Survivor is the title of an ever-popular reality television series, where a group of contestants are stranded in a remote location with little more than the clothes on their back. They compete in a variety of challenges for thirty-nine days until the individual that outlasts the competition is crowned as the Survivor.

In the first half of 2022, the financial markets put investors through a Survivor—worthy challenge, as the S&P 500 index declined -20.6% (even worse, the Nasdaq dropped -29.5%!). After a strong 2021, your portfolio was not immune to this year’s market weakness. The good news is that your portfolio held up much better than the major stock market benchmarks would indicate. You survived one the worst starts to a year since 1970! Challenging periods like this remind us why we embrace a conservative, pro-active investment strategy for you. The emphasis on Quality, Value, and Income has stood the test of time to bring solid long-term returns while taking less risk. We are confident this will continue to be true throughout the current demanding environment and beyond.

In discussions with clients, several common questions and concerns have come up. We would like to take this opportunity to use a question-and-answer format to address some of your foremost concerns.

Q: What’s causing all this market volatility?

The first half of this year delivered a perfect storm of challenges that created a lot of uncertainty for investors. The highest inflation rate in decades is taking a big bite out of consumer pocketbooks. All of us are reminded of this fact each time we fill up the gas tank or go to the grocery store. Continued supply chain issues, along with Putin’s invasion of Ukraine, exacerbated the inflation problem. In response, the Federal Reserve started getting serious about curbing inflation by ratcheting up interest rates. The fear is that ever tighter monetary policy, along with the end of government stimulus checks, will lead to a recession. These factors led to the stock and bond markets each suffering their worst start to a year in many decades. No wonder consumer sentiment is at pessimistic lows.

Q: How are we doing in this decline?

Your portfolio is not “the market”, as we have emphasized in the past. You own a diversified and select group of high-quality stocks that offer good value and dependable dividend income streams. In the last year, we took incremental steps to reduce your portfolio’s volatility. Some profits were taken in 2021 and new investments were targeted in the more recession-resistant sectors, namely consumer staples, and electric, gas and phone utilities. As interest rates rose this year, we added to your U.S. Treasury Note ladder; opportunistically, this locked in some of the most attractive yields in years and adds income and stability to your portfolio. Overall and as expected, your portfolio is holding up much better than “the market”. We fully expect your portfolio to recover lost ground early in the next sustained market upturn, which always follows the difficult periods.

In contrast, those who have been overly concentrated in the most speculative areas of the stock market have felt the most pain. Many glamorous, yet unprofitable technology stocks of all sizes are down 50- 90% from recent all-time highs! Speculation was most evident in Bitcoin, the largest cryptocurrency, which has declined almost -75% from its high late last year. In our April 2021 newsletter, we warned that these pockets of speculation would likely end in disappointment for a new generation of undisciplined speculators chasing “easy profits”. It is better to be an investor, not a speculator!

Q: What is the outlook for the rest of 2022?

As far as the economy is concerned, it is slowing down but we maintain the economy is not in a recession… yet. Our partner, Martin Pring, put it this way in his most recent research update:

“The evidence at this point suggests that the economy has entered a growth slowdown. Whether it turns into a recession has yet to be determined. However, if the economy does enter a business contraction, it will likely be the most advertised one in history. That fact alone makes it less likely to happen.” — Martin Pring

We agree with Martin’s observations. Nevertheless, whether a growth slowdown or recession is ahead, a cautious stance is warranted for your portfolio. The rest of 2022 will likely see continued financial market volatility, both up and down. This will provide opportunities to both trim portfolio holdings and replant new investments to best take advantage of the next favorable market period.

On a positive note, stock valuations already reflect a lot of bad news. The important observation to make is that the stock market decline has already discounted a serious recession. If one is mild or does not materialize soon, the market has plenty of room to rally higher.

Q: How can the market rally in the face of all the gloomy headlines?

