Wow! The first three months of market returns sure made a nice year for investors! As we pointed out in the January newsletter, “Our strong belief is that this temporary [Fall 2018] stock market setback sets up for a stronger period ahead from which you can recover and build wealth”. You should also expect continued economic growth that could support even higher stock market levels this year, notwithstanding interim bouts of volatility.

That said, last quarter we advised against extrapolating further falling stock prices, and we also caution today against extrapolating this quarter’s strong performance. Shorter time periods can be quite volatile, but over longer time horizons we fully anticipate your conservative investment approach will continue to build wealth.

WHAT HAPPENED? FED POLICY AND WORDS MATTER!

How quickly market psychology can change! Last year ended with many investors in full panic mode as a “mini” bear market for stocks took hold, despite a reasonably healthy economic backdrop. In our view, a major reason for this anxiety was the Federal Reserves’ continued monetary tightening actions. In December, newly appointed Chairman Jerome Powell had announced the ninth consecutive interest rate hike along with a forecast of two more hikes to come in 2019. Stock market traders stormed the exits with expectations that the continued tightening action could kill off an aging economic recovery: “Sell, sell, sell!” However, in early January, sentiment quickly reversed when Chairman Powell announced a reassuring pivot in monetary policy by saying the Fed “…will be patient as we watch to see how the economy evolves.” In other words, Fed policy shifted from tightening to neutral as there would likely be no more rate hikes for the time being. Immediately, investors breathed a sigh of relief and the stock market took off in a non-stop surge higher: “Buy, buy, buy!” Along with the markets, your portfolio rebounded quite strongly during the first quarter.

The question then becomes: does this aging economic expansion and bull market for stocks have staying power? Let’s polish the old crystal ball and review our current outlook.

EARLY SIGNS OF ECONOMIC “GREEN SHOOTS”

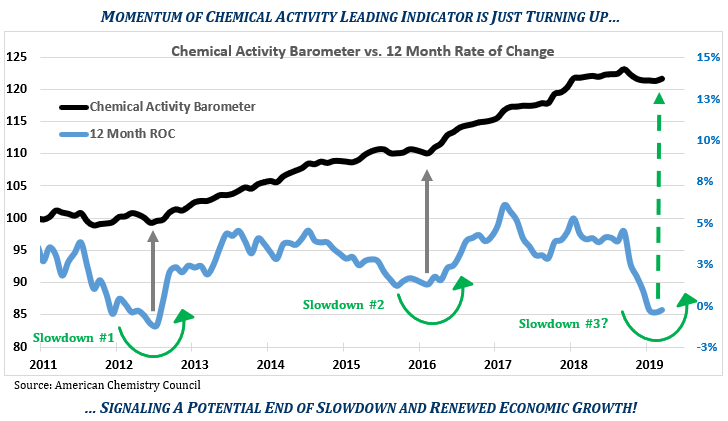

In the early weeks of 2019, the economic outlook was uncertain. However, the pace of economic growth was slowing down. The key unanswered question was: would this slowdown lead to an all-out recession? This is important for investors, since an actual recession has severe repercussions for the stock market versus only a slowdown. Just as the seasons are transitioning from winter to spring, we see evidence of “green shoots” or early signs of renewed economic growth and further extension of this nearly 10 year old business cycle. For example, one leading economic indicator that we follow is the Chemical Activity Barometer with its momentum featured in the bottom half of the chart. This dependable indicator is showing early signs of turning up once again, indicating perhaps the third mid-cycle slowdown since 2009 is behind us and stronger economic growth is likely.

As the new quarter begins, we are seeing steady improvement in the Stock Speedometer. The latest reading has moved this long term indicator out of the “danger zone” and into the “safety zone”, signaling a more favorable condition for stock prices. The latest readings give us confidence to continue gradually adding attractive new investments to your portfolio.

We remain cautiously optimistic that a resumption of the economic recovery and continuation of the profitable advance for stocks is ahead, despite that others in the financial media may be forecasting a recession. History teaches that business cycles do not die of old age; rather, they end with the Federal Reserve pushing interest rates too high and too fast. This brings the discussion back to our earlier observations of the new Fed Chairman, Mr. Powell, and the Fed’s recent announcement to hold rates steady while keeping a close eye on market conditions. Given the unlikelihood of interest rate increases this year, the probabilities favor a rebound for the economy and further gains for stock investors.

The stock market will occasionally experience emotionally driven extreme price swings, as the unusually volatile last six months have demonstrated. These periodic schizophrenic episodes are often only loosely associated with underlying business cycle conditions. Good long term investment results come from a disciplined and consistent process, and you can substantially improve the odds of reaching your financial goals when you add in a dose of patience. We have used this formula successfully for decades and throughout many different financial, economic and political climates. Now, in our 42nd year working with wonderful clients, we are proud to say that we have delivered on our promise to both protect and grow your hard earned wealth over many challenging decades.

Thank you for your confidence and placing with us the important responsibility of managing your wealth. Please let us know if your circumstances should change or if you should have any questions regarding your portfolio.

We are proud of our very own Pamela Ross in her efforts to give back to our community in various philanthropic ways. Currently, she is studying to advance her career by becoming a Certified Financial Planner (CFP) and, with that designation, aspires to teach financial literacy classes to our youth. To that end, Pamela recently volunteered at the YWCA’s Financial Empowerment Summit for High School Girls in Berkeley, where she was asked to present a few financial insights to the attendees. Recognized for her leadership, experience and enthusiasm, she has subsequently been asked to present at future financial literacy events. On top of Pamela’s busy life managing the office, running trails, and volunteering for anti-human trafficking efforts, she feels blessed to serve and empower our community’s youth through financial literacy programs.

We are honored to support Pamela in her passion to enrich members of our community and empower others to better their lives. Well done Pamela!

Photo by Joshua Earle on Unsplash