The stock market continued its blistering rally off of the pandemic lows set in March 2020. Indeed, gains were achieved in the last five consecutive quarters—an extraordinary winning streak! In part, current stock prices reflect the improving business conditions we outlined in our January 2021 newsletter. The pent-up demand for goods and services, along with steady employment growth, should help sustain this economic recovery, especially as the reopening continues. However, as we enter the second half of the year, it is important to note that the business cycle is maturing. Historically, as the cycle matures, it lends to more stock market volatility and moderate gains. Next, we will elaborate on our tempered yet still positive views for the rest of 2021.

No doubt about it, this pandemic-related business cycle is like none other in modern history. The economy and corporate earnings dropped off of a cliff as the virus forced a suffocating lockdown. Now, with more than a year later and the help of unprecedented monetary and fiscal stimulus, the boom times have returned! Our observation is that the current business cycle recovery is in stark contrast to the last one coming out of the Great Recession of 2008-2009. The prior excruciatingly slow expansion stretched over many years and was hobbled by a badly damaged banking system. Conditions are different in this unique cycle. The banking system is strong and both fiscal and monetary policy are several orders of magnitude larger than witnessed during the Great Financial Crisis. In contrast with the last weak expansion, this one exploded out of the gates. Consumers flush with cash have ignited a widespread buying frenzy. Witness the remarkable surge in home and used-car prices as just two examples. This ebullient spending behavior is already stoking fears of higher inflation.

The question then becomes: Is this dynamic recovery sustainable? We believe so, but the consensus forecast is for the economy to grow at a slower rate as the rest of the year progresses. Case in point, recent economic data, for instance automobile, appliance, and home sales are already coming off the boil and reflect the easing rate of growth. Supply chain disruptions that created shortages in many raw industrial commodities (not to mention toilet paper!) are gradually resolving as global production ramps up. Key materials including copper, steel and lumber, are dropping in price after staging massive gains. The net effect is that current widespread inflation fears could be short-lived as the economic pace moderates.

Bottom line: The benefit of following the business cycle is that we are always looking forward to the next major turning point for financial markets. This disciplined strategy is one of the cornerstones to helping you reach your financial goals with peace of mind. For now, we see continued growth ahead, but at a diminishing rate. Despite the softening pace, we remain optimistic for additional portfolio gains in the second half of the year.

Financial Market Outlook

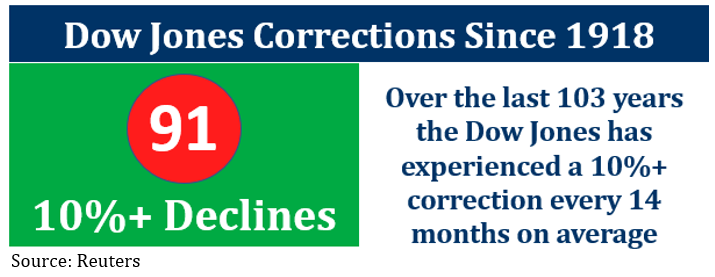

Truly, it has been an impressive stock market advance. While we believe the runaway bull market for stocks is not finished, it is perhaps getting tired. After an extraordinary rally, the market is entitled to take a short breather. Temporary stock market declines are a normal fact of life for investors. Since 1918, the Dow Jones Industrial Index has experienced 91 declines of 10% or more. In other words, the stock market has experienced a correction every 14 months on average. For reference, we have not experienced a 10% or greater decline since the pandemic lows 15 months ago.

Typically, periodic shorter-term declines within a bull market allow the stock market time to catch its breath. The market can then reenergize before stock prices ultimately reach new highs.

