In ways that nobody could have imagined, 2020 has been a highly turbulent year and certainly one for the history books. The longest economic expansion in U.S. history ended early in the year and what followed was probably the shortest recession ever! After a short but sharp global pandemic-induced recession, the economy and financial markets bottomed out in the spring and continued to improve this past quarter. Massive fiscal and monetary stimulus helped reverse the damage from the partial economic shutdown, greasing the wheels of this nascent business cycle recovery. That said, as we enter the final stretch of the year, the focus remains on how quickly jobs and the economy can shift into high gear. On that front, we are increasingly optimistic and that is one reason we are selectively adding attractive high-quality investments to portfolios. In short, the second half of 2020 and our forecast for 2021 is shaping up to be much stronger and steadier than the first half of this year. Our reasons for an increasingly positive outlook are summarized below.

ANSWERING YOUR INVESTMENT QUESTIONS

There have been several client emails and calls expressing heightened concerns over current financial market gyrations and the future economic outlook; specifically, we have heard worries over the partial economic shutdown, massive job losses, election year and the pandemic overall. The Q&A format for this newsletter serves to answer some of your questions and keep you informed of our current thinking.

1) What effects will the election have on my investments?

“If you mix politics with your investment decisions, you’re making a big mistake.”

Yet again, we think it would be wise to heed another piece of advice from Mr. Buffett. No doubt, this election campaign has been particularly contentious with negativity thrown about on both sides, which can be disheartening for investors—election years increase the level of uncertainty about the direction of our country. That said, the longer-term direction of the economy is a more important consideration, while the election could cause short term volatility in the markets. Having managed client portfolios since the mid-1970’s and many election cycles, our observation is that the economy has far more influence on the election than the other way around. In addition, any president will have to work with Congress to change policies and allocate fiscal spending—for decades that has been a slow and torturous process. So, we would not expect the election of either candidate to have an immediate impact on the economy. In fact, based on our latest business cycle research, we are optimistic for the financial markets no matter who wins the election.

2) With so many lost jobs and closed businesses, can the recession be over already?

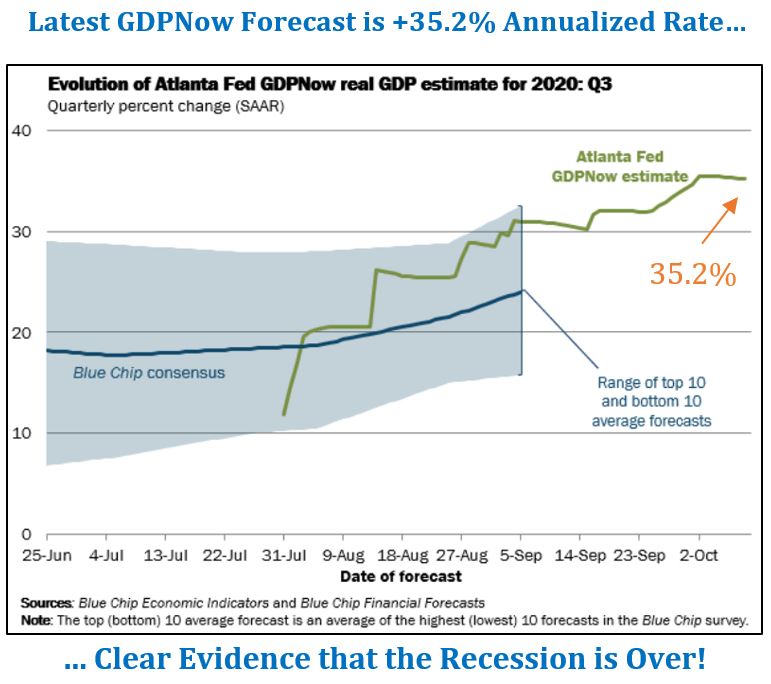

Yes, the sharp recession that began abruptly with an unprecedented partial economic shutdown has very likely ended almost as quickly as it arrived. Case in point: the latest GDPNow forecast, by the Federal Reserve Bank of Atlanta, is estimating a remarkable 35.2% annualized growth rate for the 3rd quarter! A new economic expansion has begun, but we have a long way to go to get back to the pre-pandemic record high employment numbers and broad-based growth we all enjoyed. More jobs will return as each State gradually reopens for business and a long-lasting expansion can take hold. Another encouraging sign is the rapid improvement in a multitude of leading economic indicators including new orders, retail sales, housing permits and the stock market itself. Lastly, the U.S. is not the only country showing economic improvement—in fact, a global industrial advance is underway. Altogether, these favorable points bode well for continued growth (no matter who wins the election) as we look forward to 2021!

3) In the face of an uncertain election and virus worries, you have been adding stocks to my investment portfolio. What is your thinking?

