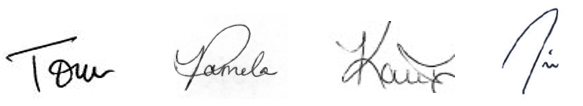

In 2023, stock prices started in rally mode and then suffered through a sharp mid-year correction. But the last quarter of the year was an absolute barnburner, with the venerable Dow Jones Industrial Index powering to all-time highs! Better yet, with the long-term momentum for stocks now turning up, we expect more upside for stocks in 2024.

A Look Back

In many respects, 2023 turned out to be the year that wasn’t. For the second year in a row, there wasn’t a recession, despite many on Wall Street promising one. There wasn’t a widespread banking crisis, despite the Silicon Valley bank failure (among others) in March. There wasn’t a spike in the unemployment rate, despite the Federal Reserve’s continued sharp interest rates increases. Likewise, there wasn’t an implosion in the housing market, despite sharply higher mortgage rates. Despite all the challenges, it appears that the Fed was able to bring inflation down from the highest levels in more than forty years without causing a recession. Against all odds and many “expert” opinions, the Fed may be able to take credit for engineering an economic “soft landing”.

An economic soft landing, or mid-cycle slowdown, is a desirable result because it allowed the past few years of raging inflation to ease without enduring a full-blown recession. This should not be surprising news to you as we suggested that outcome in our Summer Client Event presentation as well as in Martin’s February research piece, A Funny Thing Happened on the Way to the Recession. In each publication, we presented hopeful evidence of ongoing growth, contrary to the popular pessimistic opinions. By staying disciplined and patient through the volatile months, your portfolio was able to finish the year on a high note.

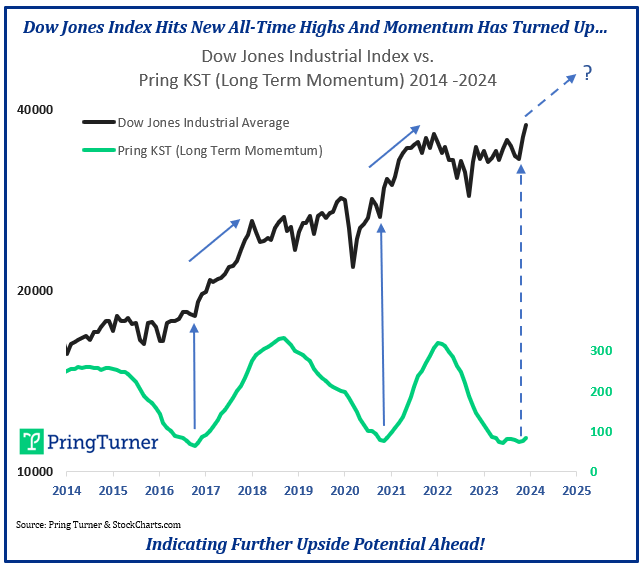

While positive stock market returns are welcome news, it is important to note that it was a particularly uneven year. As the chart shows, there was an unusually large discrepancy in returns between the average stock in the S&P 500 and the “Magnificent 7” heavyweight technology stocks*. On average, they surged by 111% in 2023, while the remaining 493 stocks in the index experienced a modest increase of just over 12%. In fact, those seven now constitute 28% of the entire index.

Put another way, the capitalization-weighted S&P 500 index is not as widely diversified as most investors would imagine. In 2023, being properly diversified hindered the performance of conservatively managed stock portfolios. We highlighted this atypical condition in our July client newsletter and suggested the rest of the market could play some catch up with the largest companies: “Our view is that it is likely the broader market will join the party and help propel the overall market and your portfolio higher.” Indeed, the strong rally into year-end took most stocks with it, and we expect this healthier trend to endure.

2024 Investment Outlook

The main catalyst for our continued positive outlook for the financial markets is clear: interest rates and inflation have fallen sharply. Stock and bond prices are rallying in anticipation of the Federal Reserve shifting to an easier monetary policy throughout 2024. At the same time, the economy has been remarkably resilient and corporate earnings are set to grow measurably. Some might call it a “Goldilocks Economy”, not too hot or too cold, but just right!

