Summary

- No one knows the specifics of new economic policies nor when they will begin to affect the economy, but our view from Main Street, Walnut Creek is the positive aspects will outweigh the negatives.

- Contrary to conventional wisdom, stocks responded very well to the surprising presidential election results and your investment portfolio participated nicely.

- Although there may be occasional downdrafts, we believe the major trend continues to be upward and we remain optimistic stock investments will provide positive returns in 2017!

2016 Review – Happy Old Year

We are very pleased to report solid and consistent investment performance in 2016, especially considering you faced a very challenging year with many surprises and volatile price swings. The year began ominously with the worst first week stock market decline in history! It recovered slowly until plunging again due to the shocking Brexit vote in June. Once again, it recovered into late summer only to stumble nine consecutive days right into Election Day. By election eve most major U.S. stock price indexes were barely higher for the year. And then with surprising election results, stocks finished with an exceptional rally to near record high levels. Throughout all the crosscurrents and challenges in 2016, you enjoyed competitive investment returns while taking considerably less risk.

In 2017, our investment advisory business celebrates its 40-year anniversary, and we are proud to have delivered these consistent investment results throughout our firm’s history in Walnut Creek. Our reliable and flexible investment strategy is based on paying careful attention to important business cycle shifts and uncovering investments offering a combination of quality, value and dependable income. This conservative approach has stood the test of time and we are confident in our ability to continue to serve you well, no matter the surprises or challenges that may face the market.

Financial Markets React to Election Results

Stocks

In our Fall Market Update (click to read), we likened the economy to a race car driver needing to stop for refueling. A pit stop is a necessary rest in order to continue the race. Business cycle fundamentals were already improving pre-election. Our view was, no matter who was to win the election, the economy had taken a short breather but was prepared to “rejoin the race” and extend the bull market for stocks, Six Reasons to Be Bullish (click to read). And indeed it did! Contrary to conventional wisdom, stocks responded very well to the surprising presidential election results and your investment portfolio participated nicely.

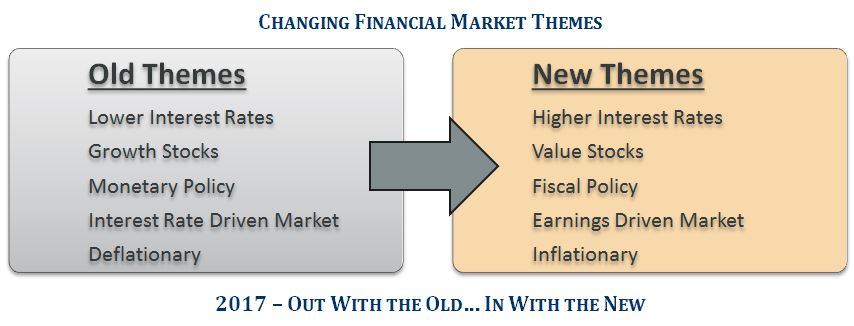

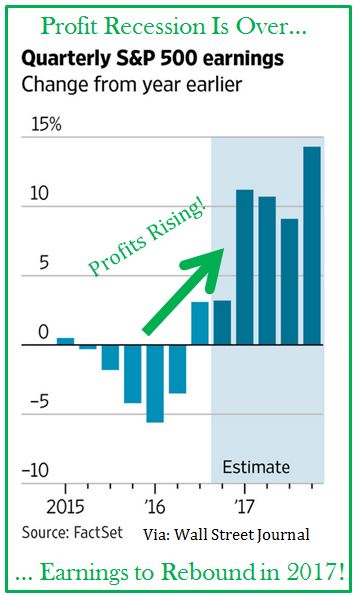

Primary influence on the economy is being transferred from the Fed via monetary policy to Congress and the administration via fiscal policy. The positive market reaction to the election is a result of a major policy shift. First, investors are anticipating a significant increase in spending (infrastructure investment). Second, tax reductions for individuals and corporations are being considered, leaving more money for consumer and business spending. Lastly, easing regulatory burdens will be stimulative and provide another positive tailwind for stocks. Combined, these measures should act to boost corporate earnings (see chart below) and that is being reflected in higher stock prices. The market looks forward and today’s actions are discounting these positives.

However, to be fair these growth initiatives may be somewhat offset by oth er factors. The Federal Reserve’s stated intention to raise interest rates three times in 2017 could lead to further strengthening in the dollar. That possibility along with the threat of protectionist trade policies would create some headwinds for U.S. corporate profits and stocks. No one knows the specifics of new economic policies nor when they will begin to affect the economy, but the positive aspects look to outweigh the negatives. These aspects add credence to the optimistic view in our own business cycle research that supports an extension of the current economic expansion. In other words, there is no recession in sight that would change our longer term optimistic view for stocks.

er factors. The Federal Reserve’s stated intention to raise interest rates three times in 2017 could lead to further strengthening in the dollar. That possibility along with the threat of protectionist trade policies would create some headwinds for U.S. corporate profits and stocks. No one knows the specifics of new economic policies nor when they will begin to affect the economy, but the positive aspects look to outweigh the negatives. These aspects add credence to the optimistic view in our own business cycle research that supports an extension of the current economic expansion. In other words, there is no recession in sight that would change our longer term optimistic view for stocks.

Areas of Emphasis for 2017

Several themes continue to provide opportunity to grow your investment portfolio:

#1: Stocks are moving from an interest rate driven market to an earnings driven one where cyclical companies tend to outperform. The stock market is no longer being driven by lower and lower interest rates, rather by improving profits and earnings. Later cycle beneficiaries include energy, financial, industrial, technology and basic materials, which are well represented sectors in your investment portfolio.

