 10-year U.S. Treasury bonds plunged to levels last seen in 2012 and 2016 (circled). Each period of low interest rates refreshed a slowing economy. The result was an economic rebound and higher stock prices (arrows). Bottom line: we believe the economy is set to emerge from the third growth slowdown of this cycle and likely to provide investors with additional gains.

Summary

Despite the strong year so far, we remain sensitive to the fact that one cannot extrapolate above-average returns forever into the future. That is why we are on alert to any changes in evidence that would shift our tactics and emphasis from growing to protecting your portfolio. The benefit of following the business cycle is that we are always looking forward to the next major turning point for financial markets. This disciplined strategy is one of the cornerstones to helping you reach your financial goals with peace of mind.

Your confidence and trust are deeply appreciated. As always, please feel free to contact us with any questions regarding your portfolio or changes to your personal circumstances.

Special Announcement

We are pleased to announce an expanded relationship with Vincent Petti, founder of Planned Futures Financial Group LLC, (PFFG), a registered investment advisory firm based in Colorado Springs, Co. We have sub-managed a portion of PFFG’s client assets for several years and it has been a pleasure working with Vince and his client family. Indeed, it is rare to find another advisor who so closely shares our own values and investment philosophy. That said, we have added an additional layer of service to the PFFG client family, whereby we will also provide them with back-office support.

Please help us in welcoming aboard PFFG clients into the Pring Turner family! We are grateful for the opportunity to get to know you all better and look forward to working more closely with you. Welcome!

Footnotes:

[2] Rate as of October 8, 2018

[3] Based on the largest Pring Turner holdings, your yield could differ.

[4] Based on the largest Pring Turner holdings your dividend growth could differ.

[5] For illustrative purposes only. Not a prediction for future dividend growth performance or future stock yields.