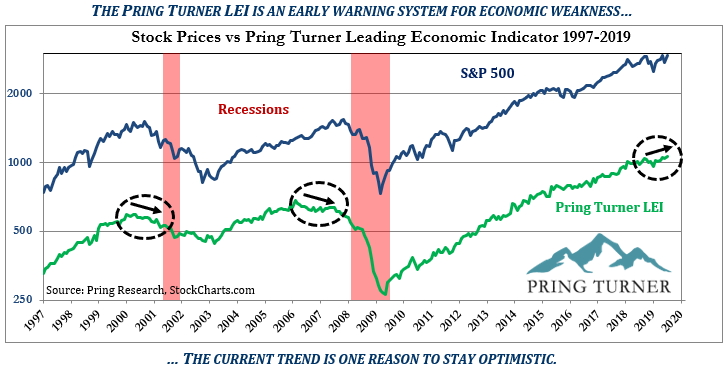

The Pring Turner Leading Economic Indicator (LEI) comprises a weighted ROC for three key economic sectors and a financial one. These are construction, consumer spending, employment and the stock market. It has led every recession since its inception in the 1950’s. To be fair, it also signaled the non-recession of 1966. Signals are triggered by the “Recession Caller” in the lower window dropping below the red trigger line. The latest data point to the indicator moving away from that line in the direction of renewed recovery and away from a business contraction.

Source: Pring Research

The most severe stock market declines (-20% or more) have occurred during economic recessions. For retirees, it is especially critical to avoid recession-driven market declines in order to effectively secure a stable retirement lifestyle. Recovering from these big losses can be a difficult and highly stressful endeavor. This is one reason why we follow the natural rhythm of business cycle swings closely and stay on alert for major turning points in the economy.

What is the Pring Turner LEI telling us now? The following chart shows the most recent 20-year history of this forward-looking indicator, and how it peaked out and began a persistent decline a year or more before the last two recessions. This behavior is in contrast with today’s positive trend where the indicator just reached an all-time high! The latest reading suggests that there is low risk of a recession in the coming months. Continued economic strength typically translates into higher stock prices.

Photo by Samuel Zeller on Unsplash