Summer doldrums plagued the markets as stocks traded in an erratic price range that became especially volatile as the quarter ended. Investors turned more cautious as a wide range of worries piled up. That said, excessive worries beget market weakness and often provide investment opportunities for long-term investors like you. We are pleased to report that your high-quality portfolio is faring well in this choppy environment and showing impressive resilience. Indeed, we are taking advantage of recent bouts of volatility to add to the valuable, high-performing businesses in your investment portfolio. Short-term volatility may persist, but we continue to be optimistic for additional gains ahead!

Last quarter’s newsletter alluded to the possibility that stock prices might be getting a bit ahead of themselves. We stated: After an extraordinary rally, the market is entitled to take a short breather. Recent headlines provide plenty of reasons to sell first and ask questions later. This market volatility reappeared from some of the concerns outlined below.

The Covid Scourge Endures—Although there is great medical progress against the virus, the severe economic impact lingers.

Inflation Spike—Food, gas, automobile, rent, home prices and other costs continue to leap higher, hurting consumers in the pocketbook.

Supply Chain Issues—Shortages are forcing production cuts, resulting in very low inventory levels. Demand is outstripping the supply of many finished goods, leading to higher prices.

Federal Reserve Policy—The Fed is moving closer to “tapering” its $120 billion per month bond buying program. Their bond purchases have helped keep interest rates ultra-low. Winding down the program could lead to higher interest rates.

Downshifting Economic Growth Rate—Business activity is still growing, but slower than the robust pace from earlier in the year. A slowing economy, along with rising inflation, will likely put a dent in corporate profit growth.

Political Wrangling—Congress is sparring over enormous tax and spending bills, as well as approving a government debt ceiling extension. Meanwhile, the total U.S. debt balance races to nearly $29 trillion. Investors and consumers will inevitably be affected by fiscal policy.

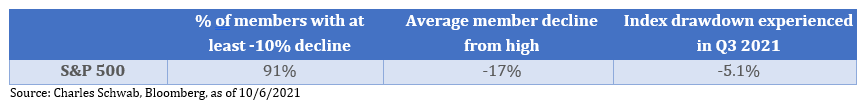

Whew! That is a long list of worries for an investor to digest. Understandably, these headwinds provide an excuse for stock prices to take a breather. This quarter, the S&P 500 (an index made up of the 500 largest U.S. companies) endured a relatively mild 5% decline thanks to strength in a few ultra-large technology stocks; however, the damage is more severe under the surface. In fact, more than 450 of the stocks in the index experienced a 10% or greater decline at some point during this year. Moreover, the average stock decline from their highs is -17%!

Translation: Due to the growing list of worrisome headlines, many stocks have already corrected in price, providing opportunities to invest at a discount.

Reasons to Stay Optimistic

Now, for some good news.

Consumer Savings Growth—Consumers are building up savings at an astonishing clip. Household balance sheets have not been this strong in over fifty years! Since consumer spending makes up about two-thirds of the economy, this bodes well for continued economic growth.

Corporate Productivity—Corporations are more productive than ever, thanks to accelerated equipment and technology investments. Gross domestic product (GDP) in the U.S. rose to record levels in the first quarter—remarkably with 7.5 million fewer workers. Corporate earnings are higher than ever!

Housing Market Boom—Millennials are finally moving out on their own and entering the housing market. A generational tailwind should bolster the housing market, a leading economic industry, for years to come.

Positive Stock Speedometer—Our proprietary stock trend model, the Pring Turner Stock Speedometer, continues in the “Growth” mode. Despite any short-term market turbulence, we are optimistic for continued long-term strength.

Reliable Dividend Income—Markets can correct and go sideways, but your dividends keep rolling in, quarter after quarter. You get paid while you wait for stock prices to ultimately move higher!

Our view is that the good news will eventually outweigh the worrisome headlines. It is important to remember that when worries abound and uncertainty is high, more opportunities appear for patient investors. Our continued focus is on finding high-quality companies that sport strong financials, generate excess cash, and provide consistent and growing dividends. In other words, these top-tier companies represent the Pring Turner investment mantra: Quality, Value and Income.

Summary

After a historic stock market rally from the March 2020 Covid lows, stock prices have taken a breather. Thanks to strength in a few ultra-large technology companies, the major stock indexes do not reflect the “stealth” correction that has been going on. The good news is that the average stock has been correcting in price for several months now and many are attractively valued. This provides you with the opportunity to make timely additions to your investment portfolio. While the corrective process may take more time to play out, patient, long-term investors will likely be rewarded. Stay optimistic!

We look forward to the challenges ahead and believe our disciplined methodology and prudent portfolio tactics will continue to generate long-term growth for your portfolio. Thank you for your confidence in us. As always, please feel free to contact us should you have any questions regarding your portfolio or if there are any changes in your personal circumstances.

Did you like this article?

Footnotes:

Photo by Kelly Sikkema on Unsplash