Our Investment Advisory clients experienced nine months of solid performance despite numerous stiff headwinds in 2016. The headwinds started in the opening weeks of the year with a vicious stock market selloff, Brexit related volatility in June, still sputtering economy and election year jitters. In today’s low interest rate world investors, especially retirees, face significant challenges in meeting their long term retirement goals, but challenges are nothing new for us. As an investment advisory firm based in Walnut Creek since 1977, our clients have faced periods including inflation, deflation, wars, recessions, the dot-com crash, real estate bubble, and global banking crisis. Despite the many challenges over multiple decades, our conservative investment process designed to keep you a step ahead has delivered steady growth with roughly half the market risk. Our overriding goal has been and will always be to help you reach your financial goals with peace of mind.

Answering Your Investment Questions

This quarter’s newsletter will address your most common investment questions and provide our current financial market outlook.

1) What effects will the election have on your investments?

Concerns about the upcoming election is the most popular question we have received at our Walnut Creek office. This election campaign has been particularly contentious with negativity thrown about on both sides, which can be disheartening for investors. Election years increase the level of uncertainty about the direction of our country. While the election could cause short term volatility in the markets, the longer-term direction of the economy is more important. Our observation is that the economy has far more influence on the election than the other way around. Any president will have to work with Congress to change policies and allocate fiscal spending—for decades that has been a slow and torturous process. So, we would not expect the election of either candidate to have an immediate impact on the economy.

One investment theme that both candidates are touting in their respective campaigns is the desire to increase spending on infrastructure projects. Indeed, the Federal Reserve has done about all they can with monetary policy to stimulate the economy by lowering interest rates to historic low levels. Politicians on both sides are promoting heavy government spending on roads, bridges, airports and the electric grid system, among many other projects. From our investment advisory standpoint, this type of stimulus would favor sectors that we have been adding to portfolios including industrial, machinery and material companies. The best news is that we only need to endure a one more week before the election is over!

2) With interest rates so low, what happens to bond investments if rates go up?

Never in 5,000 years of recorded history have investors had negative interest rates, but that is a fact today. An astounding 47% of global interest rates are in negative territory. Remarkably, international savers now pay bond issuers to hold their money and, on top of that, 80% of bonds pay investors under 1% and a full 96% of all global bonds pay less than 2%… can you believe it! Purchasing a ten year U.S. government bond today locks in a paltry 1.7% fixed rate for the next ten years—that’s not a rate of return the typical retiree requires to pay the bills and keep up with inflation. Rates are not likely to go much lower but there is plenty of room for them to go higher. As rates go higher, bond prices decline with the longest maturity bonds subject to the largest risk of loss. As fee-only investment advisors, we are avoiding longer maturity bonds and building a “ladder” of short to intermediate term bonds instead. A ladder means arranging bond investments with successive maturity dates to allow flexibility to reinvest into higher paying bonds as each comes due at maturity. This conservative strategy greatly reduces risk in the bond portion of the portfolio. Finally, despite a near-term rise in bond rates, we suspect that rates will stay range bound for many years, offering cyclical opportunities to temporarily invest in longer dated bonds. We say it is a better strategy to “rent” longer term bonds rather than to “own” them until maturity. We are confident that our bond market experience and business cycle research will allow us to boost returns in your bond portfolio as compared to typical buy and hold investors.

3) I’m retired. At my age, why does my investment portfolio have more stocks than bonds?

Historically, bonds were always considered safer than stocks, but that is most definitely not true today with record low interest rates. Conventional wisdom has been turned upside down with interest rates near historic lows. In today’s low return world, it makes sense to hold more stocks than bonds regardless of age! In fact, the average stock in the S&P 500 pays a 2% dividend yield, that’s considerably more than a ten-year U.S. Treasury bond of 1.7%. By comparison, the dividend yield for stocks in our typical investment portfolio average 3.3%, which is nearly double the income from bonds. Add in the potential for dividend increases and you can appreciate why high quality, dividend growth stocks are more attractive than low yielding fixed rate bonds today. Whether stocks go up or down, it is comforting to know that dividends provide a solid foundation to your portfolio with dependable and growing income streams. Yes, stocks can be more volatile than bonds but, historically, stocks with the highest quality rankings tend to decline far less during significant market declines. That is another key reason why we emphasize high quality stocks in your investment portfolio.

4) Are there any other ways to increase income in my investment portfolio?

Our job as investment advisors is to continuously search for ways to enhance returns in your portfolio. One way we plan to boost income is by selectively incorporating a conservative strategy called Covered Call Writing. With this strategy, you agree to sell a portfolio stock at an agreed upon price within a certain time and a speculator will pay you a “premium” for this option. As an investor, you can collect premiums, which generate additional income to augment your investment returns. In exchange for extra income, the strategy can partially limit the upside potential in a particular holding. Our plan is to gradually and carefully implement this income enhancing strategy. Look for educational material to reach you soon and we stand ready to answer any of your questions. So, yes, this Covered Call Writing strategy is one conservative method to increase income for you.

5) In the face of so many worries and challenges in the world, you have been adding stocks to my investment portfolio. What is your thinking?

