After a robust upswing for stocks in the first quarter, the second quarter gave back much of those gains. Temporary defensive portfolio tactics helped you avoid much of the decline the past three months. Mounting levels of global uncertainty once again weighed on investors. The ongoing European financial crisis, Asian economic growth slowdown, political year uncertainties, an oncoming year-end fiscal cliff, sagging consumer confidence and a weakening U.S. economy all added to investor insecurities and pressured stock prices. The question is, does the news get worse or has the market over-reacted and contrarily is it now positioned to climb the proverbial “wall of worry?”

Our view is the stock market is poised to move higher and enjoy a stronger second half of the year. While acknowledging the array of issues weighing down investor expectations, there are also some veiled or unrecognized positives not factored in the marketplace. When we balance the facts we conclude the stock market has more upside potential than downside risk. Let’s review the known concerns and also express some potentially positive outcomes.

The Wall

European Financial Crisis

Eurozone leaders recently held their 17th (or is it 18th?) summit meeting to deal with their badly damaged banking system and sovereign debt problems. This extended messy attempt to deal with budget deficits, bank capital deficiencies, rising government debt burdens and habitual overspending has tortured investors off and on for the past two years. During that time, political and monetary leaders struggled to come up with a meaningful way to acknowledge large losses at the major European banks. The massive losses stem mostly from investments in now questionable sovereign debt issues—namely from the “PIIGS” countries, Portugal, Italy, Ireland, Greece, and Spain. Recent agreement on a plan to bolster the banks with fresh capital from Eurozone governments (bailouts) to improve bank balance sheets and write off the bad debt mirrors actions the United States took to stabilize our banking system in 2008-09. Markets reacted very favorably (once again) to this positive step toward stabilizing the badly wounded European banking system. This is one worry being shuffled to the back burner at least for the time being.

Fiscal Cliff

The term fiscal cliff refers to the combination of significant tax increases, medical cost hikes and mandated federal budget spending cuts scheduled to take effect at yearend 2012. Economists fear the result will be sharply lower economic growth which raises the probability of a new recession in 2013. The looming fiscal cliff is another legitimate concern facing investors today, but we would argue much of its effect is already substantially priced into the markets. Our expectation is congressional leaders will not want to go through another politically damaging financial stalemate like last summer. Look for some action before year-end to head off the fiscal cliff issue and relieve investor fears. Any progress defusing the fiscal cliff time bomb may very well be a messy political circus, but could remove another layer of uncertainty and lead to higher stocks prices.

