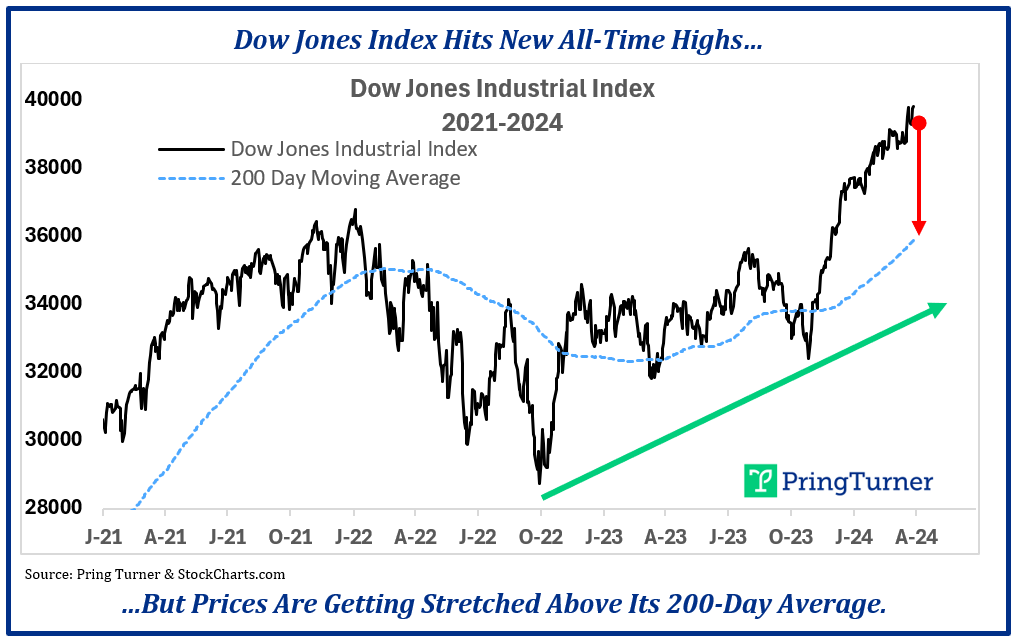

The new year is off to a fine start with stock prices continuing to rally and once again reaching new all-time highs. As we suggested in our winter newsletter, broadening participation within the stock market would be a welcome sign. Indeed, our wish came true this quarter with strong gains within the healthcare, industrial, financial, technology and energy sectors. On the other hand, utilities, and REITS (Real Estate Investment Trust Funds) lagged behind, as interest rates moved higher and bond prices eased. Overall, we are pleased to report back-to-back strong gains for the major stock market indexes these recent two quarters. Spring may have arrived early for investors, and we are not complaining!

However, the rally may have moved a bit too far, too fast, and is perhaps getting tired. After five consecutive months of gains, the stock market is entitled to take a short breather. To be clear, our advice is to remain positive. Despite our short-term concerns, we still believe the cyclical bull market for stocks has more room to run to the upside.

While the major stock market indexes, like the Dow Jones Industrial average displayed in the chart, are hitting new all-time highs, they are getting quite stretched above their 200-day moving average. The Dow Jones index average price over the last 200 days is represented as the smooth blue line on the chart. The current price of the index is significantly higher than the average price, which signals that a temporary market pullback is possible. In our view, recent readings of investor sentiment and psychology point to an excessive amount of greed: another good reason to tread more cautiously.

Portfolio Stability From Income

Keeping in mind that our overall mission is to both grow and protect your wealth, it makes sense to prepare for a possible, though temporary, market decline. Tactically, we are using recent stock market strength to harvest some handsome profits. Any proceeds will be added to your U.S. Treasury Money Market Fund balances that are currently earning approximately 5%. Steady income from your investments and extra cash balances serves as a stabilizing cushion for your investment portfolio.

Quality dividend income acts as a shock absorber when markets drop. While stock prices may experience fluctuations, a steady stream of dividends acts as a cushion, dampening the impact of occasional market downturns. This stability not only helps you navigate choppy waters with greater confidence, but also mitigates some of the emotional toll of market volatility. Pro-active risk management tactics, like harvesting gains and temporarily raising cash balances, are designed to bring you a more serene investment experience.

An Industrial Renaissance

A long-term investment theme that we would like to highlight is the ongoing re-industrialization of the U.S. The Covid-19 pandemic and resultant supply chain failure made clear that our country was overly dependent on the rest of the world for critical goods and services. Indeed, politicians from both sides of the aisle agreed on how this was a threat to our national security and therefore passed legislation to bolster domestic investment. From medicine, steel, aerospace, semiconductor, machinery and many other industries, the trend towards bringing back production and jobs to the U.S. is already underway. Modernizing and expanding our country’s dated infrastructure is a massive project that could boost economic growth for many years to come.

Your portfolio is well positioned to take advantage of this critical investment theme. Our job is to continually be on the prowl for new quality investment ideas in our effort to consistently add value to your portfolio. This is what makes our job so challenging, interesting, and thoroughly enjoyable. Most importantly, we are especially pleased to make it financially rewarding for you!

Summary

After an impressive rally, stock prices are a bit stretched to the upside. That leaves little room for error and helps explain why we decided to lock in some profits in your portfolio recently. Importantly, our Advanced Investment Barometer™ is still safely in growth mode – after taking a short breather we expect the cyclical bull market to reassert itself. Notably, any temporary correction in stock prices can present opportunities to replant new investments in your portfolio.

We are excited for the opportunities that lie ahead! On behalf of all of us at Pring Turner, thank you for being the reason for our shared success. As always, please feel free to contact us should you have any questions, or if your circumstances should change.