Volatility returned to the markets during the first quarter and stocks are experiencing their first significant correction in well over a year. Indeed, the last two months are a reminder that markets go through periods of weakness, despite last year’s nearly uninterrupted gains. As we stated in our January Investment Newsletter, “…investors should expect added bouts of volatility during 2018 as good and bad forces battle it out.” The latest evidence suggests that the current short term market decline is most likely part of a typical market correction within an ongoing bull market for stocks. Our best advice: Stay positive, it’s likely just a normal correction!

Nevertheless, we understand the discomfort you might have in seeing account value declines these past two months, especially after your typical account achieved all-time high levels in your portfolio (adjusting for any withdrawals) in January. While it has been a sudden change from last year’s smooth portfolio gains, we believe this temporary market shakeout is nearly complete. Our long term view is still quite optimistic for further economic growth and we fully expect an extension of stock market gains as the year progresses.

Thinking a Step Ahead and Proactively Managing Risk

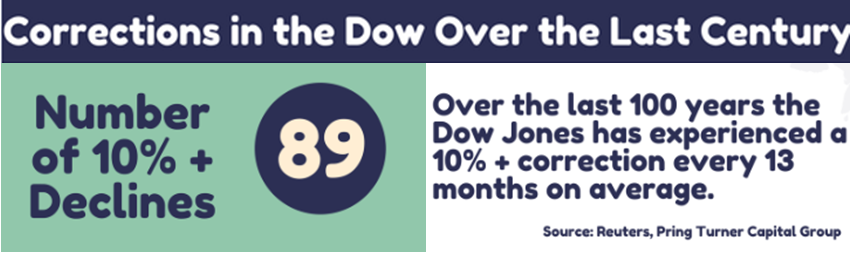

No doubt about it: upside volatility is a lot more fun than downside volatility! This reminds us of the old saying “Everyone wants to go to heaven; they just don’t want to die to get there.” Sure, it would be nice to participate in market gains without experiencing any of the market setbacks, but that is simply unrealistic. Corrections are a normal fact of life for the stock market. In fact, history teaches that you can expect roughly one double digit market decline each year. What was really unusual is the market behavior in 2017—it was quite extraordinary that stocks did not even experience a 3% decline all year! However, our conservative approach strives to temper any moderate market decline, which is why we employ many layers of risk management tactics into your portfolio.

Case in point, you may have noticed the increased sales activity in your stock holdings beginning last fall and continuing into January. This series of defensive moves were made to harvest profits and deliberately raise cash levels. We have been redeploying some of those cash reserves into more attractive long-term values for you. To reiterate, there is nothing on the horizon to suggest this correction is anything more than a temporary pullback within a long standing bull market. Looking out a couple years or even longer, we are confident these new high quality holdings purchased at reasonable valuations can once again help you achieve all-time high portfolio values (adjusted for withdrawals).

Turning Volatility to Your Advantage

The return of additional volatility might scare off many investors but we actually embrace it! As long-term value investors these short term price changes offer us a favorable time to increase your stock ownership at more attractive prices. After all, real opportunities come along when the undisciplined investor, those with very short term time horizons, who succumb to their deepest fears, sell perfectly good companies during emotionally charged market declines. The good news is you can profit from a disciplined process to identify high quality companies that offer excellent value and invest in them at favorable times like today. The icing on the cake is the dependable dividend income you earn while patiently waiting for long term capital gains to accrue.

In sum, while volatility has returned, try to think of it as an opportunity. Essentially, a correction is simply a natural stock market process by which ownership is transferred from short term speculators to long term investors. If you are prepared for volatility with ample cash balances, corrections provide you with more great companies to accumulate. History shows this correction in 2018 may be one of the few opportunities you get to add attractively priced stocks to your portfolio. Embracing volatility allows us to do what we have consistently done for you during our 40+ year history—strive to make sure you participate in market gains while reducing downside risk so you can enjoy a safe financial journey with peace of mind.

For a more in-depth review of the current market environment, we recommend watching our latest webinar recording, “Volatility Returns: Is There More Life Left in this Bull Market?” If you have difficulty finding the webinar recording on our website’s blog please let us know and we will email you a copy of the link directly.

Thank you for your continued trust and placing with us the important responsibility of protecting and growing your wealth. As always, please feel free to contact us should you have any questions or if your financial situation changes.