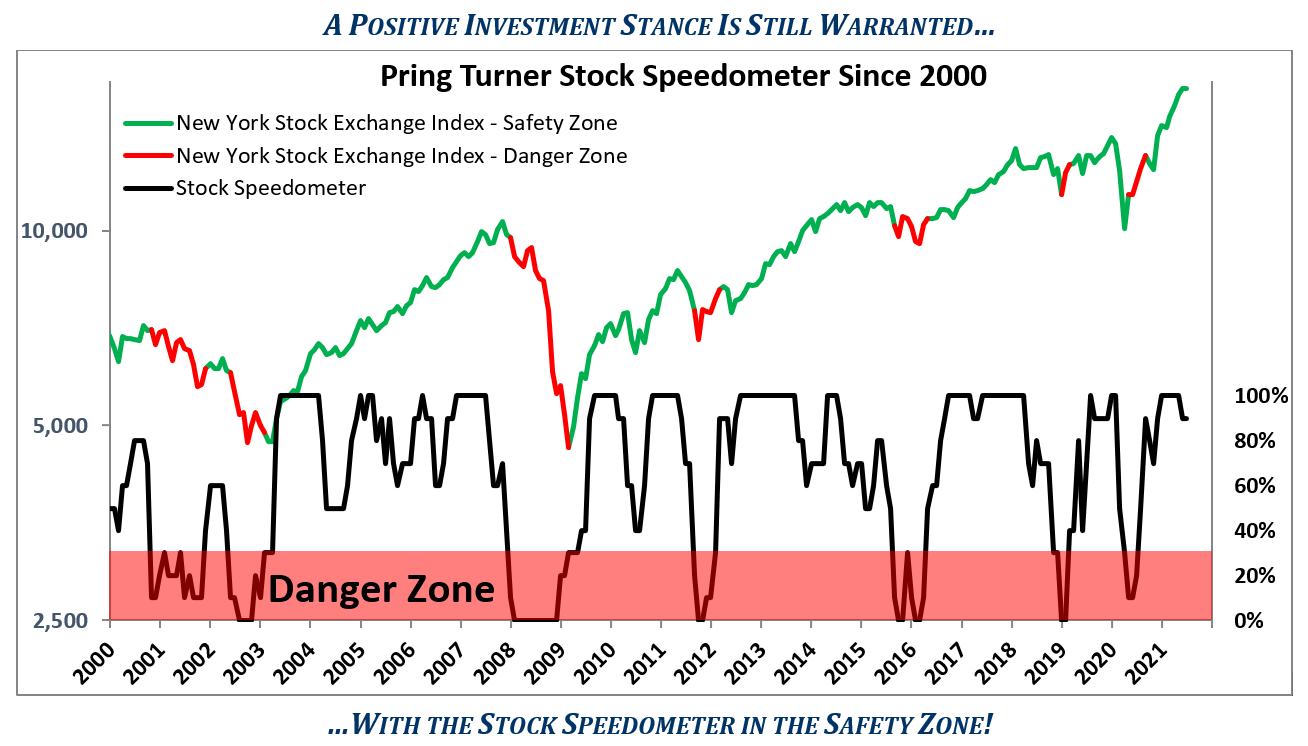

The good news is that our long-term stock market models are still signaling favorable investing conditions ahead. For example, our Stock Speedometer, remains comfortably in the “safety” zone. The favorable reading suggests higher prices ahead. This reading provides confidence that any temporary market setback will present us with a good opportunity to add above-average dividend yielding stocks to your portfolio. Our shopping list of potential investment additions includes many stocks that pay substantially higher income than a ten-year US Treasury note (currently ~1.3%). As an added bonus, quality stocks have the capacity for dividend increases each year to help beat inflation. Fixed rate treasury notes are guaranteed to pay the same low, flat income stream each year and that makes them vulnerable to the effects of inflation. The choice for long-term investors is obvious—the superior quality stocks held in your portfolio offer far better current income and growth prospects than treasury bonds.

Grateful, Yet Vigilant

As we pass the halfway mark of 2021, we are pleased with your portfolio performance given the lingering pandemic-related challenges still facing the markets. While grateful for past years of adding value to your wealth, we remain vigilant for any signs of a major turning point in the markets that would change our tactics from growing-to-protecting your portfolio. For now, we remain optimistic and plan to use any temporary market setback as an opportunity to add new promising investments to your portfolio. We look forward to the challenges and opportunities in the second half of 2021 and beyond!

We would like to take this opportunity to welcome all new clients to the Pring Turner family and we look forward to a successful relationship over many years. Thank you for the opportunity to help you achieve your financial goals with peace of mind! We value your confidence and will work hard to earn your trust each day. As always, please feel free to contact us should you have any questions regarding your portfolio or changes in your personal circumstances.

Did you like this article?

Footnotes:

Photo by Photoholgic on Unsplash