#2: Value stocks (not growth) are outperforming and reasserting their traditional long term leadership role. As value investors, we are encouraged that the multi-year headwind facing the value style may be turning into a tailwind for you once again.

#3: Volatility was widely apparent across all asset classes in 2016 and we expect this to continue in 2017. Bouts of intermittent volatility are expected and provide occasions to both plant new investments on weakness and prune portfolio holdings on strength. We are confident we have the proper tools and experience to take advantage of large price swings and extreme investor emotions.

Bottom line: we believe a number of promising investment themes will add profits to your portfolio. Although there may be occasional downdrafts, the major trend continues to be upward and we remain optimistic stocks will provide positive returns in 2017!

Bonds

While stocks took off to the upside after the election, bonds did just the opposite as interest rates immediately spiked higher (pushing bond prices lower). In fact, November turned out to be the worst month for bond prices in nearly 30 years! Expectations of a strengthening economy and higher inflation changed the low interest rate psychology quickly. In addition, the Federal Reserve hiked interest rates once again in December and announced they expect to raise rates three more times this year. Their reasoning for the tightening move is employment is strong and inflationary signs are picking up. It appears the long anticipated Fed decision to move off of the zero interest rate policy that has been in place since 2008 has finally happened.

The primary function for bonds in your investment portfolio is to establish stability and income. However, as we described in our investment research report on bonds this fall The Case For Rising Interest Rates (Click to Read), with interest rates near historic lows, bond investors had better be very careful. We anticipated the higher interest rate environment (bad for bond prices) and proactively reduced the bond portion of your investment portfolio with an emphasis on more stable short-to-intermediate term holdings. These actions helped you avoid heavy losses other bond investors experienced these past few months.

However, there are several reasons to believe that interest rates cannot sustain a prolonged rise at this time. First, with nearly $20 trillion federal government debt outstanding, the Federal Reserve simply cannot allow the cost to service this debt (interest rates) to climb much without creating budget busting problems. High debt levels will almost certainly insure relatively low levels of interest rates for some time to come.

Second, rising interest rates will likely translate into a stronger U.S. dollar versus other world currencies. A stronger dollar is an unwelcome event for a new administration that is focused on bringing jobs and manufacturing plants back to U.S. shores. So, while we expect the temporary shift to higher interest rates (and lower bond prices) to continue, we do not expect a prolonged rise.

Our take on interest rates and bond prices is that they will likely stay relatively range bound over the next several years. Our preferred strategy is to continue to hold short-to-intermediate term bonds for better stability and use periods of bond market weakness to carefully add to your bond ladder. A bond ladder is a conservative strategy to manage bond investments (Click to Read). It can reduce some of the risk bond investors face from rising interest rates, while providing added income to your investment portfolio.

Inflation Sensitive Assets

Moving opposite to the bond market, inflation sensitive asset prices improved last year and are primed to continue to do well in 2017. This includes energy A New Cyclical Bull Market in the Oil Patch Has Begun (Click to Read), precious metals and other resource based industries that are well represented in your portfolio. After a very strong start last year, precious metals prices recently lagged behind other inflation sensitive holdings. But in our view the fundamental outlook remains quite strong Streamers: The Low Risk Gold Investment (Click to Read). With our Inflation Barometer at the maximum positive level, we think the surprise of the year will be how well the cyclical sectors including industrials, materials and inflation sensitive assets perform.

Conclusion

Each New Year brings its own set of unique challenges and opportunities. Our job is to follow the path that leads to the best low risk investment results. That path is made easier with our disciplines, research and the experience we bring to the decision making process.

Be assured your investment portfolio will be subject to surprises, shocks, unexpected incidents and unwelcome crises during the next twelve months and beyond. But these temporary setbacks have always been and always will be part of the investing landscape. There is no return without some degree of risk. This is why we build so many layers of risk protection into your investment portfolio. So, when the next ‘unexpected’ crisis hits, it is worthwhile to know we believe your investment portfolio has more balance, superior quality and safety, better value and higher income than the ‘stock market’. Most importantly, every crisis creates opportunity that we will look to capitalize on and take advantage of while other investors panic.

Good long-term investment results come from a disciplined and consistent process, and when you add in a dose of patience you substantially improve the odds of growing and protecting your wealth. We have used this formula successfully for many years and in many different financial, economic and political climates. Now in our 40th year working with many wonderful clients, we are proud to say that, over many challenging decades, we have delivered on our promise to both protect and grow your hard earned wealth.

We would like to take this opportunity to welcome all newcomers to the Pring Turner family. One of the greatest privileges for us is to serve as stewards for your hard earned money. Your trust and confidence inspires us to make the very best investment decisions we can for you. Thank you from the entire Pring Turner team.

CLICK HERE TO DOWNLOAD THE PDF VERSION

DISCLOSURES:

Pring Turner Capital Group (“Investment Advisor”) is an investment advisor based in Walnut Creek, CA. The Investment Advisor invests on behalf of individuals, organizations, and other financial advisors that appreciate a conservative and active investment style that aims to deliver consistent results without taking undue risk. The key objective of the Advisor’s investment philosophy is to not lose big during major market declines, making it easier to compound wealth over the long run.

The Investment Advisor is registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Investment Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments.

In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Investment Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. Past performance is no guarantee of future results. ©2017 Pring Turner Capital Group Walnut Creek, CA. All rights reserved.