If you have ever gone to the beach or played in a pool and pushed a beach ball under water, you can appreciate how we associate current stock market conditions with that beach ball. When the ball is pushed under water, pressure begins to build. The farther under water the ball descends, the greater the pressure. The greater the pressure, the faster the ball shoots back up to the surface. Today we believe the stock market beach ball has been pushed down near the very bottom of the pool’s deep end and anticipate a snap back rally for the stock market.

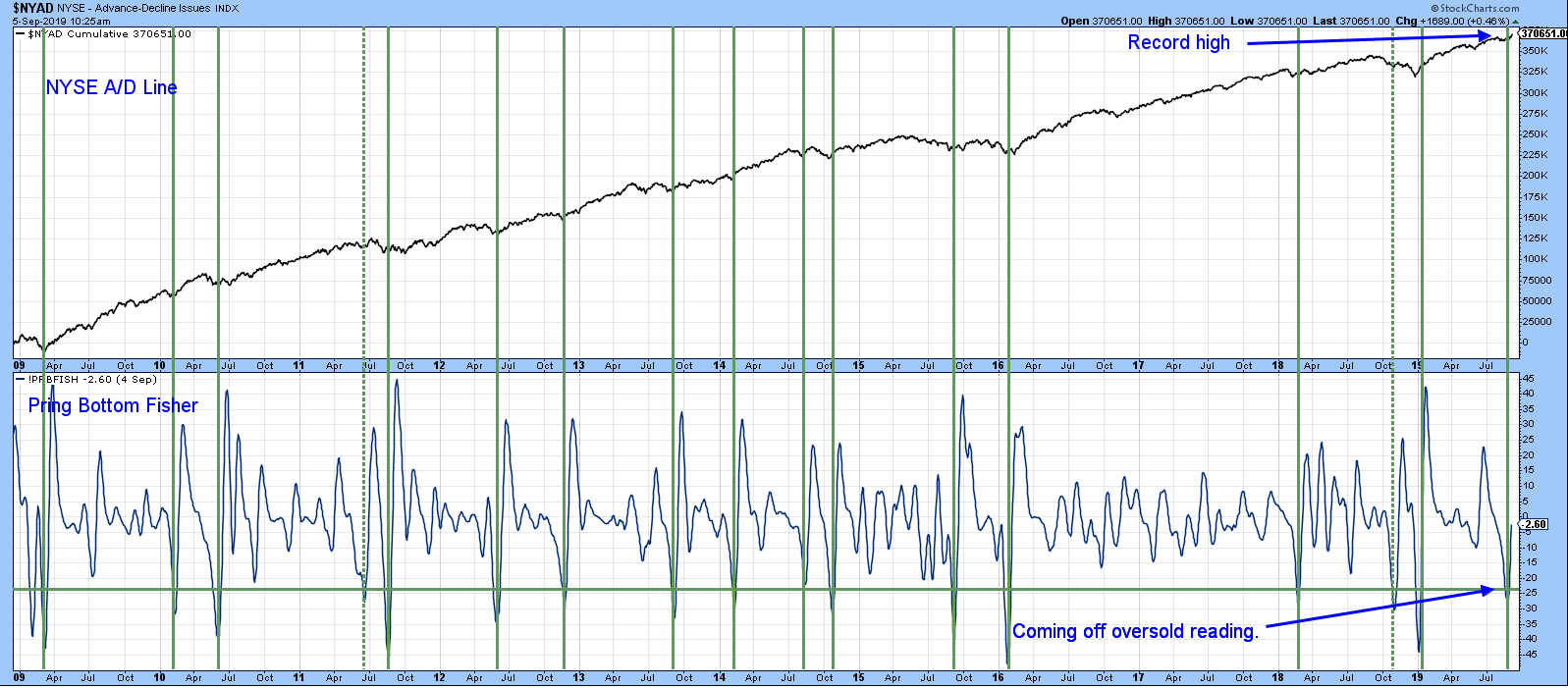

NYSE A/D Line is at an all-time high.

