Ouch! The only good news for the past few months’ stock market performance is we are relieved it is behind us. This quarter the stock market experienced much more volatility and a stiff decline, thereby ending a long string of positive quarterly returns.

We understand and feel the concern some of you are experiencing, but also advise you to not extrapolate this decline too far into the future. If you have ever gone to the beach or played in a pool and pushed a beach ball under water, you can appreciate how we associate current market conditions with that beach ball. When the ball is pushed under water, pressure begins to build. The farther under water the ball descends, the greater the pressure. The greater the pressure, the faster the ball shoots back up to the surface. Today we believe the stock market beach ball has been pushed down near the very bottom of the pool’s deep end and anticipate a snap back rally for the stock market.

There is no sugar-coating it, after outperforming in the first half of the year portfolios underperformed the last few months. Recent performance contrasts with the especially strong prior quarter ending in June when portfolios had again reached new benchmark highs.

Why the Abrupt Reversal in Performance?

First, the inflation themes that worked so well into the early summer months corrected strongly. Energy and materials (especially precious metals companies) were the big underperformers as the U.S. dollar showed persistent strength over the last several weeks. Historically, the U.S. dollar tends to move in opposite direction to commodity prices and recent rather exceptional dollar strength has been a headwind for oil and other raw material prices. To put the dollar advance in perspective at one point during the 3rd quarter the dollar moved higher for 11 consecutive weeks, the last time a move of this magnitude occurred Richard Nixon was president (August 1971). One very positive counterbalance to price weakness is the current sentiment readings for nearly all inflation sensitive themes. They are at uniformly extreme bearish levels meaning investors are fearful, an important precursor to strong upside price reversals.

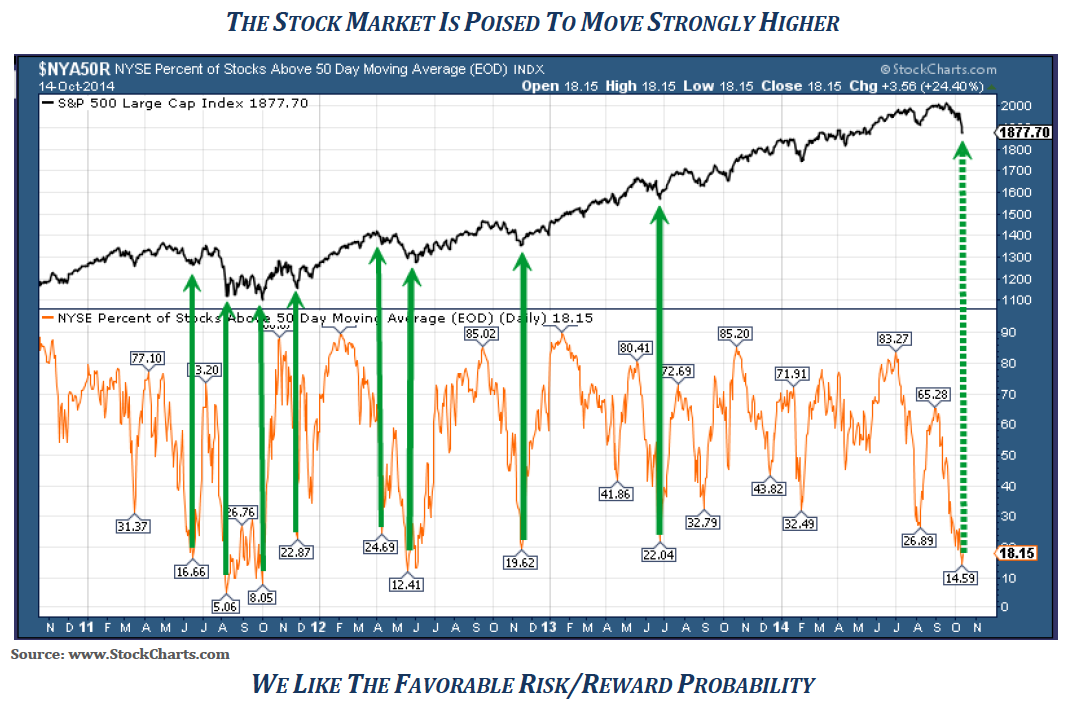

Secondly, the overall stock market began a “stealthy” correction over the summer months where the average stock dramatically underperformed the large cap indexes such as the S&P 500. In other words, until recently the index held relatively close to its high but this masked broader weakness by the average stock. To illustrate this phenomenon, we observe one internal statistic that graphically shows the “hidden” weakness and current opportunity. Recent stock weakness has hit an extreme, bottoming out with less than 15% of NYSE stocks above their respective 50 day moving average. When this indicator drops below 25%, historically above average returns follow as since 2001 average annual returns for the S&P 500 during these timeframes are nearly +58%. This indicator doesn’t move below 25% very often (about 10% of the time), but is currently offering convincing evidence that a strong rally is highly probable.

What’s Next?

The good news for now is that the leading economic indicators for the economy show continued strength and no evidence of any imminent recession for the U.S. economy. That leaves room for the extension of the business cycle expansion and continued market upside potential for both stocks and commodities once this current soft patch runs its course. The stock market is primed for a strong up move as the psychology of most individual investors and even professionals have recently turned quite pessimistic, a precondition found at important low points. Combine this pessimism with a very compressed price level and we have the ingredients for a very nice fourth quarter stock market recovery and eventual move to new high portfolio valuations.

Our tactics in the weeks ahead are to pay close attention to market behavior on any rebound. Should it display strong characteristics often seen at other major rally turning points it will be back in sync with the current economic backdrop. On the other hand, should it fail to show us the “right stuff” we will prepare for a more defensive and balanced portfolio strategy to better protect against any further declines. Our active portfolio management strategy has the flexibility to adjust to changing conditions with the goal of participating in the good periods while protecting wealth through important downdrafts.

In closing, Pring Turner principals have navigated successfully through many, many stock market declines as we are currently experiencing. If you have been our client for the past ten, twenty or thirty years or longer, you too have been through many of these periods with us. It is good to remember that it was also just a few short months ago that you were enjoying all time benchmark highs in your portfolios. We do believe our experience, knowledge of markets and business cycles will once again guide you through the current decline and help achieve even higher levels in your portfolio as you have for the past many years.

Keep in mind during this day to day volatility that, as our chart demonstrates, the probabilities are high for a strong rebound in the stock market in very short order (the “beach ball effect”). While difficult to sit through this volatility, your patience will be rewarded. We do appreciate your confidence and trust and promise to continue working hard every day to keep it.

DISCLOSURES: Pring Turner Capital Group (“Advisor”) is an investment adviser registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2014 Pring Turner Capital Group. All rights reserved.