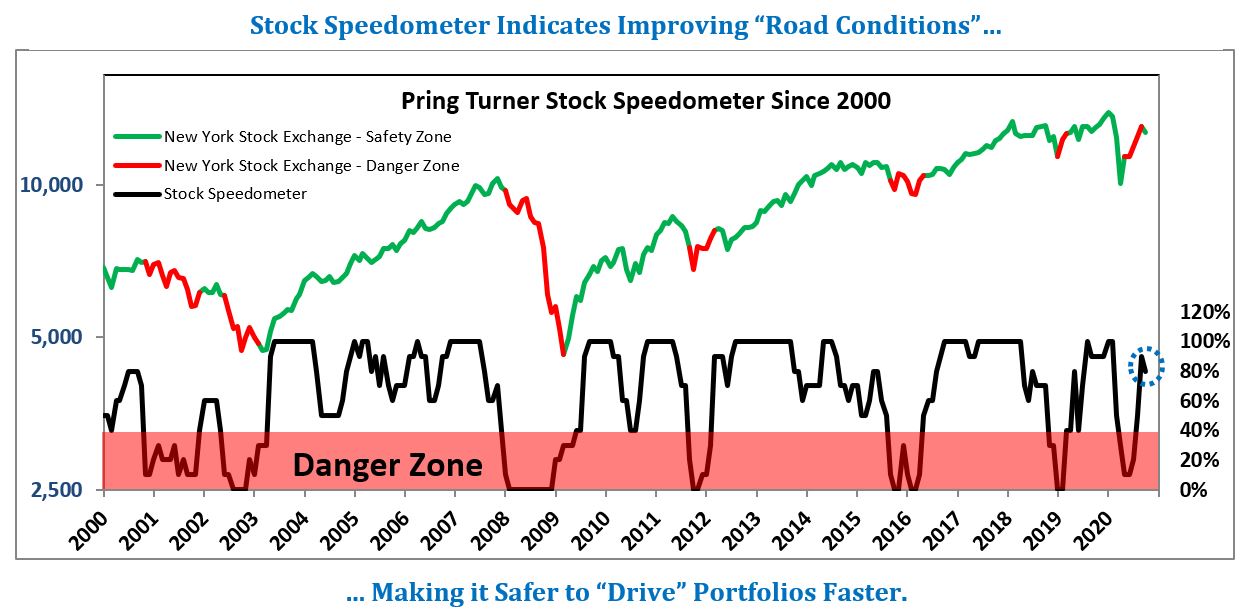

Indeed, the news headlines this year have been emotionally draining. That is one reason why we created many layers of risk management in the investment process to safeguard us all from the rollercoaster of emotions during challenging markets. One of several risk management tools we utilize is our ‘Stock Speedometer’, which has been featured in past newsletters including your last one. This tool is designed to reflect the primary environment of the stock market, whether favorable or unfavorable. To borrow a driving analogy, the Speedometer shows us at what speed we should drive your portfolio. The higher the Speedometer reading the higher stock market returns have been historically. The current Safety Zone reading is the major reason why we have been adding stocks to your investment portfolio. In fact, since our July newsletter, the Speedometer has steadily climbed out of the danger zone and reached the safety zone reading of 80 this month! Despite all the election concerns and worrying headlines, the best course of action is to follow the time-tested disciplines and selectively add high quality companies to your investment portfolio.

4) I’m retired. At my age, why does my investment portfolio have more stocks than bonds?

One consequence of the Federal Reserve’s stimulus program, aimed at fighting the sudden recession and boosting the economy, is the return of “ZIRP”—an acronym for Zero Interest Rate Policy. ZIRP is bad news for savers and bond investors, despite being a good policy for the overall economy. Historically, when bonds yielded more than stocks, they were considered a safer investment, but that is most definitely not true today with record low interest rates. Conventional wisdom has been turned upside down with interest rates near historic lows. In today’s low return world, in our opinion it makes sense to hold more stocks than bonds, regardless of age.

Moreover, the average stock in the S&P 500 has a 1.7% dividend yield, which is more than double the ten-year U.S. Treasury bond of ~0.8%. By comparison, we recently purchased some high quality stocks paying, more than 4 times the amount of income from U.S. Treasury bonds. Add in the potential for consistent dividend increases, it becomes even more apparent as to why we believe high quality stocks are more attractive than low yielding fixed rate bonds today. Whether stocks go up or down over the short-term, it is comforting to know that dividends provide a solid foundation to your portfolio with dependable and growing income streams. Yes, stocks will be more volatile than bonds and dividends are not guaranteed but, historically, stocks with the highest quality rankings tend to raise dividends regularly and decline far less during significant market declines. This is another key reason why we emphasize high quality stocks in your investment portfolio.

5) Considering the Shelter-in-Place rules and California wildfires, has your office re-opened yet?

First, thanks to all of you from across the country who shared concerns for our safety in California. Yes, the wildfires are serious and now we have a second reason to shelter-in-place, namely, to avoid the smoke-filled air! Thankfully, we are all safe and this wildfire season seems to be winding down.

Our office has yet to re-open, but we are making plans to do so very soon. You can look for our announcement with complete re-opening date details shortly. We miss seeing you and it will be great to see many of you at our Walnut Creek office once again. That said, once we re-open, there will be new protocols in place such as appointment-only meetings, one client family in the office at a time, sanitation stations, and mask wearing. In the meantime, we are completely functional as we work from home. Please feel to contact us by phone or email, at any time, should you have any questions or need help in any way.

Summary

For the reasons outlined in our Q&A discussion, we hope you can understand why we are becoming increasingly optimistic, despite the multitude of uncertainties. In today’s low interest rate world, investors, especially retirees, face significant challenges in meeting their long-term retirement goals, but challenges are nothing new for us. Since 1977, our pro-active investment advisory firm and client family have faced numerous difficult conditions including inflation, deflation, wars, recessions, the dot-com crash, real estate bubbles, global banking crisis and now a global pandemic. Despite the many challenges over multiple decades, our conservative investment process, designed to keep you a step ahead, has delivered steady growth while reducing market risk. Our overriding goal will always be to help you reach your financial goals with peace of mind.

Thank you for your trust and confidence, and the opportunity to help you. As always, please feel free to contact us should your circumstances change or if you have any questions.

Did you like this article?

Footnotes:

Photo by Markus Winkler on Unsplash