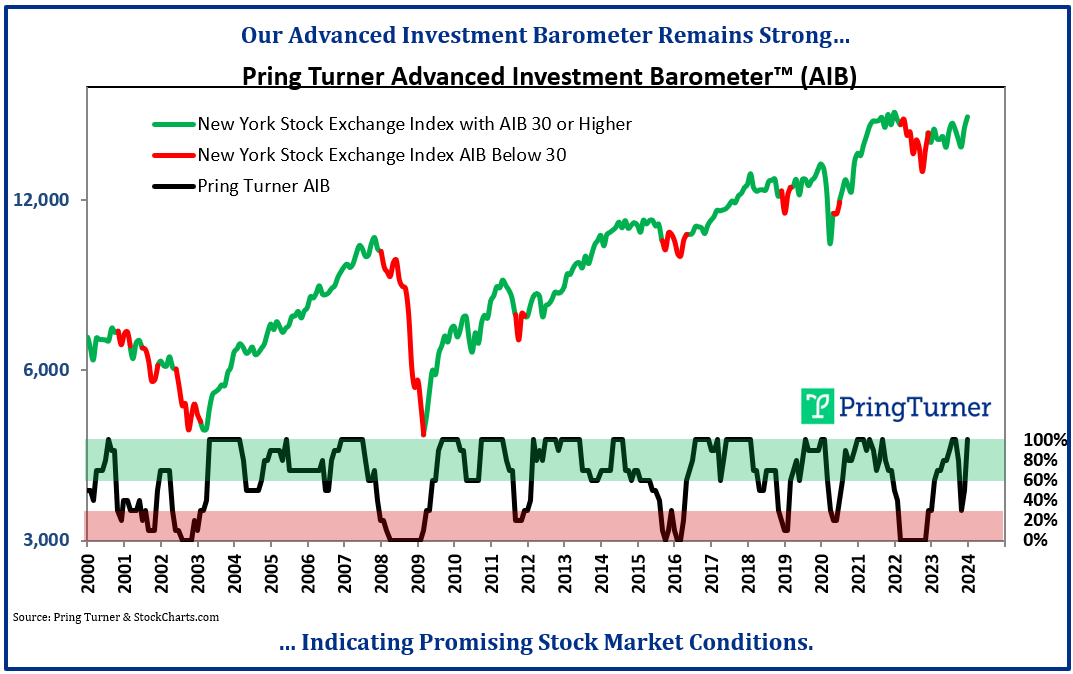

As we start the new year, our proprietary Advanced Investment Barometer remains in a positive mode, indicating further upside in the stock market. An extension to the current business cycle upswing allows for plenty of opportunities outside of the “Magnificent 7”. We are excited to find attractive, high-quality, value stocks within the “other 493” components of the S&P 500. Broadening participation within the market is evidenced by surging performance from the interest rate sensitive sectors including banks, financials, utilities, and REITS (real estate investment trusts). Also, the industrial and precious metals sectors have recently joined the party. These sectors are all well represented in your diversified portfolio.

Diversification amongst asset classes (such as stocks, bonds, REITS, international, etc.) is another layer of risk management for prudently managed portfolios like yours. For instance, stocks should perform well when the economy is growing, but bonds typically perform better during economic downturns. Proactively spreading and adjusting investment dollars across various asset classes is an important part of our career-long mission to both protect and grow your precious wealth. Our approach may not possess the jazzy and often fleeting appeal of concentrated positions in the latest speculative craze like the “Magnificent 7”. In contrast, we have long believed in the hare and the tortoise fable, where slow and steady wins the race!

All in all, 2024 is shaping up as a favorable environment for quality, income-producing stocks that are the foundation to your portfolio. To be sure, any move higher for the markets will likely include temporary setbacks and corrections along the way. But with our long-term oriented Advanced Investment Barometer in growth mode, any near-term market weakness will present opportunities to selectively add to your portfolio positions.

Lastly, we would like to take this opportunity to share our appreciation for our many wonderful clients like you who have the patience, perseverance, and loyalty to stick with our conservative investment strategy through the inevitable ups and downs of investing. We value your confidence and will work hard to continue to earn your trust each day. As always, please feel free to contact us should your circumstances change or if you have any questions.

Here is a toast to a Happy, Healthy, and Prosperous 2024!