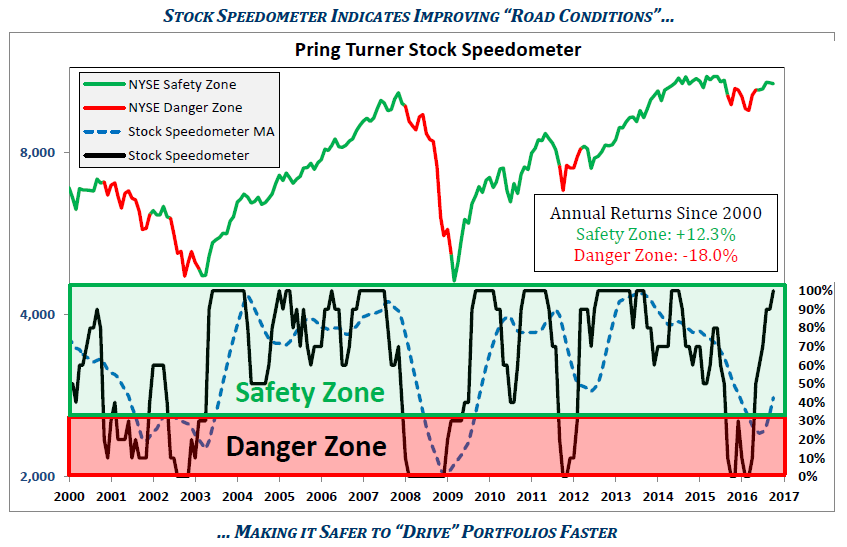

We understand and share your concerns. That is one reason why we created many layers of risk management in the investment process to safeguard you from challenging markets. One risk management tool we utilize is our ‘Stock Speedometer’. This tool is designed to anticipate the primary environment of the stock market. To borrow a driving analogy, the Speedometer shows us at what speed we should drive your portfolio. The higher the Speedometer reading the higher stock market returns have been historically. The current Safety Zone reading is the major reason why we have been adding stocks to your investment portfolio. In fact, the Speedometer has steadily climbed since March and reached the maximum positive reading of 100 this month! Despite all the concerns and worrying headlines, the best course of action is to follow the disciplines and selectively add high quality companies to your investment portfolio.

6) What is your opinion of owning international stocks compared to U.S. investments?

Ever since the Great Recession and global financial crisis in 2008, U.S. investments have performed much better than the European and Asian markets. After a long period of outperformance, however, valuations have become skewed; the rest of the world is more attractive today on most measures of value. We like the current opportunities in the international arena and will continue to use our thorough screening process to seek high quality, value and income investments. In fact, we have been using this window of opportunity to gradually include solid, globally reaching companies with attractive valuations in your investment portfolios.

7) I am concerned that economic problems in China and Europe could ultimately drag down our economy. What actions will you take to protect our investment portfolio in the next downturn?

Our long time investment advisory clients know that we will take many action steps to protect investment portfolios during adverse economic times. The cornerstone of our conservative philosophy is managing risk to protect your portfolio during lengthy market declines. One cannot invest without experiencing an occasional bear market. In our 40 year history of investment advising, we have experienced more than a few adverse markets. We take the responsibility of protecting your valuable assets as our highest duty. So, when deteriorating economic evidence appears, we begin taking the offensive team off the field and bring on a tough defense. How do we play defense? The first and most important action step is meaningfully reducing your stock exposure and increasing the levels of cash and short term bonds. The next step is to insure your core stock positions are the highest quality, highest safety-rated and those with a sterling dividend record that only financially strong companies achieve. Playing good defense wins championships and protects your investment portfolio during tough times. In turn, these proactive actions make it much easier to compound wealth for you when the offense comes back on the field again.

Conclusion

Thank you for sharing your good questions and concerns with us. Our hope is that you take away the conviction that we have a methodical and disciplined decision making process that has been tested during numerous financial challenges. Our investment advisory team has been meeting these challenges since 1977, which, by the way, included numerous election year dramas! Through it all, your investment portfolios were protected during the worst of times and grew during the good times. It is truly rewarding for us as we reflect back on client relationships, some new and some that stretch back decades. Your financial peace of mind is the greatest of these rewards.

Thank you again for the opportunity to help you along your financial journey. We sincerely appreciate and enjoy working with each of you.

Special Announcements…

We are pleased to announce Jim Kopas, CFA is now a principal in the firm. His outstanding contributions the past seven years in investment management, technology, financial planning and office administration have helped us seamlessly grow and provide ever higher levels of service to you. Thank you Jim, for your contributions and dedication to taking us to the next level. Congratulations on your latest advance in a most rewarding career helping others secure their financial success.

… And Our Newest Investment Advisor (In Training)

DISCLOSURES:

Pring Turner Capital Group (“Investment Advisor”) is an investment advisor based in Walnut Creek, CA. The Investment Advisor invests on behalf of individuals, organizations, and other financial advisors that appreciate a conservative and active investment style that aims to deliver consistent results without taking undue risk. The key objective of the Advisor’s investment philosophy is to not lose big during major market declines, making it easier to compound wealth over the long run.

The Investment Advisor is registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Investment Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments.

In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Investment Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2016 Pring Turner Capital Group Walnut Creek, CA. All rights reserved.