Your investment portfolio generated strong gains with low volatility despite the year starting full of uncertainty and concerns of a new and quite unorthodox administration. This resulted in nicely positive returns for your wealth, which adjusted for withdrawals, hit new all-time highs to end the year. So indeed, Happy New Year to all!

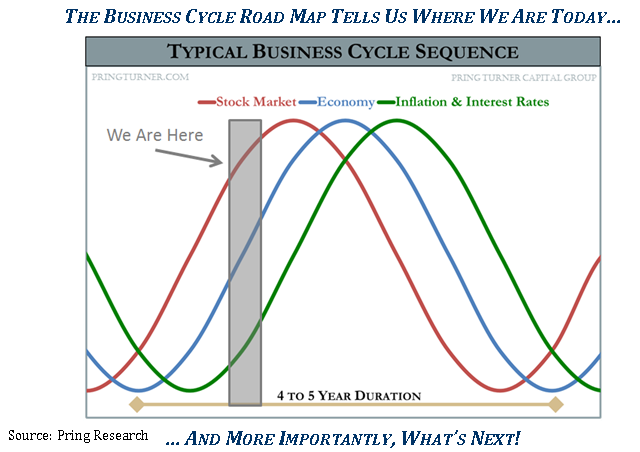

Naturally, the question we keep hearing is: how much longer can this market continue going up? While nobody can know the answer for sure, we take guidance from business cycle cues that keep us on alert for what’s next. Our quick answer is, while it is getting later in the business cycle, the good news is that the economy is gaining strength and it appears is no recession in sight. Let’s review an old friend, our business cycle schematic to help elaborate on what’s likely next for the markets and what this means for your investment portfolio.

You may be familiar with our three bell curves model of the typical business cycle featured above. This simple, yet elegant chart illustrates the relationship between stocks, bonds, inflation-sensitive assets and the economy. The blue line represents the trajectory of the economy (GDP), from boom to bust and back again. Stock prices (red line) lead the economy, peaking and bottoming ahead of business activity. Lastly, inflation and interest rates (green line) lag the economy. Where are we today? Stock prices have certainly been strong, economic momentum is building and interest rates and inflation are finally turning up from very low levels. All three are rising together!

The shaded area is our best estimation of where we are in the cycle. Putting it all together, while we are moving into the later stages of the business cycle there is potential for more upside in stock prices.

The real advantage of following the inter-relationship between the business cycle and financial asset prices is to always be on alert for the next turning point. For us, each work week begins with a thorough review of market and business cycle research. In fact, you may recognize the “three bell curves” (disguised as a mountain range in the Pring Turner logo). This serves as a gentle reminder not to extrapolate the past forever into the future because the economy and financial markets move in ever changing cycles.

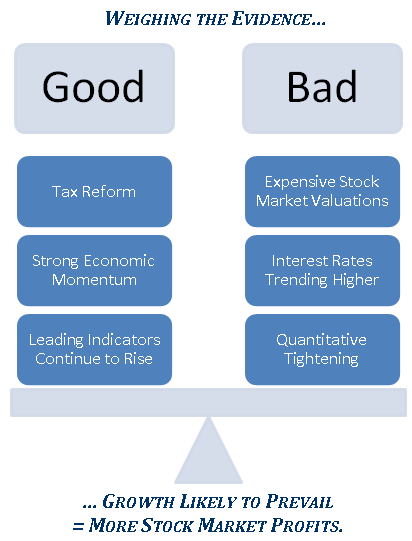

Certainly, the business cycle is alive and well, growing stronger by the day. Leading indicators for the economy point toward a continued 3% growth rate or more. Recent tax law changes for both individuals and corporations may very well extend the economic momentum. On the other hand, the Federal Reserve is beginning to take the punch bowl away from the party by steadily raising interest rates and starting “QT” (Quantitative Tightening) by slowly selling off bond holdings. As detailed in the three bell curve schematic, higher and rising rates later in the business cycle have the potential to eventually choke off the expansion. So, while it was relatively smooth sailing in 2017 and this year begins with strong market momentum, investors should expect added bouts of volatility during 2018 as good and bad forces battle it out. Rising interest rates and wider market swings could present new challenges and opportunities. Weighing the pros and cons, we believe further growth will prevail and additional stock market profits are most likely in store.

Tactics for 2018

Stocks: Accelerating economic growth and ever stronger corporate earnings should act as a continued tailwind for stock prices. Your core stock holdings are well balanced amongst the various economic sectors and exhibit common characteristics of high quality, solid value and above average dividend income. It is important to keep in mind you do not own ‘the market’; rather you own a very select group of well established companies.

The stock market is now being driven by improving profits and earnings rather than lower and lower interest rates. Historically, as you move from an interest rate driven market to an earnings driven market, late stage stocks tend to outperform. Later cycle beneficiaries include energy, financial, industrial, technology and basic materials, which are well represented sectors in your investment portfolio.

Bonds: In direct opposite fashion to stocks, stronger economic growth and a less accommodative Federal Reserve combine to provide a headwind for bond investors. This environment calls for the continued use of a shorter-term “bond ladder” in your portfolio. A bond ladder is a conservative strategy to manage bond investments (Click to Read), which invests roughly equal amounts of money in fixed income securities that mature on different dates. This conservative strategy is a low risk way to generate predictable income flow while reducing the risk you face from rising interest rates.

Summary

As that legendary philosopher and baseball great Yogi Berra is oft quoted: “It’s tough to make predictions, especially about the future.” This is good advice and no matter the direction or changes in the financial markets, your investment success will depend not on predictions, but on our experience to anticipate and adapt to new trends, and overcome challenges as they occur. What will be consistent about 2018 is the disciplined approach utilized to invest your hard earned money. This proven investment process is designed to protect and grow your valuable assets, especially when the underlying economic environment changes.

We would like to take this opportunity to welcome all new clients to the Pring Turner family and we look forward to a successful relationship over many years. Thank you for the opportunity to help you achieve your financial goals with peace of mind! We value your confidence and will work hard to earn your trust each day. As always, please feel free to contact us should your circumstances change or if you have any questions.