The stock market caught a second wind during the summer months. After a wild roller coaster ride in the first half of the year, stock indexes finally cleared their late January highs in the last week of the quarter. With another strong quarter of economic growth behind us, indications are that this rather mature business cycle is still healthy. We remain optimistic for continued wealth building opportunities – seeing no immediate storm clouds on the economic horizon.

A Very Positive Sign — Consumer Strength

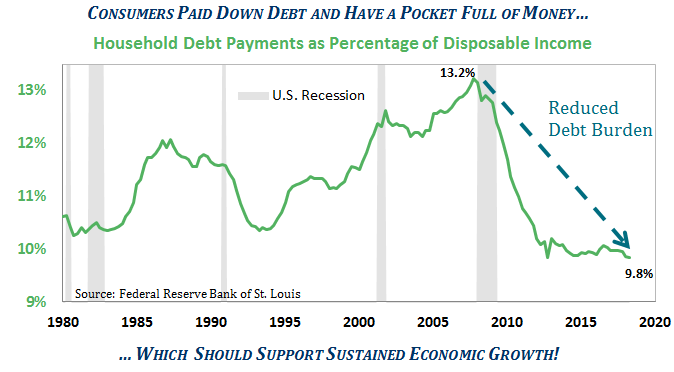

In the aftermath of the Great Recession, the typical consumer “got religion” and aggressively paid down and/or re-financed debt while steadily bolstering their savings. This prudent response resulted in a 10 year rebuilding period that reduced household debt payments, as a percentage of disposable income, from 13.2% in 2007 to just 9.8% today (see chart below). With consumer pocketbooks in a healthy position, the stage is set for further sustained economic growth ahead.

As always, the financial markets will not go up in a straight line and there will be volatile periods. The never-ending stream of headline news distractions shake markets and can test investor patience. However, it is important to stay positive at this time as recent economic readings should provide a steady tailwind for the stock market.

But…A Growing Risk — the “Indexing” Mania

We are increasingly concerned about the amount of money blindly pouring into passive mutual funds and ETFs, a strategy known as “indexing”. This indexing phenomenon, along with the ballooning popularity of a handful of richly valued internet stocks, is a major caution sign to market historians like us. In fact, there are similarities to the late 1990’s technology bubble. Back then, even conservative investors threw caution to the wind by overly concentrating investments in the dazzling dotcom and telecom sectors–without consideration for the prices being paid. Little regard was given for the elevated risks and periodic declines that could absolutely ruin one’s long term retirement plans.

Prudent Diversification with a Focus on Value has Temporarily Penalized Investment Returns

Admittedly, your portfolio has not kept pace with the major stock market indexes thus far in 2018. Investors who embrace common sense investment principles such as diversification and fundamental value have been trailing behind the stock market this year. In typical late-cycle fashion, stock market gains have become increasingly concentrated in the most expensive or over-believed stocks. Specifically, the sizzling internet commerce companies have entered what we would now call the “silly season” with prices reaching ridiculous levels, far, far above realistic valuations. We believe these popular stocks are far more risky than many investors realize, and thus conditions are set where many will be burned by following the pied-piper of popularity. These are precisely the types of stocks, as value investors, we intentionally underweight in your portfolio.

In the Aftermath of the “Indexing” Collapse, Quality, Value and Income Will Shine

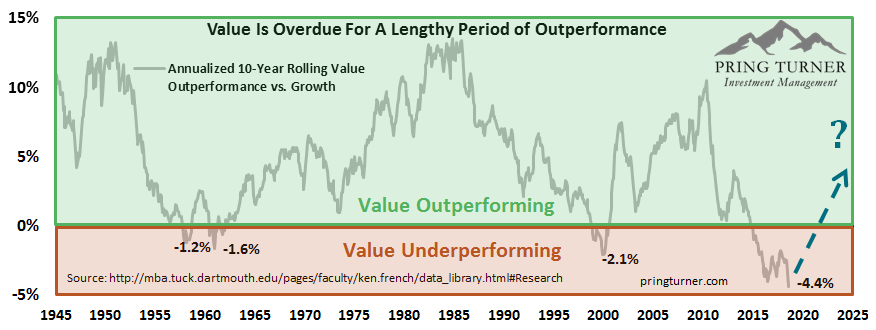

Our clients’ long-term track records demonstrate that when you combine a playbook for both offense and defense, along with disciplined value investing, investors can achieve solid risk-adjusted returns. Of course every few years we expect to encounter some rough patches. Even the most successful investment strategies will temporarily fall out of favor and their followers may lose patience. Such has been the case in recent years as value investing as compared to growth investing has experienced its longest dry spell since 1945! So, what can value investors expect looking forward?

The chart below compares value vs. growth investment performance. It clearly illustrates that every period of long term under-performance for value vs. growth investing in the past 70 years has experienced a return to value’s pre-eminence with strong absolute and relative performance. We believe the environment today is quite similar to the early 2000’s following the dot.com bust when leadership changed and value stocks outperformed for a number of years. Evidence is building that value is starting to once again reassert its long-term dominance of roughly 5% annual out-performance. We can all look forward to a return to better results on the road ahead, as value investors.

As illustrated in the chart, value investing has just experienced its worst 10-year relative performance (-4.4% Annualized) vs. growth investing since 1945! Following each previous period of underperformance, value investing had a renaissance and experienced a significant period of relative outperformance.

Conclusion

Healthy consumers with more money in their pockets will support this growing economy and future corporate profits. Simply stated, it is still a bull market for stocks. But, it is also evident that many of today’s stock leaders are becoming quite overly priced and popular. You should sleep better knowing you are invested in a portfolio of higher quality, better value and substantially higher income producing companies. These investments are relative bargains today and we believe are set to resume their longer term outperformance track record.

Good long-term investment results come from a disciplined and consistent process, and when you add in a dose of patience you substantially improve the odds of growing and protecting your wealth. We have used this formula successfully in many different financial, economic and political climates before and, over many decades, have delivered on our promise to both protect and grow your hard earned wealth.

Thank you for your trust and allowing us to help you on your journey to achieve your goals with peace of mind.