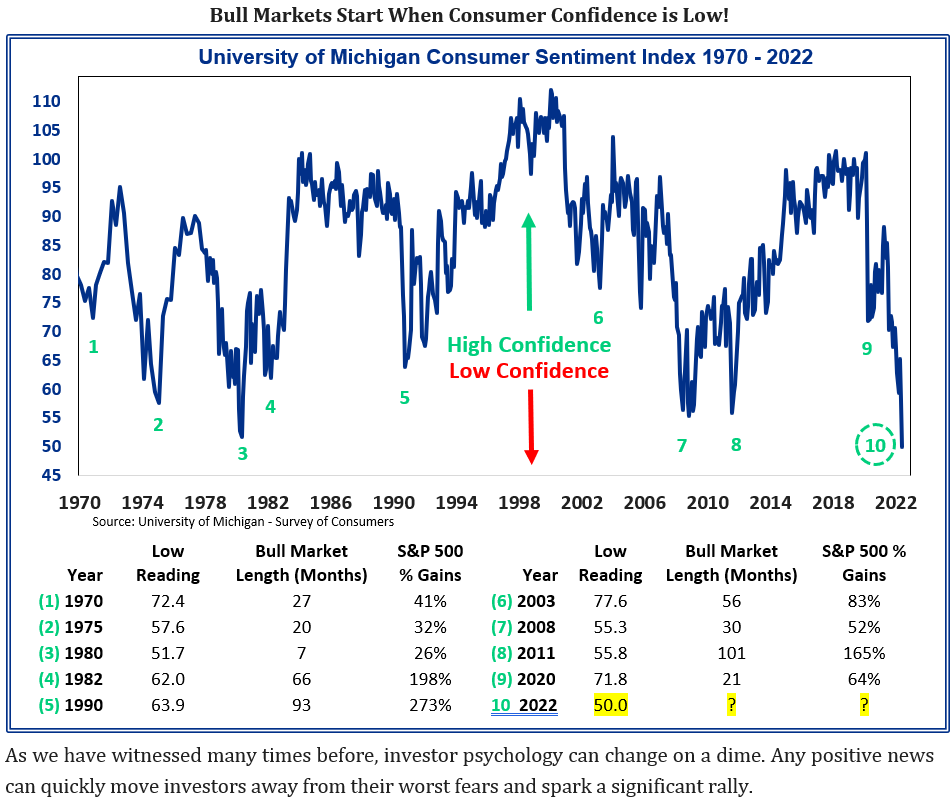

This may sound a bit counterintuitive, but extremely low consumer confidence is actually good news for investors! Whenever attitudes tumble to current pessimistic extremes, stocks have already greatly digested and discounted the bad news. The Michigan Consumer Sentiment Index is a monthly survey of consumer confidence levels in the United States. The survey is based on telephone interviews that gather information on consumer expectations for the economy. The latest poll just hit a record low of only 50! As detailed in the chart and table, we identified the rare times when the University of Michigan Consumer Confidence poll hit these low extremes. Each time, despite poor consumer expectations, significant stock market gains followed.

Q: With all the talk of recession, what could possibly go right?

Several recent headwinds appear to be reversing course and can serve to improve investor sentiment.

- Consumer interest rates (like mortgages) are declining again.

- Oil and most commodity prices are tumbling, a sign that inflation may soon peak.

- The Federal Reserve could pause rate hikes. In effect, it would take its foot off the economic brakes once signs of interest rates and inflation peak.

- Supply chain shortages are steadily improving, as COVID’s drag on the economy continues to alleviate.

Investor concerns can ease and financial markets can stage a durable advance as each of these headwinds settle down.

Summary

The first half of 2022 was one for the record books—but you survived! Both the stock and bond markets suffered their worst start to a year in many decades. While down, your portfolio featuring Quality, Value and Income held up much better than the major indexes would indicate. The unwinding of a speculative mania, and fears of inflation and a possible recession have contributed to overall stock and bond market weakness. There is a silver lining here: future stock market gains are strong when, as today, consumer and investor sentiment reaches extremely pessimistic levels. All it takes to spark a rally, as discussed in our last answer, is a bit of good news.

We are optimistic and confident that we can successfully navigate the challenges and opportunities ahead. Our overriding goal is to deliver the two most important things all of our clients are seeking—to protect and grow your wealth.

Thank you for your continued trust and confidence in us. We appreciate you and are honored to serve as stewards of your hard-earned wealth. Please do not hesitate to contact us if you have questions or there are any changes to your circumstances.