Consumer Sentiment

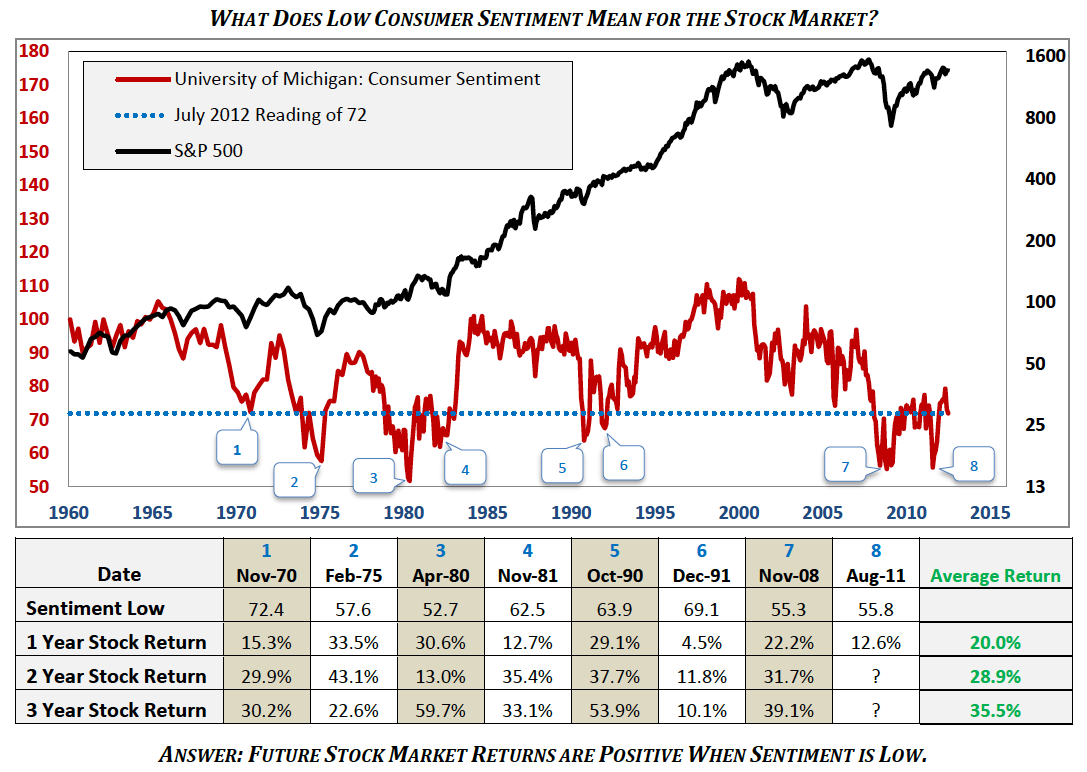

The most significant consequence of the “Great Recession” and subsequent anemic economic recovery is the U.S. consumer is left with a particularly jaundiced view of the world. One important measure, the University of Michigan: Consumer Sentiment Index (July 2012 reading of 72), is sagging relatively close to a 50-year low due in part to the above-mentioned economic and other current geopolitical worries. Consumers have a bleak outlook for their economic well-being, but we would argue (counter-intuitively) this can be a positive for stock prices. Historical studies demonstrate low confidence readings are actually a long term positive for future stock market returns. Our table illustrates low confidence tracks favorably for future investment profits. There is an old Wall Street saying the best returns come when the stock market climbs a wall of worry.

And… What Could Possibly Go Right?

Amidst all the worries, what are some potentially positive surprises?

- Energy prices continue to moderate, putting more spending money in consumer pockets, reducing corporate operating costs and boosting economic growth.

- U.S. economic data such as auto sales, business loans and employment continue modest improvement. New home construction and sales, spurred on by record low interest rates, meaningfully contribute to growth.

- Emerging market countries (China, India, Latin America, etc.) take stronger actions to stimulate economic growth in their own countries thereby spearheading renewed global growth.

- Stabilized and improving home values add to the positive “wealth effect” for U.S. households for the first time in five years. This is the most unexpected and welcomed economic surprise.

Bottom line, the best investment opportunities for investors happen when confusion and worry are the greatest. Investors can have either worries and low stock prices or good news and high stock prices, but not good news and low stock prices. We believe today is an opportunity for patient and conservative investors. So much negative news is already factored into today’s stock market that anything less bad will result in a continued dynamic up move.

Shifting to Offense

Last quarter’s newsletter expressed our expectation for stocks to consolidate the first quarter’s advance and pull back in prices during the second quarter. Weakness did indeed take place and concurrently more quality values surfaced. We are now shifting tactics due to our more positive view. The game plan is to methodically add attractive growth and income investments into your portfolio. Our goal is to position your portfolio to take advantage of the anticipated up move. Pring Turner holds high expectations to see your wealth reach new benchmark levels in the second half of 2012 as the stock market climbs this wall of worry.

Special Delivery!

Be on the lookout for a package to arrive in the mail for your summer reading enjoyment. Our newly released book Investing in the Second Lost Decade will be mailed before month-end. The book details our long-term market outlook and the survival tactics necessary to successfully navigate another lost decade. We are especially pleased to have the book reviewed in the New York Times business section. The investment philosophy, methodology and decision-making process described are the same that have brought you successfully and profitably through the last lost decade. We appreciate your loyalty and we look forward to do even better for you in the next decade. Thank you.

DISCLOSURES: Pring Turner Capital Group (“Advisor”) is an investment adviser registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2014 Pring Turner Capital Group. All rights reserved.