Sources: StockCharts.com, Pring Research

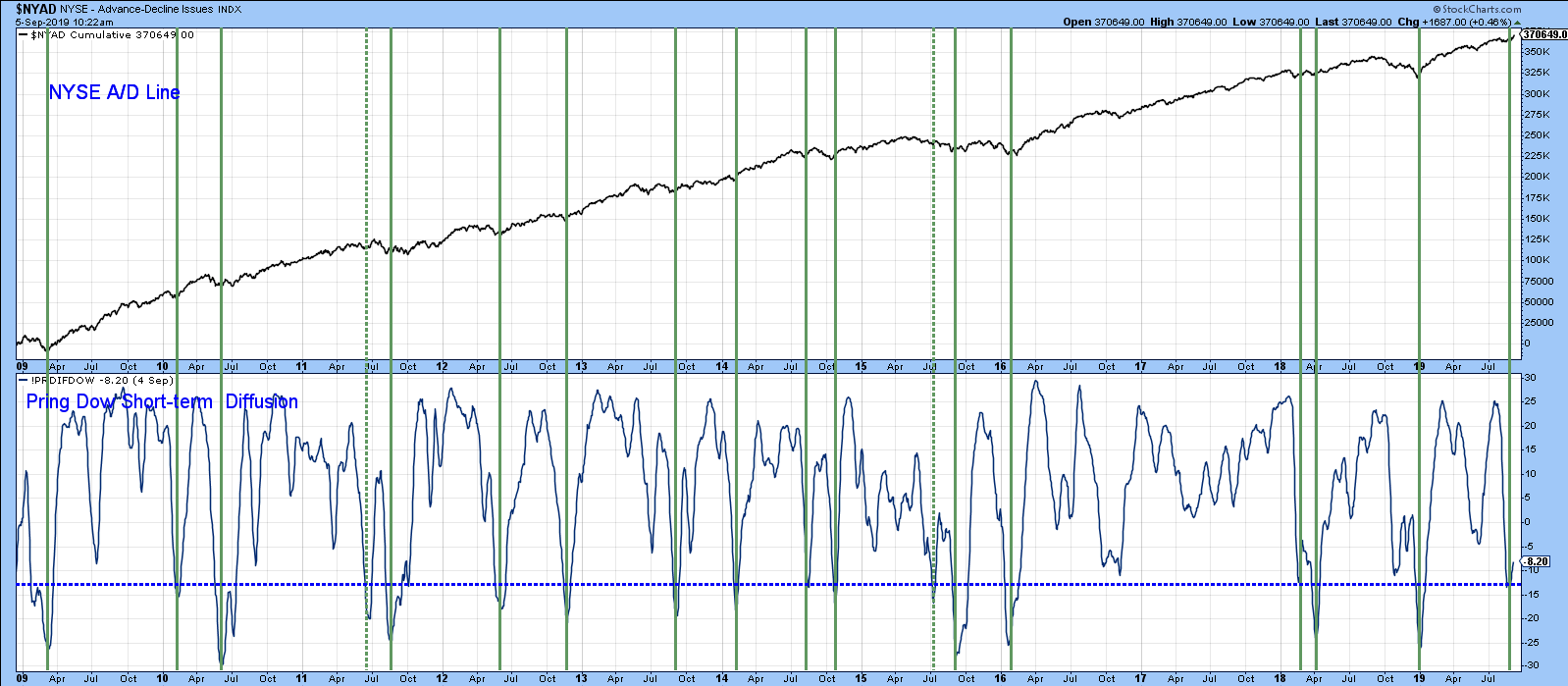

These two charts show that the market is coming off an oversold condition but the NYSE A/D Line is at an all-time high. That is an extremely unusual situation as the green vertical lines show that the A/D line has usually corrected by the time these momentum series have bottomed. The reason probably lies in the fact that rates across the board have been falling dramatically and this has positively affected the plethora of interest sensitive NYSE listed stocks. Falling rates are rocket fuel for equities because they stimulate the economy. For an explanation of the Bottom Fisher go here and for the Pring Diffusion go here.

Sources: StockCharts.com, Pring Research

Photo by Raphaël Biscaldi on Unsplash

Disclaimer: Pring Turner is a Financial Advisor headquartered in Walnut Creek CA, and is registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. The views represented herein are Pring Turner’s own and all information is obtained from sources believed to be accurate and reliable. This information should not be considered a solicitation or offer to provide any service in any jurisdiction where it would be unlawful to do so. The views expressed herein represent the opinions of Martin Pring, and are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. Neither the Investment Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein.