Congratulations! We are pleased to report 2021 was a strong year! In fact, stocks have now advanced over the last seven consecutive quarters! This year’s path was unusually steady with only short bouts of volatility, making the stock market journey to new all-time highs relatively smooth. Most likely, 2022 will see a return to a more normal and challenging financial environment for investors. You may learn more about those challenges, as well as opportunities, in our 2022 financial market outlook.

But first, we have a special announcement to make. In 2022, our investment advisory business celebrates its 45th anniversary! We are proud to have reached this major milestone and are fully aware that we couldn’t have done it without our wonderful client family. Thank you!

Honed over the last 45 years, our reliable and flexible investment strategy is based on paying careful attention to important business cycle shifts and uncovering investments offering a combination of high quality, good value and dependable income. Indeed, you may have noticed our new logo and tag line, which encapsulates our investment mindset: Quality. Stability. Confidence.

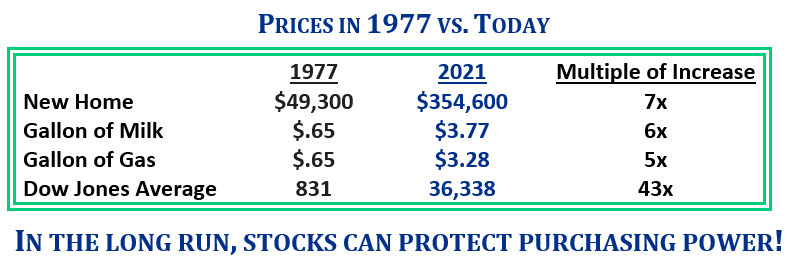

This careful approach has stood the test of time. Indeed, since our founding in 1977, many things have changed, especially prices! There is a lot of talk about inflation these days, but this is not a new problem. The table below compares the cost of a few common items in 1977 to today. The most important observation to highlight is that, over the long run, stocks have done a great job protecting and growing wealth despite the ravages of inflation. The danger of inflation is not new at Pring Turner and combatting it is a crucial part of our investment selection process. This is a big reason why your portfolio includes quality companies which possess stable and durable business models.

Source: thepeoplehistory.com

Financial Market Outlook

Economy

It is becoming increasingly evident that it is far easier to abruptly shut down the global economy than it is to open it all back up. Supply chain disruptions and the resultant low inventories of goods continue to be with us. Compounding the imbalance, consumers are still clamoring to buy goods, leading to the highest levels of inflation since the 1970’s. That piece of bad news has suddenly gotten the attention of the Federal Reserve.

In response to the startling inflation numbers, Federal Reserve chairman, Jay Powell, recently announced an accelerated schedule for the “tapering” of bond purchases. Tapering is the process of slowly reducing the amount of bond purchases by the central bank. Since the Covid crisis began, the Fed has been buying at least $120 billion of bonds each month, providing unprecedented support to the financial markets and economy. The purchases have helped to keep interest rates ultra-low but may have also contributed to the spike in inflation.

In further response to inflationary pressure, Chairman Powell expects to begin slowly raising short-term interest rates (from 0%!) this year. In simple terms, for the first time since the Covid crisis began, the Fed is taking steps to become less accommodative to the economy. We don’t expect these initial steps will have a big impact on the financial markets, but we are on alert for any adverse changes to our outlook. The good news is that leading economic indicators for the economy are still strong, an indication that growth will continue in the first half of this year, albeit at slower levels than last year.

Financial Markets

Considering the economy will still be on a growth path this year, we think the right strategy is to continue to emphasize high quality, dividend paying stocks in your portfolio. Value stocks (not growth) have outperformed as of late, reasserting their traditional long-term leadership role. As value investors, we are encouraged that the multi-year headwind facing the value style may be turning into a tailwind for you once again. Value sectors of the market include financial, industrial, basic materials, and energy, which are well represented in your investment portfolio. In addition, along with energy and real estate holdings, precious metal streaming companies (click to read) can act as an inflation beneficiary during the current inflationary part of the cycle.

On the other hand, with an inflationary backdrop and interest rates poised to move higher, bonds should continue to face headwinds. Our preferred strategy is to continue to own short-to-intermediate term bonds for better stability and use periods of bond market weakness to carefully add to your bond ladder. A bond ladder is a conservative strategy to manage bond investments (click to read). It can reduce some of the risk bond investors face from rising interest rates, while providing added income and stability to your investment portfolio. Bottom line: we believe there are several promising investment themes in your portfolio. Although there may be occasional downdrafts, the major trend continues to be upward, and we remain optimistic stocks will provide positive long term returns for you!

Conclusion

Each New Year brings its own set of unique challenges and opportunities. Our job is to navigate the path carefully so that you can participate in the market gains while reducing your downside risk. That is made easier with our disciplines, research, and the experience we bring to the decision-making process.

That said, your investment portfolio will likely be subject to surprises, shocks, and unwelcome crises during the next twelve months and beyond. But these temporary setbacks have always been and always will be part of the investing landscape. There is no return without some degree of risk. This is why we build so many layers of protection into your investment portfolio. So, when the next ‘unexpected’ crisis hits, may you be assured in knowing that we aim to invest in companies with, superior quality, greater safety, better value, and higher income than the ‘stock market’. Most importantly, every crisis creates opportunity that we look to capitalize on and take advantage of, while many other investors panic.

Good long-term investment results come from a disciplined and consistent process. When you add in a dose of patience, you substantially improve the odds of growing and protecting your wealth. We have used this formula successfully for many years and in differing financial, economic, and political climates. Now, in our 45th year working with many wonderful clients, we are proud to say that, over many challenging decades, we have delivered on our promise to both protect and grow your hard-earned wealth: Quality. Stability. Confidence.

One of the greatest privileges for us is to serve as stewards for your hard-earned money. Your trust and confidence inspire us to make the very best investment decisions we can for you. Thank you from the entire Pring Turner team.

Wishing You A Happy, Healthy and Prosperous New Year!