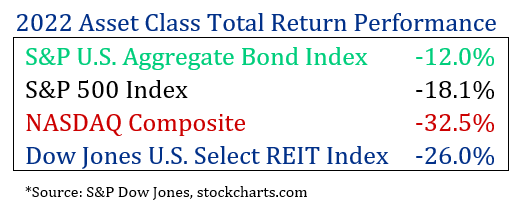

Investors faced a minefield of problems in 2022. The year began with the S&P 500 stock index at all-time highs. Then Russia invaded Ukraine. Oil, along with most consumer prices, continued to soar as inflation spiraled higher. In a belated response to persistent inflation pressure, the Federal Reserve began what would become the steepest interest rate-tightening cycle in history. Bond, stock, and REIT (Real Estate Investment Trust) prices declined sharply as interest rates surged. The last decade’s growth stock darlings, many residing in the NASDAQ stock index, suffered the largest losses. A quick glance at various performance benchmarks shows this story.

In simple terms, it was a particularly volatile and challenging year for many investors; on the other hand, your portfolio adapted to changes in the investment landscape relatively well. As the year progressed, your stock exposure was methodically trimmed back to reduce overall portfolio risk. Ample cash reserves and shorter-term Treasury Notes were emphasized for additional safety. This defensive shift in your actively managed portfolio served you well amidst the pain many other investors suffered through. That said, we believe 2023 will be a transition year for financial markets where our investment tactics will, at some point, likely shift from protect to growth-mode.

Financial Market Outlook

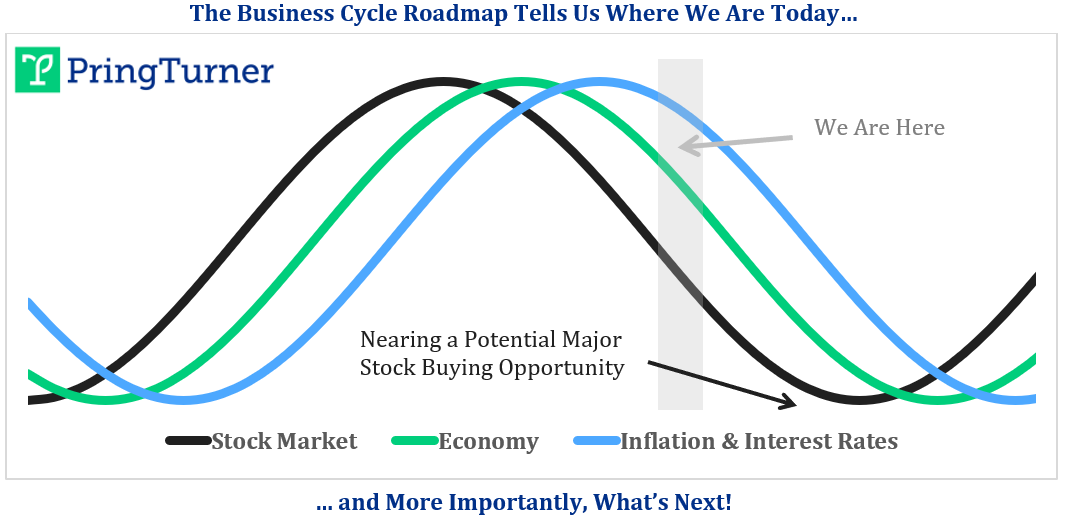

Economic expansions, contractions, and recessions have always impacted financial markets. As our business cycle schematic illustrates (below), the stock market typically peaks out well ahead of the economy. True to form, the stock market averages topped out about twelve months ago and slower economic growth followed. So, what’s next? Interest rates and inflation appear to be in the process of topping out. When interest rates peak for this cycle, bond prices will be the first asset class to perform well. That is one reason why we have been busy building out your bond ladder. The highest U.S. Treasury yields since before the Great Financial Crisis presents a great opportunity to lock in attractive rates and boost your portfolio income. As this year progresses, the stock market will likely provide a lower-risk opportunity to add quality stocks at attractive valuations. The game plan will be to gradually shift your portfolio strategy from defense to offense as the evidence and outlook improves.

