Summary

- Our typical portfolio was well positioned and, despite the many challenges, performed nicely with attractive returns.

- We take comfort in relying on time tested market models, or barometers, to smooth the ride through these challenging periods.

- You can sleep easier knowing the higher quality levels in your portfolio are structured to withstand challenging markets.

- We appreciate your trust and giving us the vital responsibility of taking the day to day financial decision-making burden off of your shoulders.

The first half of 2016 unsettled investors with many surprising cross-currents that posed difficult challenges, challenges we expect to define the year. In fact, the first week of January erupted with the U.S. stock market’s worst start ever followed by the world experiencing its worst single-day market swoon during the last week of June. However, despite wide volatility, the S&P 500 stock index ended up barely 2% for the first half year. Bond yields dropped to historic lows, strengthening bond prices in your portfolio. Remarkably, over 30% of the world’s government bonds now offer investors negative yields, which no investor in history has ever experienced! Finally, gold had its best quarterly performance in 30 years, leading a strong rebound in inflation sensitive assets like energy and industrial commodities. We are pleased to report our typical portfolio was well positioned and, despite the many challenges, performed nicely with attractive returns. Most importantly, your returns were generated while taking less than half the market risk.

Latest Concerns

Investors start the second half of 2016 still facing an uncertain outcome of Britain’s withdrawal from the European Union (EU), commonly referred to as “Brexit”. Brexit has the potential to be a catalyst for either positive EU reforms, or it could continue to destabilize global financial markets. Our initial thoughts are that the surprising election results led to a sharp short term over-reaction in the financial markets which has since recovered rather quickly. Only time will tell the full consequences of this controversial vote. We are concerned with possible competitive currency devaluations (currency wars) in the longer term as countries attempt to cheapen their currencies in order to capture a bigger slice of the economic pie. A spiraling currency war is a big threat to global economic and trade growth, and one we will keep a close eye on. One possible side effect is this may well be the fundamental reason gold has awakened from its long slumber and appreciated strongly so far this year.

Challenges and Opportunities for Investors

This new challenge, along with others we noted in our January client newsletter, exposes financial markets to the potential for great price swings. This type of environment will be trying on investors’ resolve and patience. Successful outcomes will require a disciplined and nimble decision making process to protect and grow one’s capital as markets adjust to new realities and challenges. At Pring Turner, we take comfort in relying on time tested market models, or barometers, to smooth the ride through these challenging periods.

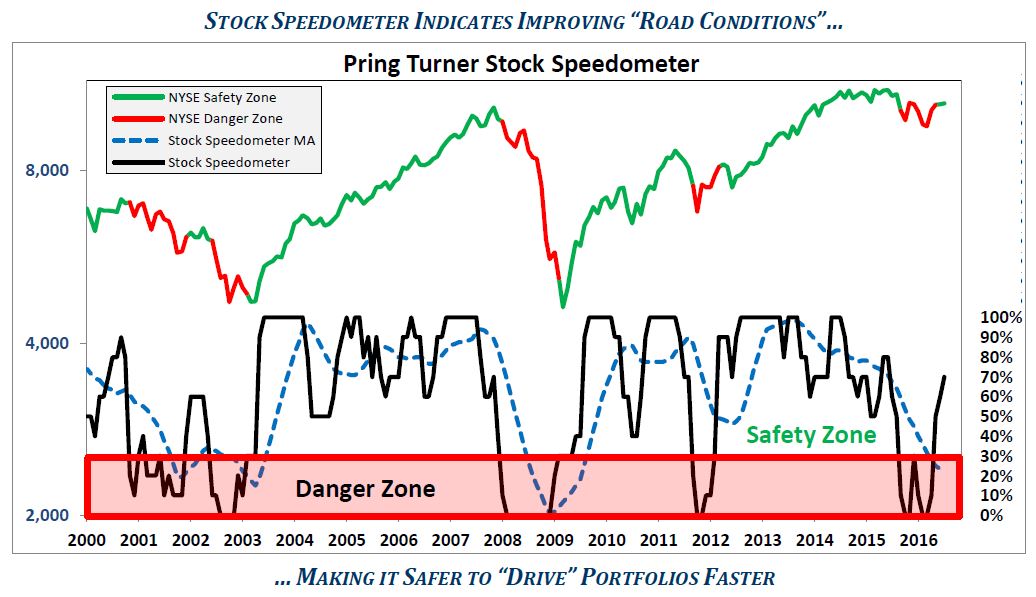

For example, we are seeing steady improvement in our Stock Speedometer that we introduced to you last quarter. The latest reading has moved this long term indicator out of the “danger zone” and into the “safety zone”, signaling a more favorable backdrop for stock prices. The latest readings give us confidence to continue adding positions to your portfolio gradually, in spite of the Brexit turmoil.

Additionally, over the past month, our Inflation Barometer flashed a ‘buy’ for the first time since 2014. This signals an improving environment for industrial, natural resource and other inflation sensitive beneficiaries. Countries that are rich in natural resources also tend to do well when the Inflation Barometer reaches a positive level, opening up additional investment opportunities to choose from.

Let us briefly highlight the international investment theme that we are gradually expanding in portfolios. Since the 2008 global financial crisis, the U.S. stock market has far surpassed the rest of the world in rewarding shareholders. In the process, while the U.S. market outperformed, international markets lagged considerably behind. After seven long years of underperformance by foreign markets, the valuation differences have turned significantly more attractive for international stocks. Valuation measures such as price compared to earnings, book value, dividend yield and other fundamental metrics, now favor many foreign equities over domestic companies. We search continuously for high quality, dividend paying stocks showing good value from anywhere around the world. As we established last quarter with our long term value vs. growth chart, we expect superior performance from value type investments and these are increasingly found beyond U.S. boundaries.

Pring Turner’s Core Philosophy

As a conservative investment management firm, we have always built many layers of risk protection into your portfolio, including our key components of quality, value and income. One criterion to assure your portfolio has the highest quality levels is to integrate ValueLine’s Safety Ranking into our decision-making process. ValueLine, founded in 1931, is a highly regarded independent investment research publishing firm. Their ranking system compares and combines balance sheet, financial strength and price stability to arrive at a safety ranking. Ranks of 1 and 2 are the highest quality and safety levels. Rankings of 3 are average, while safety rankings of 4 or 5 are below average for quality and safety. As shown in the table below, historically the stocks with the highest quality rankings go down much less during significant stock market declines. We remain diligent in our efforts to emphasize the top safety rankings for you. You can sleep easier knowing the higher quality levels in your portfolio are structured to withstand challenging markets, allowing your portfolio to both generate consistent income and recover from market declines more easily. This is just one more example of how we build a portfolio with safety in mind. By the way, like you, we also like to sleep well at night!

Our core safety first philosophy drives the careful application of our decision-making process, with the key being mitigating risk at every decision point. Your portfolio is well diversified with quality securities so as to generate competitive returns with a low degree of risk. It is gratifying to know how well this has worked over the past six to twelve turbulent months and indeed over the long running 40 year history of managing our client’s wealth. Of course, no investment strategy works all of the time, every quarter or even every year. But Pring Turner’s long term performance record demonstrates our philosophy and decision-making practices do an enviable job of protecting and growing your valuable assets.

We appreciate your trust and giving us the vital responsibility of taking the day to day financial decision-making burden off of your shoulders. Please contact us if you have questions or wish to discuss any changes in your personal financial circumstances. Thank you from the entire Pring Turner team.

DISCLOSURES: Pring Turner Capital Group (“Advisor”) is an investment adviser registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2016 Pring Turner Capital Group. All rights reserved.