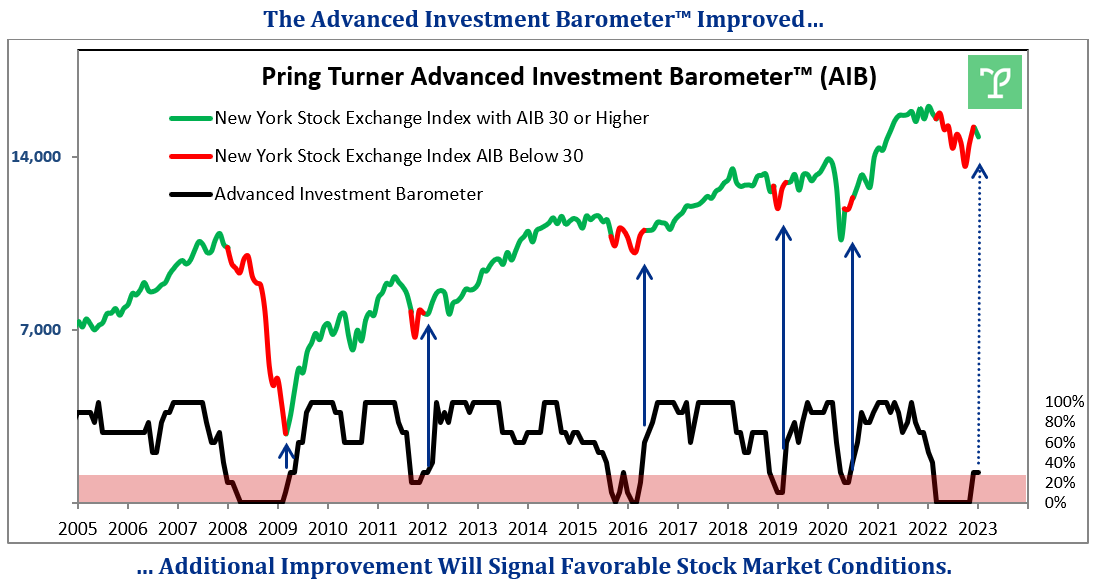

How will we know when it is time to shift to an offensive game plan? One way is by paying attention to our long-term stock market model known as the Advanced Investment Barometer™ (formerly known as our Stock Speedometer). Essentially, this model helps us decide if we should be focused on growing or protecting portfolios. Historically higher readings have led to better returns for the average stock; conversely, lower readings have led to poorer returns.

As the new year begins, we are seeing some initial progress in the Advanced Investment Barometer™. The latest reading has moved this indicator from zero to 30, the highest reading in nearly a year and an early indication of improving conditions for stock prices. Upon further improvement, it will be the time to gradually add stocks offering high quality, good value, and growing dividend income to your portfolio. This offensive shift can lay the foundation for building your wealth, as we move toward the next business cycle expansion. Safeguarding your portfolio throughout challenging periods allows for the opportunity to quickly recover and reach new highs in the favorable ones!

Summary

Protecting your capital through these tumultuous and volatile times has not been an accident or merely good luck. We have always preached that the key to successful long-term investing is to not suffer large losses. Stable returns are the result of numerous risk management guidelines that we consistently use to carefully manage your precious wealth. For over 45 years, our study of the business cycle, investment disciplines, proprietary research tools (like the Advanced Investment Barometer™), and experience have navigated varied financial market conditions well. As this new year begins, a vigilant and defensive stance remains appropriate to further shield your portfolio value. Thankfully, we believe 2023 will be a transition year for the financial markets, allowing a shift in tactics back to growing wealth. We look forward with patience and confidence to taking full advantage of the next wealth-building phase for you.

Conclusion

We would like to take this opportunity to welcome all new clients to the Pring Turner family! Volatile financial markets, when coupled with disappointing outcomes for many investors, led some to seek out a sensible and pro-active investment strategy. In our view, pro-active risk management is the key to effectively navigating volatile market periods. Since our founding in 1977, this prudent approach has helped generations of clients safeguard and build their wealth. We look forward to successfully working for you and your family in the decades to come.

To new and established clients alike, thank you for the opportunity to help you achieve your financial goals with peace of mind. We value your confidence and work hard to honor your trust every day. As always, please let us know if your circumstances should change or you have any questions regarding your portfolio. Wishing you a healthy and Happy New Year!

Learn how our unique approach and personalized advice can help you grow the value of your financial portfolio.

Special Announcements

We would like to highlight key accomplishments in our ongoing effort to improve our offering for you. Pring Turner’s future has been bolstered with the addition of some very talented and conscientious professionals.

First, we are proud to announce that Pamela Iwaszewicz earned her CERTIFIED FINANCIAL PLANNER™ designation. This allows us the opportunity to offer financial planning services to you and your family. Also, we are thrilled to report that Pamela is our newest Partner and equal owner in Pring Turner. Congratulations, Pamela!

Next, we would like to thank you for warmly welcoming our new Operations Manager, Katie Fisher. Katie’s vast industry experience, attention to detail, and sparkling personality make her an invaluable team member. Katie, thank you for your important work and guidance in taking our operations to even higher levels. You are already making a substantial impact on the Pring Turner team and client family!